|  |

The drive to incorporate climate risk management brings with it a number of challenges and apparent contradictions for insurer’s investment decisions. In this article, Robert Chaplin, partner, Slaughter and May and Beth Dobson, PSL counsel – insurance, Slaughter and May, consider the potential conflicts this could raise for managing the competing interests of different stakeholders, and the unintended consequences of incentives to invest in green assets.

The pressure to invest in green assets

All insurers subject to the Solvency II regime, whether in the UK or the EU, need to comply with the ‘prudent person principle‘ in respect of all of their investments. This means that their first priority is to ensure their investments are suitable to support liabilities to policyholders, taking into account factors such as security, liquidity, profitability and duration matching. Where suitable and appropriately priced green assets are not available, insurers will continue to invest in a range of assets, with differing levels of sustainability.

On the other hand, the transition risks arising from climate change are recognised by regulators as an important factor for insurers in managing their portfolios. In the UK, for example, the PRA has explicitly stated (in its supervisory statement from April 2019 SS3/19) that insurers should consider whether there is an excessive accumulation of financial risks from climate change (particularly those likely to crystallise via the transition risk factor) in their investment portfolio, and consider mitigants when this is the case.

Insurers therefore have a balancing act to do when selecting their investments. Assets which are most profitable today, and therefore most suitable to meet the responsibilities of the firm to its policyholders and shareholders in the short term, may become less profitable in the future as we transition to a net zero economy. Shareholders are also likely to put increasing pressure on corporates to invest responsibly.

Lack of green assets

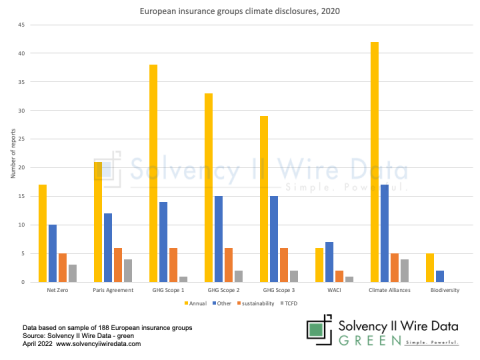

The investment picture is made more difficult by the relative lack of availability of green assets which are suitable for insurer investment portfolios. Data gaps also complicate the picture, as without a more granular view of the carbon footprint of underlying assets in relevant funds it is difficult to assess fully the climate change risks which may sit within portfolios.

There are signs that these data gaps will diminish in future as a range of mandatory disclosure initiatives (such as the UK’s Greening Finance roadmap) are implemented. Data gaps are, of course, also an issue from a risk management perspective as firms seek to manage the financial risks arising from climate change.

Assessing insurance asset risk

Insurers also need to consider how the risks arising from assets are assessed – and the prudential regime may in future need to adjust its approach. For example, the PRA considers that for some assets there may be a disconnect between the actual risk posed on a forward-looking basis and their measured risk under the current regime. This is especially true of investment in carbon-intensive industries but also potentially applies in a more positive way to some more innovative assets.

Regulatory incentives

Looking ahead, from August 2022, EU insurers subject to Solvency II will have additional incentives to consider climate change as part of their investment strategies. The Solvency II regime will be amended to require firms to:

- take sustainability risks into account in the prudent person principle,

- take into account the long-term impact of their investment strategy on sustainability factors, and

- reflect any relevant sustainability preferences of its customers in their investment strategy.

Insurers may in future also be pushed more towards investment in green assets if the European Commission implements possible changes to capital rules to penalise investment in “brown” assets and incentivise investment in “green” assets. Similar ideas have also been considered in the UK in the current review of UK Solvency II.

There is much disquiet about such incentives, as it goes against the principle of capital setting reflecting risks to insurer solvency and may result in unintended consequences. As noted in the 2021 PRA Climate Change Adaptability Report: “Ultimately, regulatory capital cannot substitute for government climate policy”.

There are also questions over whether pushing insurers into green assets and away from brown assets is the right thing to do from a policy perspective. If brown assets are devalued as a result of divestment by financial institutions they will be picked up elsewhere, outside of the regulated sector.

A better approach may be for insurers to work with their investee companies to facilitate the transition to a sustainable future, provided sufficient progress can be seen to be made.

The quest for insurance green assets

There are a range of factors which suggest that insurers will gradually move toward increased investment in green assets. Conflicting demands of stakeholders and the need to find assets which best match insurers’ liability profiles are, however, likely to mean the process is not entirely straight forward.

The views expressed are the authors’ own.

Related climate risk content:

Insurance climate risk reporting

Report: Climate risk management for insurers

WACI – a blunt tool for climate disclosures

Examples of climate risk disclosure in the SFCR

The environmental investment challenge for insurers – what comes next?