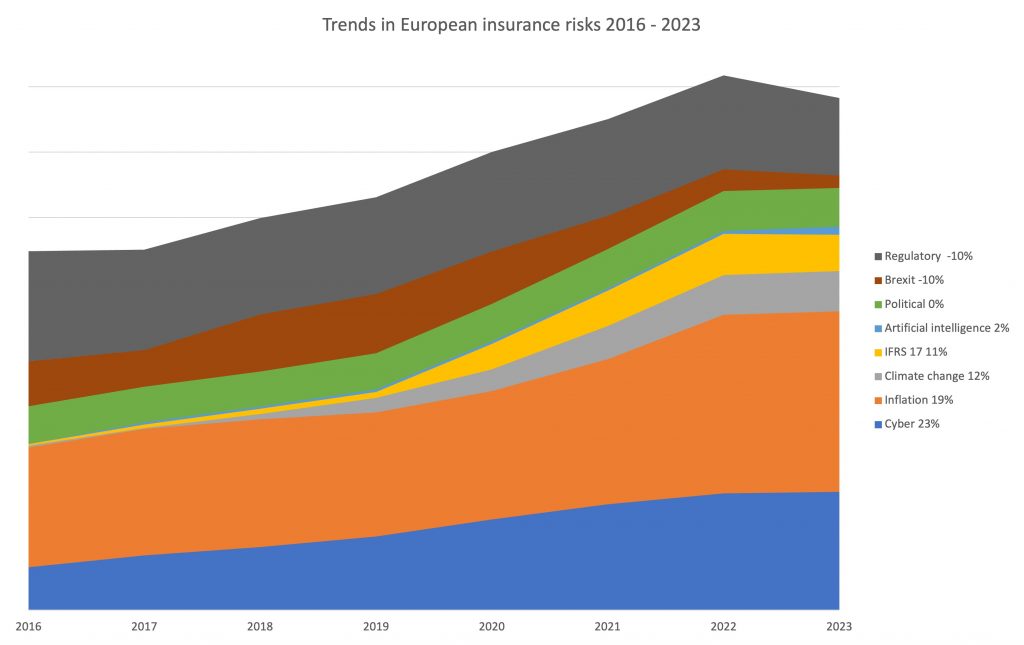

Text analysis of SFCR reports published by European insurers between 2016 – 2023 reveals rising engagement with cyber, inflation and climate risks, while political and regulatory risks recede.

The findings are based on full text analysis of close to 18,000 SFCRs (Solvency and Financial Condition Reports) conducted by Solvency II Wire Data.

Cyber and inflation risks biggest risers

The prevalence of mentions of cyber risk in the SFCRs has steadily risen from 13% in 2016 to 23% in 2023, closely followed by mentions of inflation: 37% to 55% in 2023.

Climate change and the introduction of IFRS 17 accounting standard have both risen over the period (12% and 11% respectively), albeit with a notable rise in recent years. The terms are almost entirely absent from the early reports, which is undestandable given the prominance they have been given in recent years.

Decreasing concern for political and regulatory risks

In cotrast to the above, mention of political risk has remained unchanged over the period and regulatory risk reduced from 34% in 2016 to 24% in 2023.

Artifical intelligence (AI) is mentioned in reports as early as 2017, although remained at 1% until increasing to 2% in 2023. Mention of AI is mixed in terms of risks and opportunities, for example it is also discussed in the context of digital underwriting and robotics.

2023 SFCR risk map

By far the biggest risk in 2023 based on mentiones in the SFCR is inflation. 55% of the reports analysed mentioned the term, followed by cyber with 36%.

While there was a 10% decrease in the mention of regulatory risk in the reports, it is the third most prevalent term, with mentions in a quarter of reports. In 2016 it was mentioned in 34% of the SFCRs, almost as much as inflation (37%).

The SFCRs text as bellweather of insurance risk

The 2023 anlysis is base on 1,300 2023 SFCR reports collected by Solvency II Wire Data at the time of writing. Only English was used in the search terms, and some duplication may arise due to those entities that publish a single group SFCR for all solos.

While by no means comprehensive, this type of analysis has proved a fair indication of overall trends in past reports, for example the analysis of EU climate disclosures 2020 – 2021 (see also here).

Looking at the long term trends points to a few interesting observations, for example that political risk has alway been on the agenda, although the events have changed over the period; regulatroy risk has been decreasing in prominance over the period and that AI is not quite registering on the radar yet for most insurers.

Further analysis of 2023 Solvency II reporting of individual insurance groups has also been published by Solvency II Wire Data:

- ASR introduces tier 3 capital

- L&G solvency ratio down

- LV= returns to tier 3 capital

- NN Group solvency ratio unchanged

- Drivers of Solvency II ratio change 7 European insurance groups 2022 – 2023

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

Datasets available on Solvency II Wire Data

- Swiss Solvency Test (SST): all available data 2016 – 2022

- Bermuda Financial Conditions Reports (BSCR): all available data 2016 – 2022

- Bermuda Financial Statements: data for 226 insurers 2016 – 2022 (1090 reports) selected tables

- Israel Economic Solvency Ratio Reports: all available data 2016 – 2022

- Lloyd’s Syndicate filings: data for 143 syndicates 2016 -2022 (767 reports) selected tables

- SOLVENCY II WIRE DATA Captive Hub