Category: SFCR Analysis

Analysis of the Solvency II public disclosures

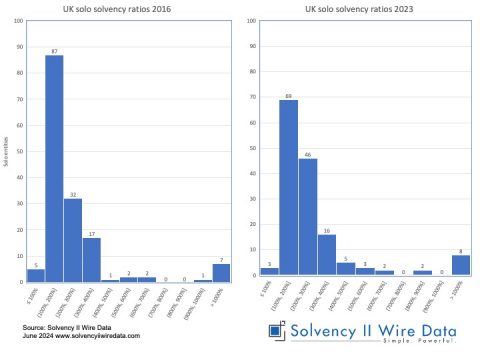

UK Solvency ratio distribution 2016 – 2023

June 18, 2024

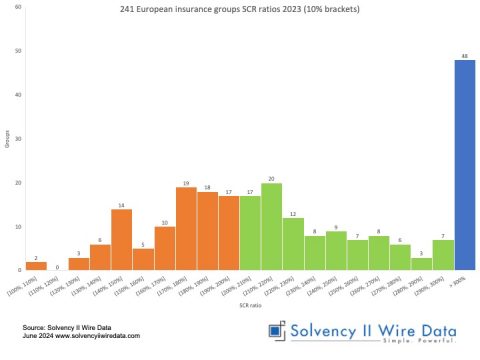

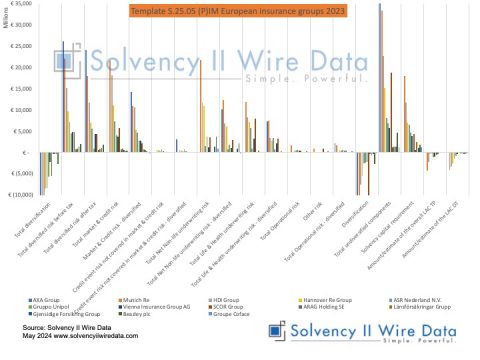

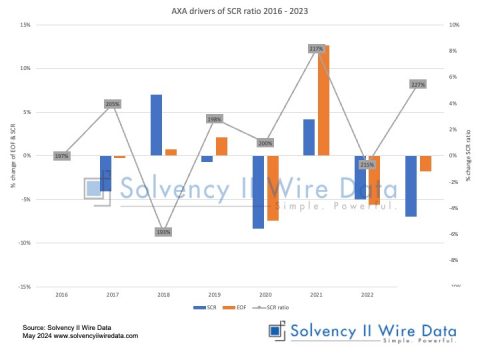

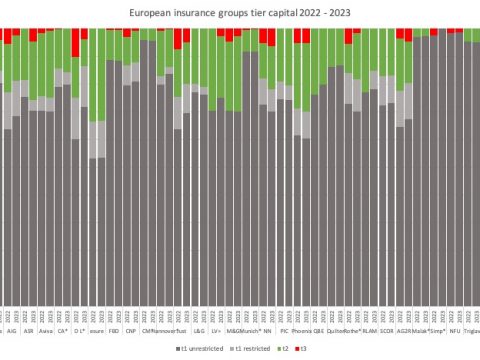

European insurance market insights 2023: group tier capital

April 19, 2024

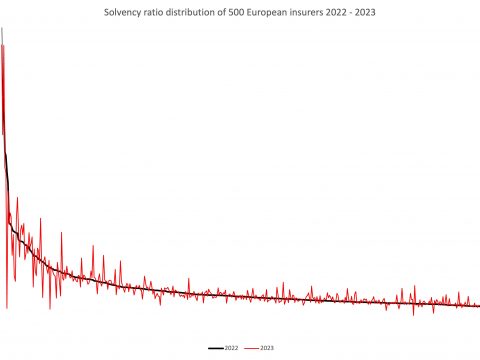

European insurance market insights 2023: 1st 500 QRTs

April 15, 2024

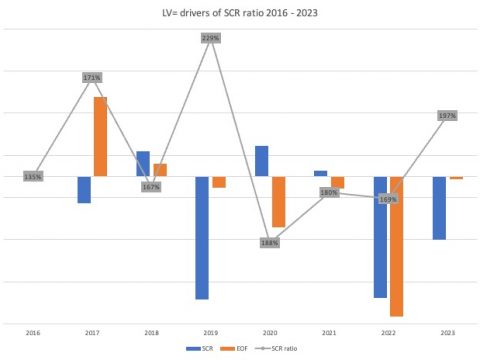

SFCR 2023: LV= returns to tier 3 capital

April 9, 2024

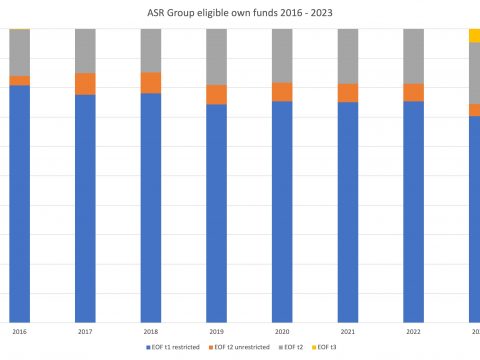

SFCR 2023: ASR introduces tier 3 capital

April 9, 2024

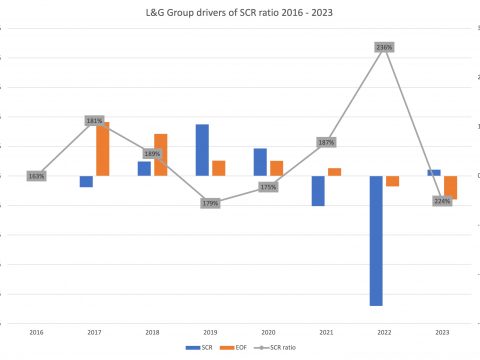

SFCR 2023: L&G solvency ratio down

April 4, 2024

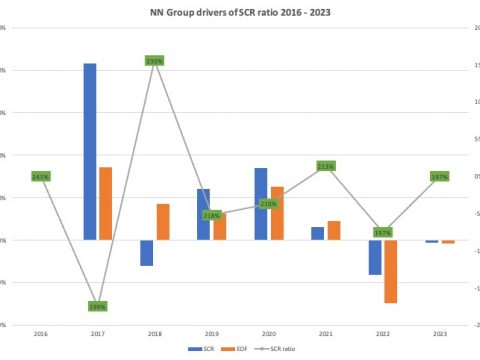

SFCR 2023: NN Group solvency ratio unchanged

April 1, 2024

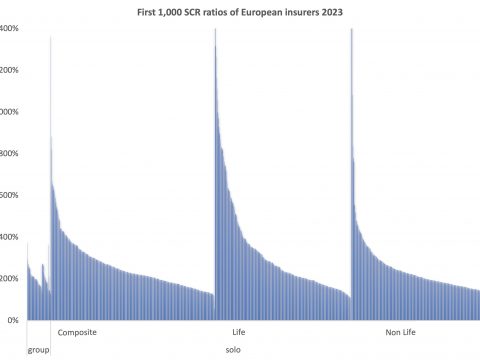

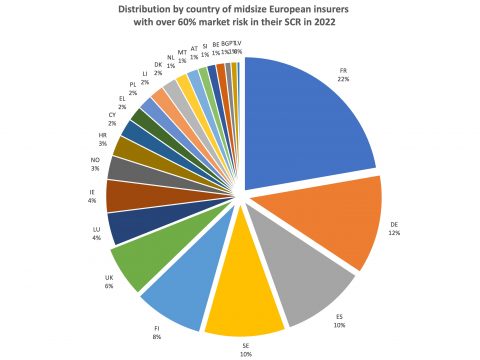

SCR market risk sub-module of 1,000 midsized European insurers

February 29, 2024

IFRS 17 in the SFCRs

February 21, 2024

Bermuda insurance technical provisions and risk margin

September 20, 2023

Bermuda Solvency Ratios 2022

August 24, 2023