Annual statistical data about the European insurance industry published by EIOPA recently, excluded the UK for the first time.

The EIOPA insurance statistics are published on an annual and quarterly basis for group and solo insurers subject to Solvency II. The latest annual solo figures for Solvency II balance sheet, own funds, premiums, claims and expenses, asset exposures, use of transitional and LTG measures no longer include the UK.

The number of Solvency II entities

In its latest files EIOPA listed a total of 2,383 solo entities subject to Solvency II in 2021 (2,436 in 2020). However, those figures exclude the UK from all years.

Copies of the EIOPA files from previous years held by Solvency II Wire Data show that in 2020 the total number of solos including the UK was 2,675 (of which 247 were UK insurers).

The UK has also been removed from the EIOPA Register of Insurance Undertakings. The current version of the list only includes a handful of UK insurers. Previous versions listed close to 5,000 UK insurers.

UK Solvency II disclosures

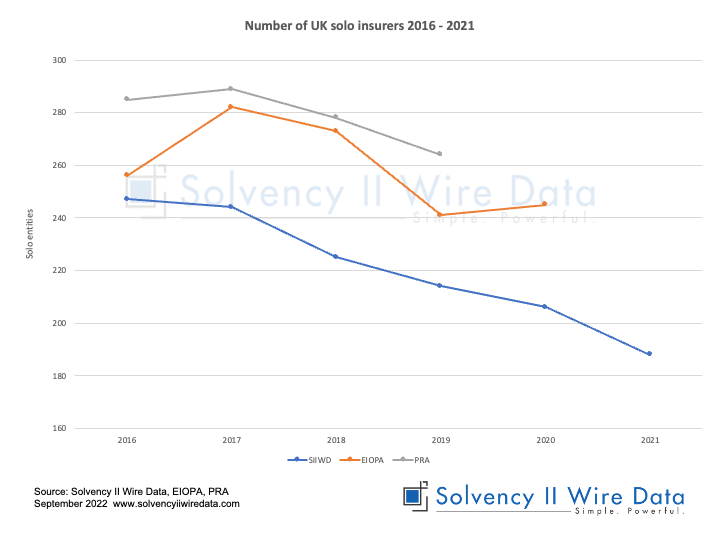

Solvency II Wire Data figures for the UK track the official data closely. The chart below shows the number of UK solo entities between 2016 – 2021 as published by EIOPA, the PRA and based on publicly disclosed data collected by Solvency II Wire Data.

The PRA stopped publishing its Solvency II supervisory disclosures in 2019, however, as noted above, previous EIOPA official statistics still included the UK in 2020.

The discrepancy between the two official figures is due to the way each authority counts third country insurers. The data are published at different times, which may also impact the count, especially in relation to mergers and company relocations.

The Solvency II Wire Data figures include 188 solo UK entities in 2021. Since Solvency II reporting began seven years ago, data for around 90% of UK solos has been publicly disclosed each. The figures also exclude companies that have published SFCRs, but did not published QRTs.

Part of the drop in the 2021 numbers may also be attributed to the fact that some insurers with a non-31 December year end have not yet published.

UK insurers rise in total assets

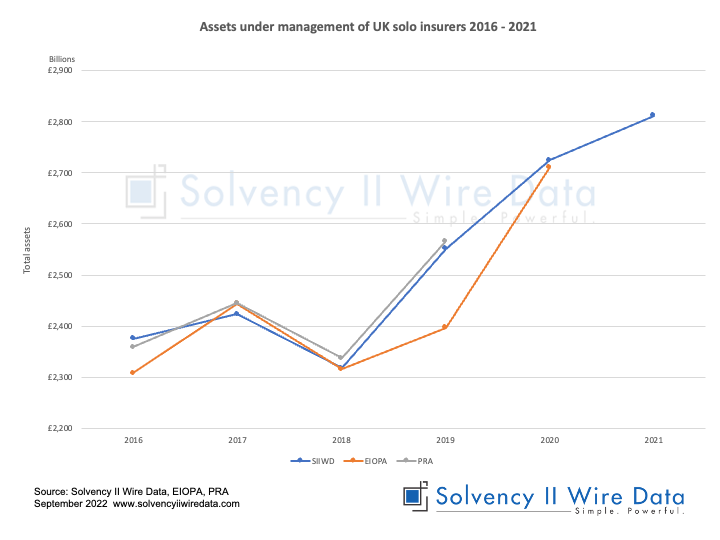

Despite the overall decrease in solo entities in the UK, total assets under management (as defined in the QRTs template S.02.01.02_R0500_C0010) continues to rise.

The chart below shows the total asset value over the same period.

The reduced number of entities may reflect a consolidation in the market, as well as the relocation of some companies to the EU post Brexit.

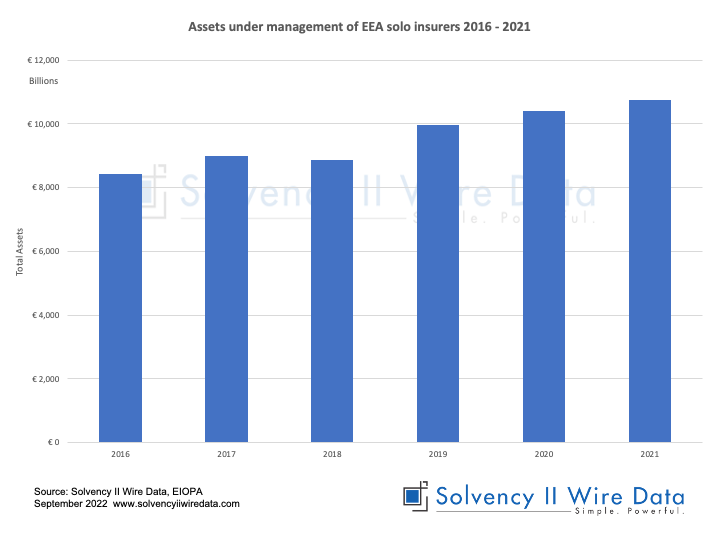

The increase in total assets echoes figures for the EEA as can be evidenced by the EIOPA annual statistics for the EEA (excluding the UK).

The future of Solvency II public disclosure in the UK

The UK continues to consult on its post-Brexit regime, with growing pressure for the UK government to show a “Brexit dividend” by attempting to hack down Solvency II.

But with the exception of a few areas, most of the regime seems to have been welcomed by the UK industry; in no small part due to the vast influence the UK yielded on the political process during the drafting of the Solvency II rules and a reluctance to incur further implementation costs.

In terms of reporting and disclosure, there does not appear any defined trend other than a general desire to slash “Brussels red tape”.

On 25 August 2022, the PRA published an update stating that it has implemented EIOPA Taxonomy 2.6 and that from 31 December 2021 firms should use this version to meet the reporting requirements (as set out in PS29/21).

However, due to the ongoing review of Solvency II, the PRA states that: “firms should not implement EIOPA’s Taxonomy 2.7 or any subsequent publications.”

The PRA’s Solvency II reporting schedule lists 2022 year-end annual submissions for solo and group. respectively, as 8 April and 20 May 2023.