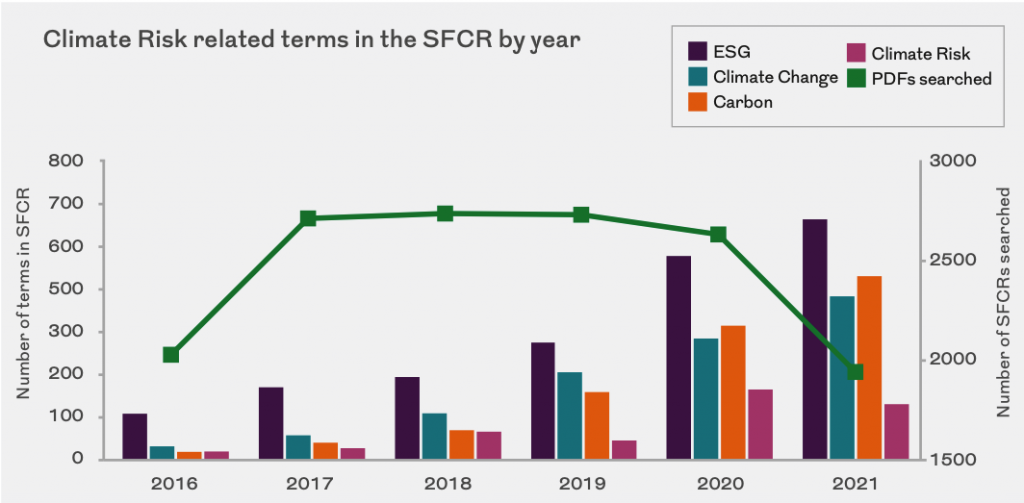

Just over one in ten SFCR reports referenced climate change in 2021, according to joint research published by Solvency II Wire and Royal London Asset Management.

Climate Risk Management for Insurers – Benchmarking: Update to November 2021 paper, builds on research published last year, analysing the 2020 Solvency II disclosures of the European insurance market as well as detailed qualitative analysis of the climate-risk disclosures of twenty of the largest UK and European insurance groups.

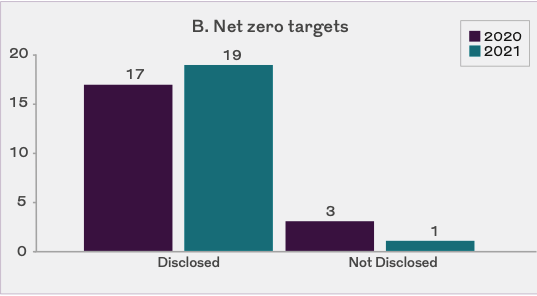

The findings support the evidence that insurers continue to publish more detailed climate information, with more groups publishing key benchmark metrics such as net zero targets, carbon foot print, data coverage for investments and Weighted Average Carbon Intensity (WACI).

The report concludes: “In all the areas we surveyed, there is an overall improvement in the volume of disclosures and their quality, pointing to the fact that the insurance industry has been upgrading its capabilities to identify, quantify, report, and manage climate- related financial risks.”

Climate information shortcomings

However, despite the overall increase in volume of disclosures, the research also reveals a number of shortcomings in the state of insurance climate disclosures in Europe.

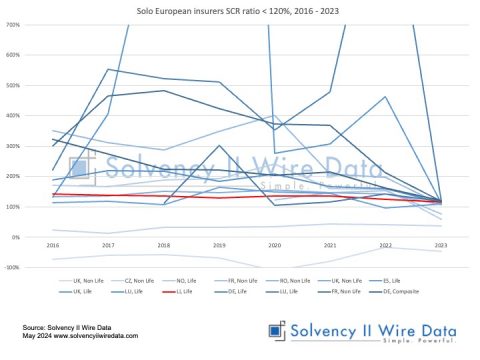

The vast majority of SFCRs do not contain information on climate change, and even a wider measure such as ESG was only found in about a third of the reports analysed (see chart below).

Furthermore, an initial review of the SFCR texts does not point to a substantial increase in the level or details of climate information provided in each report.

The qualitative analysis of the group climate disclosures also found moderate increases in the levels of disclosures relative to 2020.

The most widely reported measure is the commitment to achieve net zero by 2050 (see chart). In contrast only three UK insurers published information on their data coverage for investments.

For metrics such as WACI, the research found that there is still a high divergence between the groups. And while noting an increase in green asset allocation, these still represent a relatively small proportion of insurer’s overall investment portfolio.

European Insurers’ climate disclosures in 2021

Insurers are getting better at disclosing climate risk information and there is a clearly identifiable trend pointing up, rather than down, in both the number of insurers disclosing and the quality and volume of information. But as an annual report card for insurance climate disclosures in 2021, we would have to conclude: better but not enough!

Download Climate Risk Management for Insurers – Benchmarking: Update to November 2021

Download Climate Risk Management for Insurers – Benchmarking of Emerging Best Practice

Related content