The state of climate risk disclosure in the 2020 SFCRs can best be described as poor. A text search of the content of close to 2,600 SFCRs published in 2020 reveals that even the broadest climate-related terms such as ESG only appears in about one fifth of reports.

Research into other insurance climate disclosure documents such as the annual report or TCFD report showed that figures relating to net zero trajectory, carbon footprint were most widely reported. Although, in line with the overall state climate metric reporting, further and better-quality data is needed.

Notwithstanding the above, the 2020 SFCR crop has produced some standout examples of climate risk reporting that can help shape best practice climate reporting moving forward.

The selected themes draw on the recommendations of the TCFD framework and represent some example of the more comprehensive disclosures in the SFCRs.

Carbon footprint most comonly repoted in the SFCR

The term ‘carbon’ appears in 160 SFCRs, while ‘carbon footprint’ can be found in about 30 reports, of these only a handful provided figures.

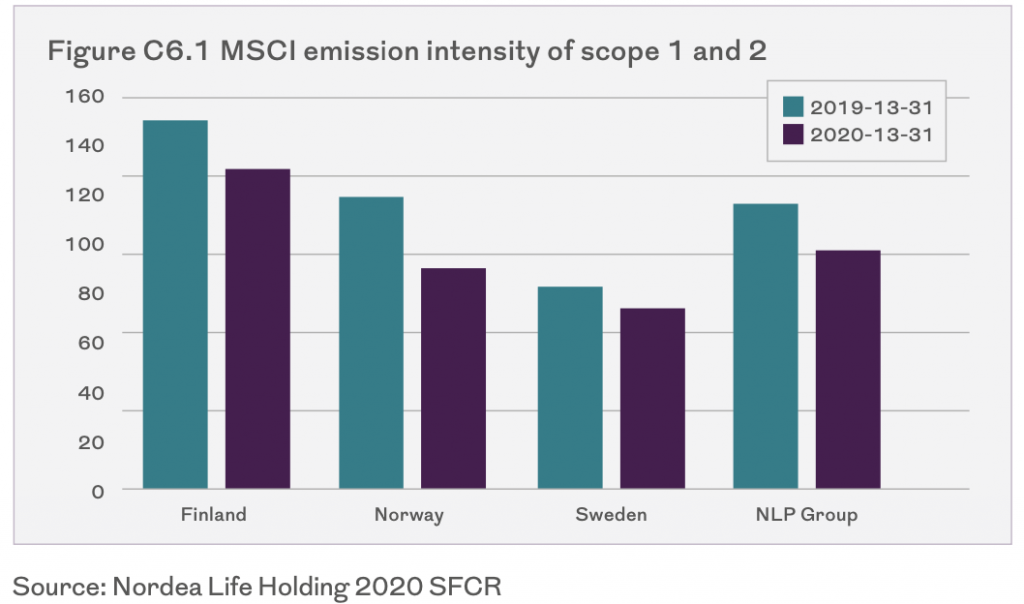

The Nordea Life Holding SFCR includes a chart detailing emission intensity for 2019 and 2020 of scope 1 and 2 carbon emissions across the territories in which it operates as well as for the group as a whole.

The company also provides the following commentary: “The figure illustrates that emission intensity attributed to the investments of NLP Group has already started to reduce, showing both the efforts of investee companies to reduce emissions and the efforts of NLP Group to step away from emission intensive investments.”

Net Zero targets and interim targets

The term ‘net zero’ only appears in 26 SFCRs published in 2020. Most insurers published their target date, while some also provided interim target information and as well as involvement in other wider initiatives they were part of.

Scottish Widows stated its aim of reaching net zero target by 2050 as well as “an intermediate target of halving our investments’ relative carbon footprint by 2030.”

The group explained that it does not intend to rely on carbon offsetting schemes and that instead it has “committed to driving carbon reduction in the real economy to achieve net zero goals.”

No WACI in sight

No WACI (Weighted Average Carbon Intensity) information was found in the SFCRs surveyed. However, Nordea Life Holding provided detailed information about what kind of data it collects about climate risk and impact on investments.

“NLP has established a comprehensive database for ESG risk indicators such as greenhouse gas emissions (GHG emissions), the Climate Value at Risk (Climate VaR), the CDP Climate Change Score, ESG scores and many others. External data providers include, among others, MSCI and CDP. The database is updated regularly and developed continuously in order to achieve a good coverage of NLP assets with available best practice indicators of ESG risk.”

Promising signs of green Investment reporting

The term ‘green bond’ appears in 13 SFCRs. A handful of variations such as ‘green economy’ could also be found. In addition to investment figures some insurers detailed their green investment principles or commitments and noted they operated exclusion lists in their investment portfolio.

For example, Munich Re detailed green bond issue in a section on its subordinated liabilities: “The increase in subordinated liabilities stems from the issuance of a green bond amounting to €1.25bn by Munich Reinsurance Company in the third quarter of 2020.”

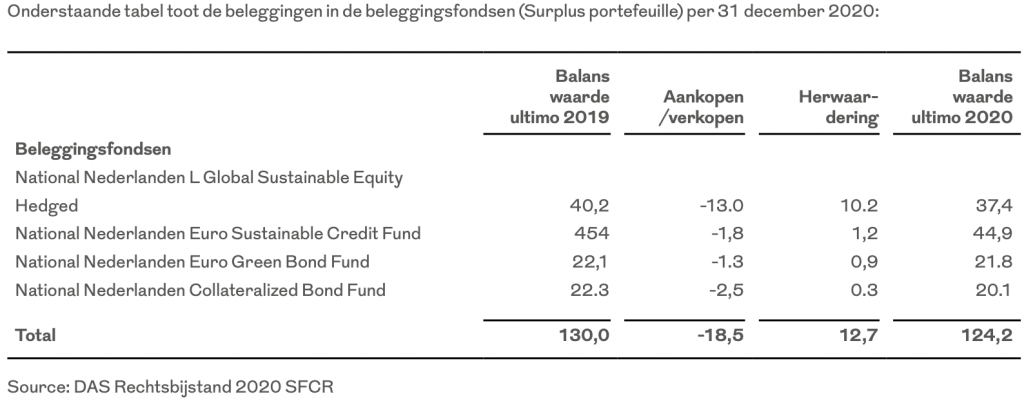

The Dutch insurer DAS Rechtsbijstand published a table showing details of its investment funds listing green and sustainable bond.

Management of climate risks

Analysis of key terms relating to climate risk management shows that overall there is relatively little information published in the SFCRs on the approach to managing climate risks. The term ‘climate change’ only appears in 13% of SFCRs (10% in 2019), while ‘ESG’ appears in 22% (12% in 2019).

Nordea Life Holding provided one of the most comprehensive sections on climate risk in the SFCR. The company described its climate-related strategies as part of its overall ESG work as follows: “Mitigation of ESG risk is achieved through appropriate decisions regarding capital allocation and investment decisions, developing internal policies, frame- works and tools for quantifying ESG risk and the engagement of asset managers with investee companies with the aim of communicating ESG-related goals and setting the focus on sustainable development.”

The SFCR also contains this table showing the impact of ESG risk on key risk types closely aligned to the Solvency II standard formula.

Very limited data coverage of investments

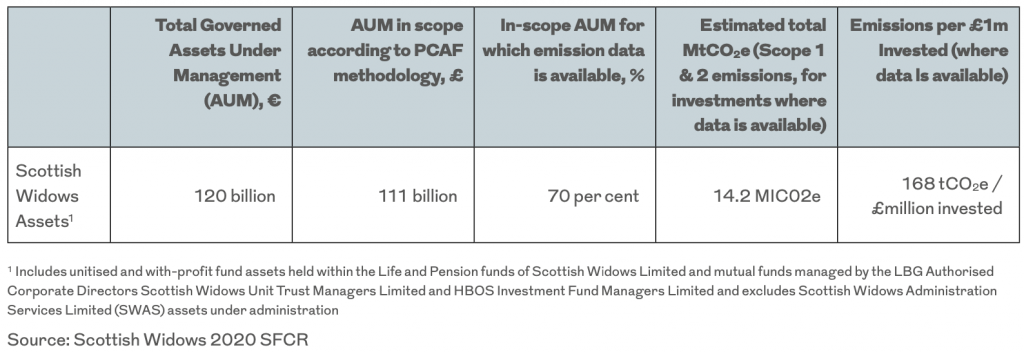

Scottish Widows was the only company surveyed to publish detailed figures about data coverage in its SFCR including a table detailing the “financed emissions for the Insurance Group’s Policyholder assets”.

Although the chart is based on 2018 data, they represent the best example of disclosures in this area to date. According to the company: “We are disclosing 2018 emissions as there was more comprehensive company emissions reporting data available at the time of calculation.”

Climate VaR, stress tests and scenarios

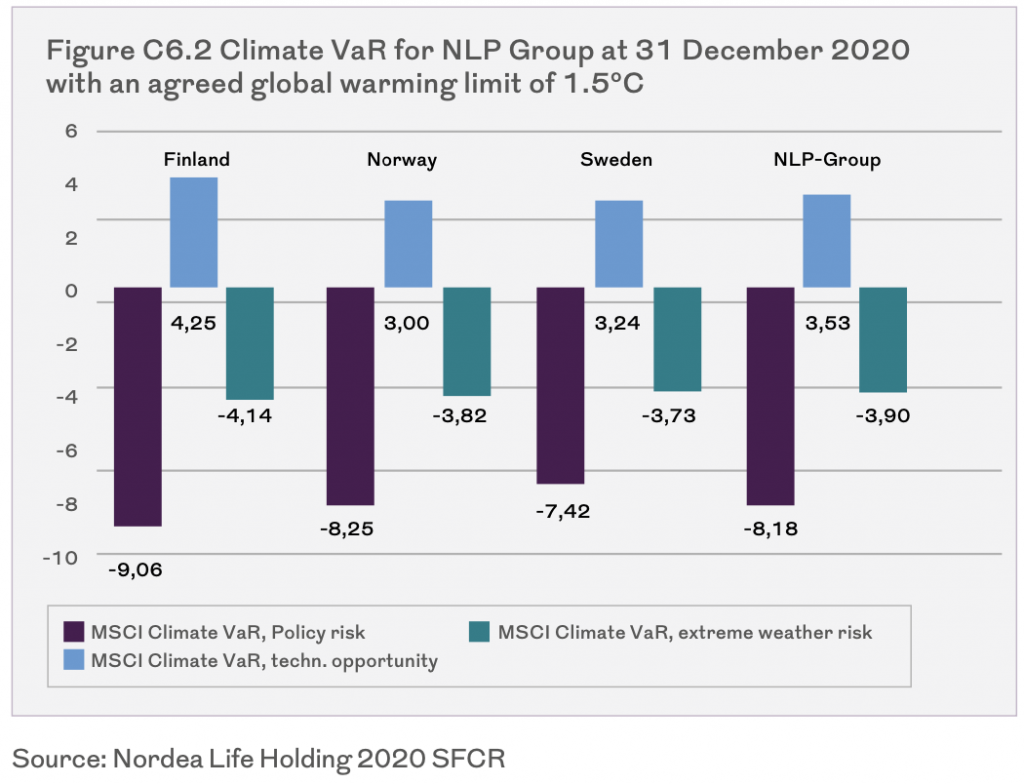

The only European insurer surveyed that disclosed any information about climate VaR in its SFCR (including figures) is Nordea Life Holding.

The accompanying text details the climate risk scenarios used. “The Climate VaR is given … for a scenario with an assumed target of limiting global warming to 1.5°C. In this ambitious scenario, the negative development of the market value of the investment port-folio due to changed climate regulation is estimated to be around –8%. The impact from physical risk in the form of extreme weather events is estimated to be around –3.9%. A counteracting effect of an estimated +3.5% may materialise in the form of opportunities due to technological advances.”

Other insurers provided some scenario and modelling information in their SFCR, although few provided figures.

For example, Topdanmark detailed some of it stress testing results, stating: “only one out of 900 years will exceed the reinsurance cover of DKK 5.1bn in a storm event on the company’s current insurance portfolio.”

Fidelis Underwriting Limitedis the only insurer surveyed to link climate risk directly to its solvency ratio: “The financial effects of climate change on underwriting and investment performance – this scenario resulted in a post-loss solvency ratio of 116%.”

Climate-related disclosures in the SFCR – the road ahead

Pressure on insurers to provide climate risk information will increase in the coming years. At the same time greater emphasis is being placed on the SFCR as a key communication document for European insurers. The two factors are likely to drive demand for more extensive and comprehensive climate risk disclosures in the SFCRs.

—

Access the full findings of the report Climate Risk Management for Insurers – Benchmarking of Emerging Best Practice.

SFCR text analysis of over 12,000 SFCR reports was provides by Solvency II Wire Data, an insurance database of the Solvency II SFCRs reports.

Related climate risk content:

Insurance climate risk reporting

Report: Climate risk management for insurers

WACI – a blunt tool for climate disclosures

Examples of climate risk disclosure in the SFCR

The environmental investment challenge for insurers – what comes next?