The market risk sub-module in the SCR often makes up the largest component of the solvency capital requirement of most insurers. While it is more commonly a subject of interest relating to larger firms, little has been published on the proportion of the market risk sub-module for smaller European insurers.

Solvency II Wire Data has identified 1,000+ solo insurers with AUM between EUR 50 million and EUR 1 billion (Total assets S.02.01.02_R0500_C0010) based on their 2022 SFCR reports.

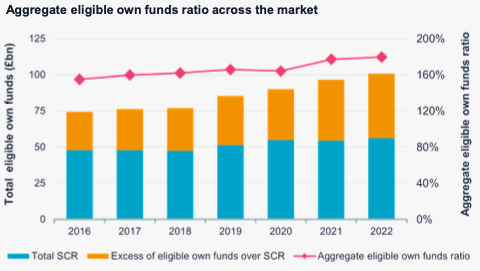

The sample covers EUR 315 billion AUM, Eligible own funds of EUR 119 billion and SCR of EUR 55 billion.

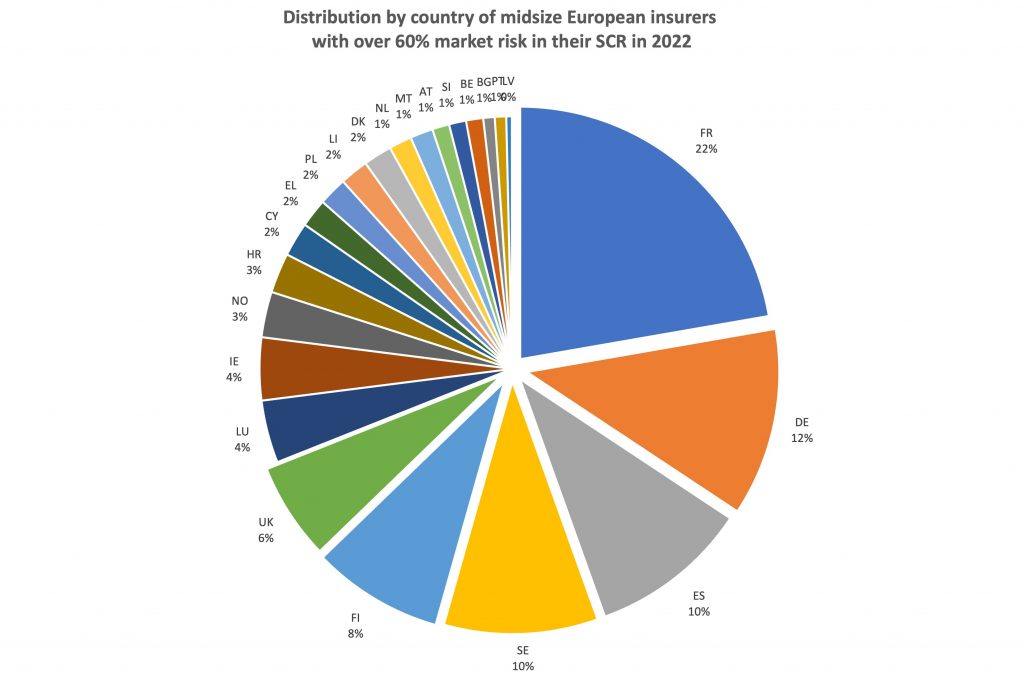

For over 250 companies the market risk component of the SCR makes up more then 60%. All use the standard formula to calculate their SCR. Just over half are composite insurer, 21% are life insurers, 26% non-life insurers.

The main geographical distribution of the sample is as follows: 22% in France, 12% in Germany, 10% in Spain and Sweden, and 6% in Finland.

97 of the companies are solo entities of a group.

Identifying a large proportion of the market risk sub-module in an insurer’s SCR is often the first step to exploring the asset allocation of an insurer. The analysis shows some of the potential found in smaller European insurers.

More information about the sample is a vailable to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).