Tag: Data

Data and data management

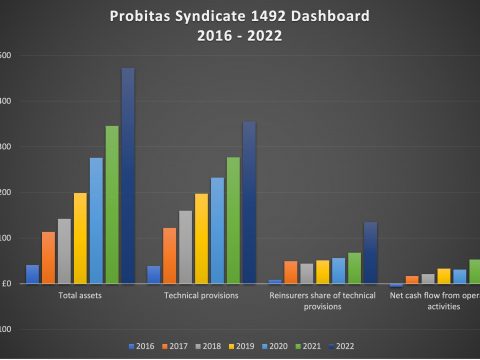

Aviva Probitas acquisition – a Lloyd’s market dashboard

March 5, 2024

Managing government climate policy uncertainty

October 19, 2022

Climate-related risks – a coordinated response to a global challenge

October 10, 2022

Position paper: Conflicts of climate disclosure

October 7, 2022

2021 SFCR group early analysis

May 24, 2022

Solvency II Wire Data 30 day report – 2021

May 11, 2022

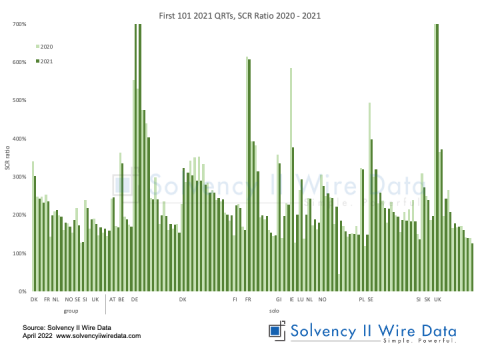

The First 101 2021 QRTs

April 7, 2022

Shifts in the Dutch Insurance Market Structure 2016 – 2019

October 29, 2020

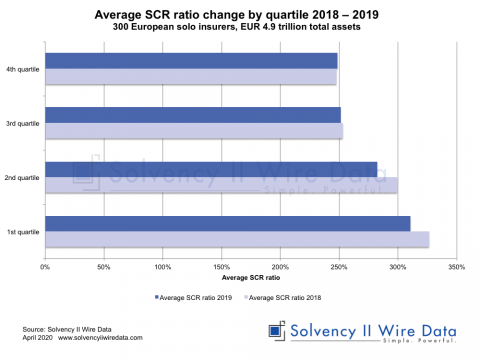

Solvency II News: SCR ratios lower in 2019

April 14, 2020

Analysis of EEA Life Insurance Market 2018 SFCR & QRT data

January 22, 2020

Insights from the first 2019 Solvency II SFCRs and QRTs

January 1, 2020

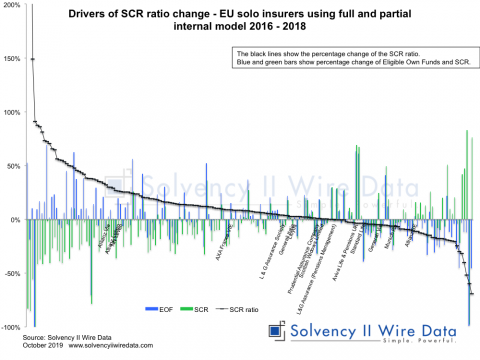

Drivers of Solvency II SCR ratio change across Europe 2016 – 2018

October 23, 2019

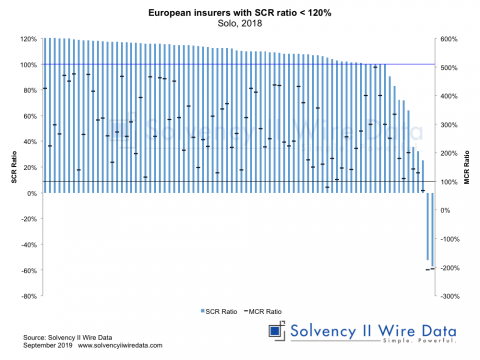

Insight into the lower end of the European insurance market

September 2, 2019

Putting the Solvency II QRTs to the test

November 16, 2018

Solvency II and equity price valuation

November 5, 2018

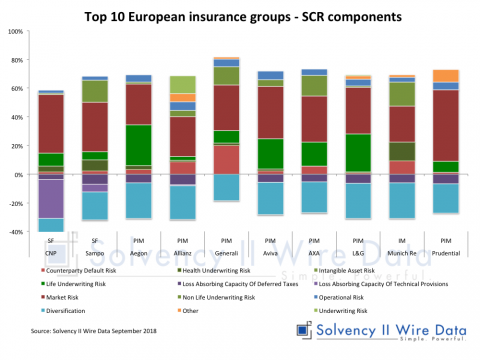

SCR components comparison of European insurance groups

September 11, 2018