Tag: SCR

Solvency Capital Requirement – the higher of the two capital requirements under Solvency II.

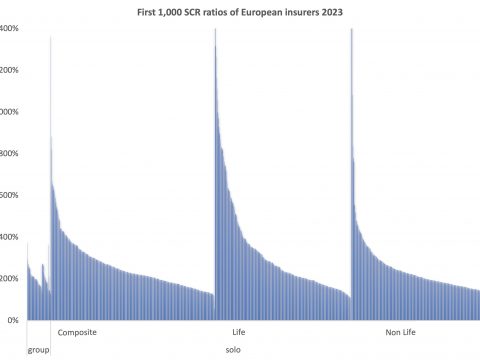

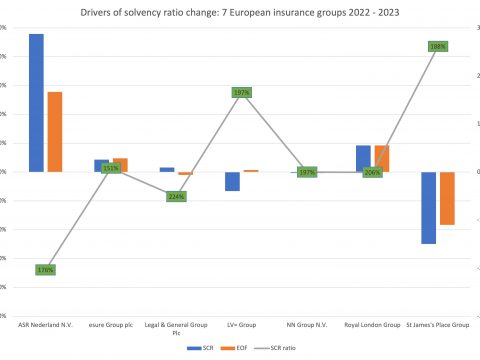

European insurance market insights 2023: 1st 500 QRTs

April 15, 2024

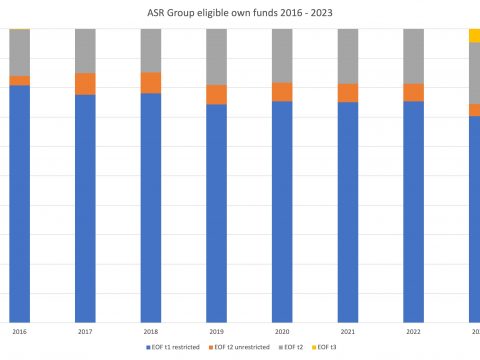

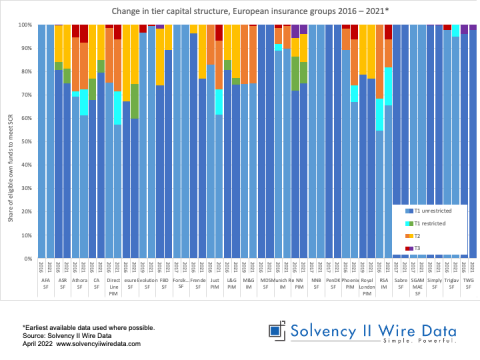

SFCR 2023: ASR introduces tier 3 capital

April 9, 2024

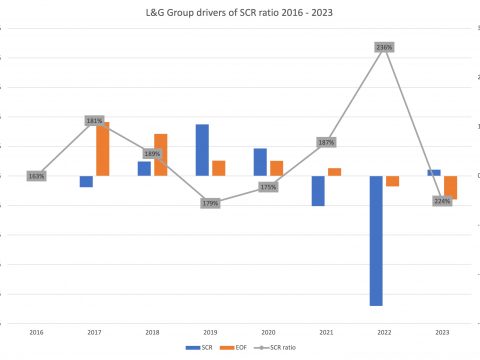

SFCR 2023: L&G solvency ratio down

April 4, 2024

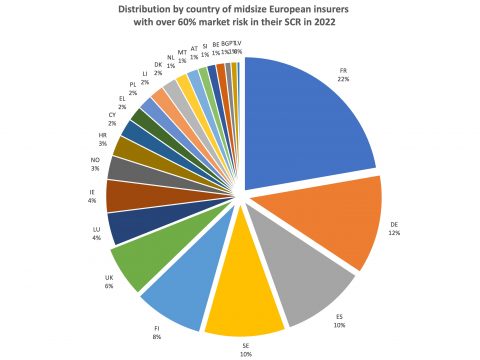

SCR market risk sub-module of 1,000 midsized European insurers

February 29, 2024

Solvency II News: 7th annual Solvency II survey

September 7, 2023

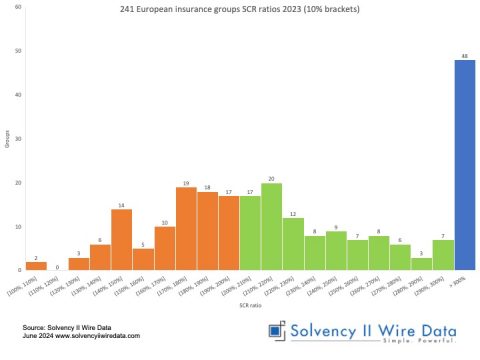

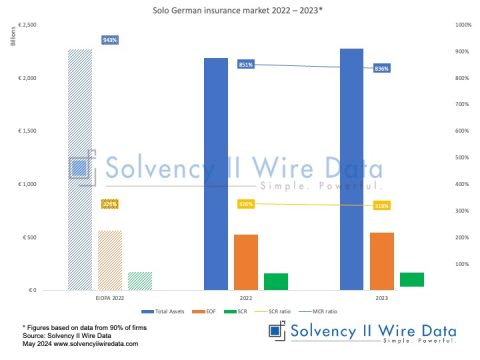

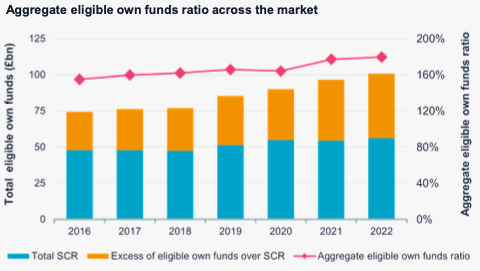

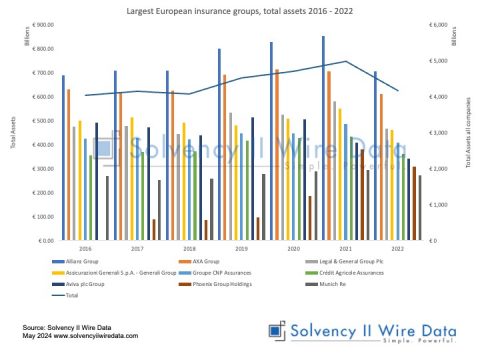

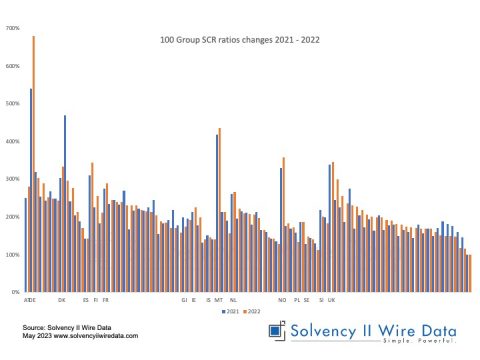

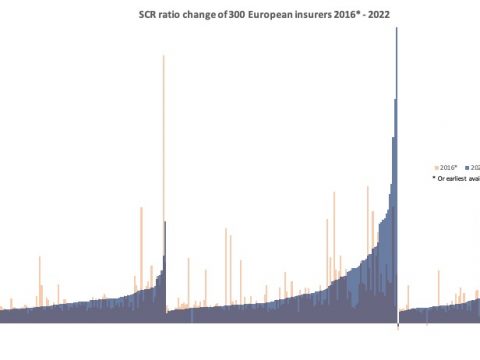

2022 Group SCR Ratios

May 19, 2023

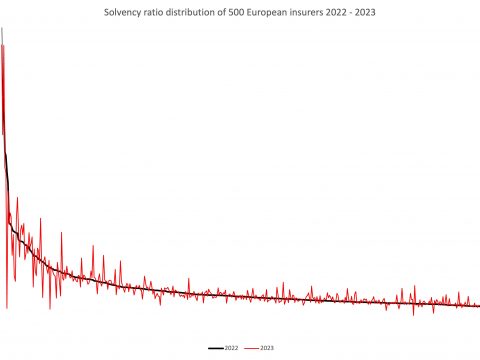

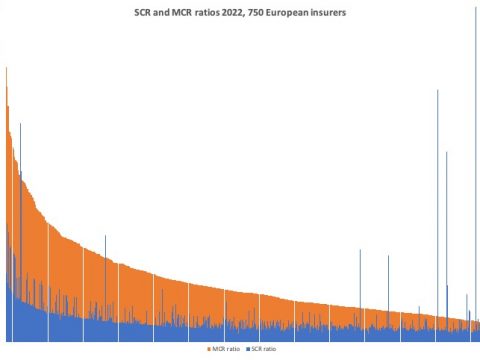

2022 Solvency II Ratios

May 1, 2023

First 2022 Solvency II SCR ratios

April 17, 2023

Solvency II Wire Data 30 day report – 2021

May 11, 2022

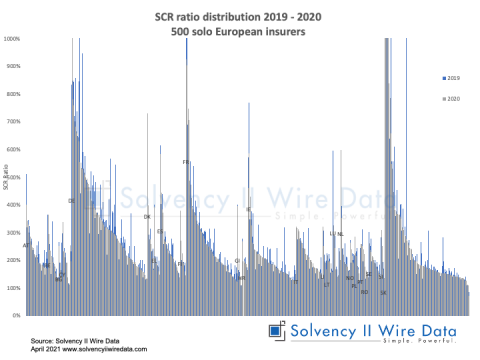

500 2020 QRTs packed with insurance data

April 19, 2021

Market risk sensitivities data in the SFCR

March 14, 2021