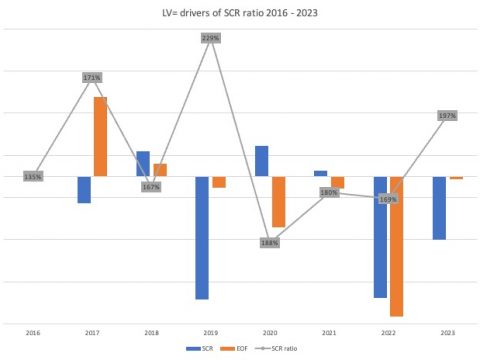

Analysis of 90% of solo German insurers subject to Solvency II reporting in 2023 reveals an overall drop in the SCR ratio, despite a rise in eligible capital.

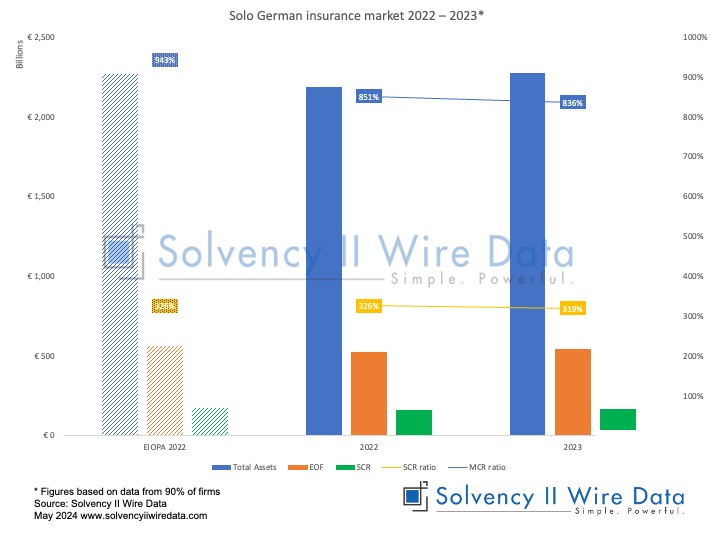

Solvency II Wire Data has fully processed the Solvency II QRT data of 90% of solo German insurers reporting to year-end 2023. The sample covers total assets of EUR 2.27 trillion, 4% higher than the same companies in 2022 (EUR 2.18 trillion).

While the Eligible Own Funds (EOF) to meet the SCR rose to EUR 543,094 million (EUR 523,579 million in 2022) the SCR of the sample also rose to EUR 170,123 million (EUR 160,717 million), this drove the Solvency ratio of the sample down from 326% to 319% in 2023.

The Solvency ratio of the German insurance market in 2022, according to the official EIOPA insurance statistics was 326%. EOF were EUR 560,629 million and the SCR was EUR 172,145.

The chart below shows the shifts in total assets, EOF, SCR, SCR ratio and MCR ratio of the sample.

Further analysis of 2023 Solvency II reporting of individual insurance groups has also been published by Solvency II Wire Data:

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

Datasets available on Solvency II Wire Data

-

- Swiss Solvency Test (SST): all available data 2016 – 2022

-

- Bermuda Financial Conditions Reports (BSCR): all available data 2016 – 2022

-

- Bermuda Financial Statements: data for 226 insurers 2016 – 2022 (1090 reports) selected tables

-

- Israel Economic Solvency Ratio Reports: all available data 2016 – 2022

-

- Lloyd’s Syndicate filings: data for 143 syndicates 2016 -2022 (767 reports) selected tables

-

- SOLVENCY II WIRE DATA Captive Hub