Analysis of over 1,000 of the 2022 SFCRs and QRTs processed by Solvency II Wire Data reveals a doubling of the number of reports containing market sensitivity information.

12% of the 2022 SFCRs in the sample included detailed market sensitivities data relative to 6% of the same reports in 2021.

The sensitivities data covers a range of shocks including: equity markets, interest rates, credit spreads of corporate and government bonds, real estate values, expenses and loss rates.

A number of firms published business specific sensitivities. For example, Pension Insurance Corporation published sensitivities to the house price index.

DAS Legal Expenses Insurance Company Limited published information on climate stress scenarios for the third year running (see below).

RCI Services Ltd also published climate change sensitivities as well as the impact of cyber security risk

Vhi Insurance DAC published a number of ORSA scenarios for the second year.

16 reports included detailed scenarios of inflation in 2022. In contrast inflation scenarios were only described in 6 reports in 2021

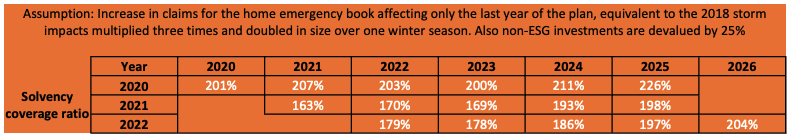

Impact of climate change on claims scenarios

The climate scenarios published by DAS Legal Expenses Insurance Company over the past three years, shows a growing negative impact of climate change on the firms solvency.

Using past shocks to estimate impact on the SCR

One Greek insurer used analysis of past financial shocks including the 1987 Black Monday market crash, the Libyan oil crisis of 2021 and the Lehman’s default of 2008 to estimate the impact of similar events on the firm’s SCR.

The SFCR text (translated from Greek using the built-in translation tool on Solvency II Wire Data) concludes: “From the above analysis it follows that the repetition of the Russian Financial Crisis of 1998 has the greatest negative impact on the SCR. On the other hand, the repetition of six scenarios (US 10yr treasury + 100bps with propagation, Greece Financial Crisis – 2015, Interest rate up 100bps , EUR up 10% vs USD, US Curve Steeping and 1987 Black Monday – current correlations) results in the SCR ratio improving by up to 5 percentage points. Nevertheless, no scenario leads the Company to an SCR ratio below 134%, which allows it to maintain its solvency at particularly high levels, even with the possible occurrence of extreme scenarios.”

Sensitivity reporting in 2022 SFCRs

The trend in sensitivity reporting in the SFCRs is likely to increase in the coming years as the drive for trasparency and clarity from market participants and regulators seek to standardise reporting formats.

Solvency II Wire Data is an innovative insurance database of the Solvency II SFCR data provided by Solvency II Wire.

To view a list of features see the Solvency II Wire Data Innovation Timeline.