LV= published its Solvency and Financial Condition Report early, following a trend of early reporting by European insurance groups this year.

LV= Solvency II ratio

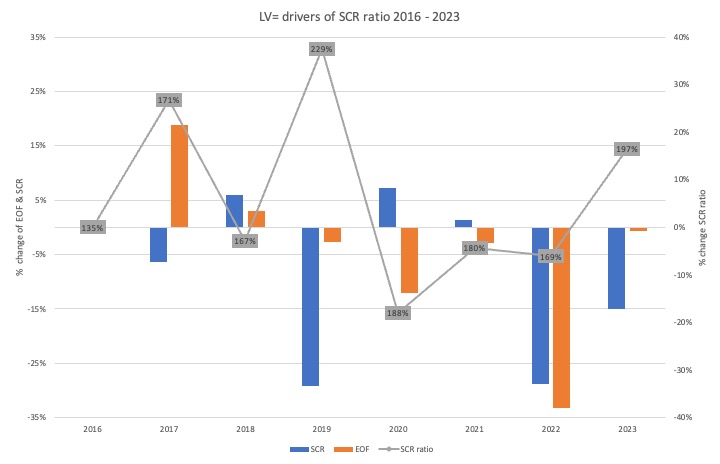

The group has one of the more dynamic Solvency II ratios, rising and falling over the years between 135% (2016) to 229% (2019).

The 2023 ratio is 197% driven mostly by a sharp decrease in the SCR relative to unchanged eligible ownd funds to meet the SCR.

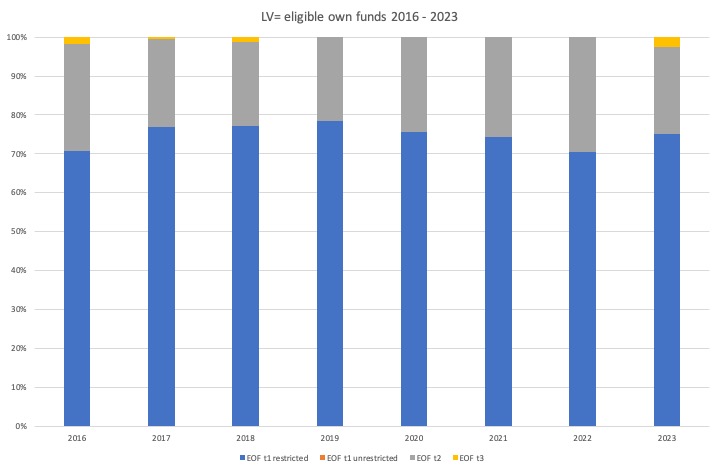

LV= tier 3 capital eligible own funds

LV=’s tier 3 capital in 2023 is reported at GBP 25 million, this after several years where the group did not use any of the tier 3 capital allocation towards its Eligible Own Funds (EOF).

The SFCR explains that tier 3 capital represents the groups deferred tax assets.

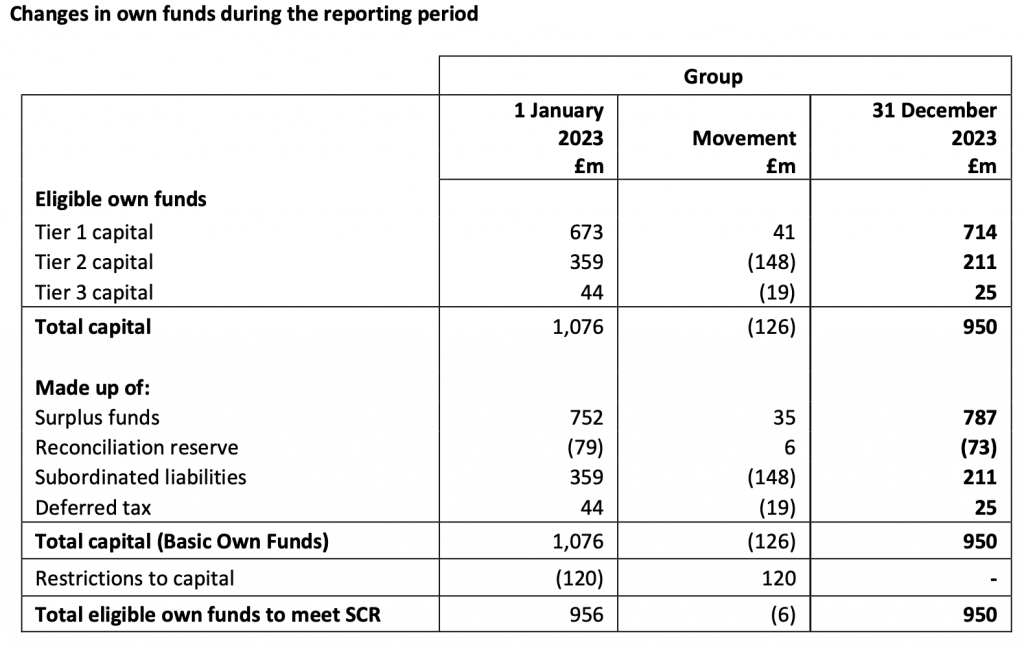

The company also published figures on the shift in Eligible own fund over the reporting period.

Tier 3 EOF shifted from GBP 44 million to GBP 25 million between January and December 2023.

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).