Insurance failures have been rare under the Solvency II regulatory regime since it entered into force in Europe in 2016. But when they do happen they present a unique opportunity to scrutinise the effectiveness of the regulation.

Solvency II Wire and LCP have teamed up to investigate these early failures in order to assess the value and quality of the Solvency II public disclosures. The process has uncovered regulatory failings at a European and international level and has paved the way for the creation a set of indicators that could help to identify insurance failures in the future.

Authors:

Gideon Benari Editor, Solvency II Wire Gideon Benari Editor, Solvency II Wire |  James Sandow Associate consultant, LCP James Sandow Associate consultant, LCP |

Disclaimer: the events described in this article are on-going. Information is accurate, based on our understanding of the available data as at date of publication.

Part 1: A cross-border reinsurance spiral

On 12 March 2018 an Irish insurance company called CBL Insurance Europe DAC was placed into administration. This was not an event that shook the financial world, nor did it make any major headlines in the press. And rightly so. CBL Insurance Europe (CBLIE) was a relatively small insurer with EUR 20m total assets and EUR 6m technical provisions.

The firm was classified as a “Low impact firm” under the Central Bank of Ireland’s PRISM supervision framework. CBLIE was the first insurer to have failed in Ireland under Solvency II. But, more importantly, it was also the first in Europe to have failed and produce a Solvency and Financial Condition Report (SFCR) and Quantitative Reporting Templates (QRTs): the Solvency II public disclosures.

And while Solvency II is explicitly not a zero-failure regime, it is designed to create an early warning system, or regulatory ladder of intervention, to alert supervisors to any potential weaknesses and allow for sufficient time to take mitigating action. The Solvency II public disclosures are an important part of that process in that they are designed to encourage market discipline through increased transparency.

The failure of CBLIE (and a handful of other insurers) under Solvency II, provides an opportunity to examine the quality of the public disclosures in order to assess their effectiveness. The two questions at the heart of this investigation are:

- Was there sufficient information in the SFCR and QRTs to flag up a firm’s potential failure?

- If the indicators were there, would it be possible to identify other vulnerable insurers?

The story begins …

To understand the effectiveness of the Solvency II public disclosures in enforcing market discipline as envisaged by the regulation, it is first necessary to understand the complex web of events that let to the failure of the Irish insurer.

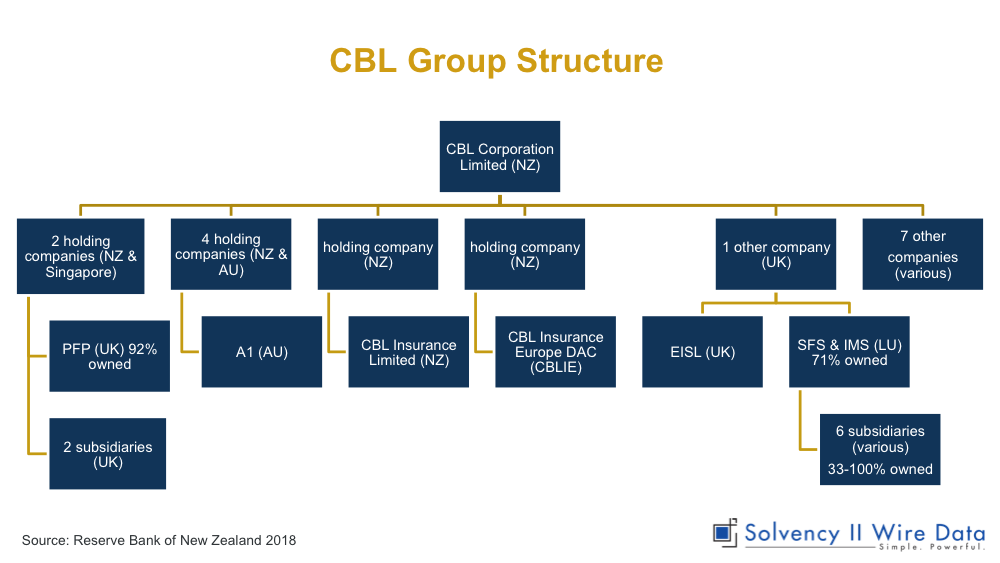

CBLIE was part of the CBL Corporation in New Zealand, “a specialist insurance and reinsurance group focused on credit and financial risk,” according to the company website. As can be observed from simplified group structure chart, through its various subsidiaries and branches, the group provides cover across multiple regions including Asia and Europe. The group structure is the first clue to understanding what happened to CBLIE.

Group capital flows

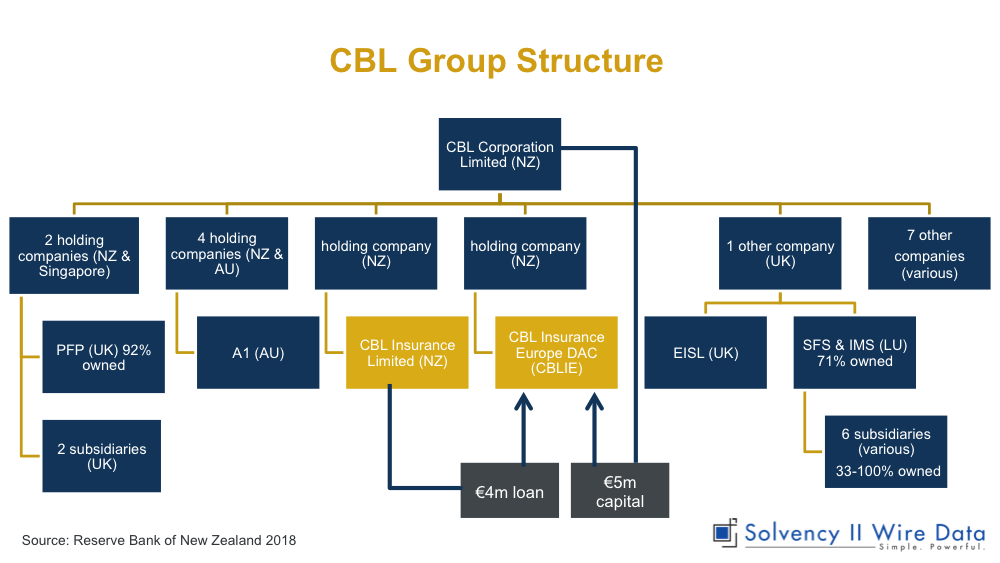

The CBL Insurance Europe 2016 SFCR (published in May 2017 as at 31 December 2016) reveals that CBLIE received an intercompany loan of EUR 4m (about 20% of total assets) from another entity in the group: a New Zealand based insurer called CBL Insurance Limited.

According to the company website: “CBL Insurance Limited is the largest and oldest provider of credit surety and financial risk in New Zealand.” The SFCR also reveals that, as a result of the ORSA process, the parent company CBL Corporation committed to provide CBLIE a EUR 5m capital injection to raise its Solvency ratio to 150% from 125%, over a forecast period of four years.

Rapid growth

Another clue, which can be found in the SFCR, is the rapid growth of CBLIE over the previous year. Between 2015 and 2016 the company almost tripled its Solvency Capital Requirement (SCR) from EUR 4.1m to EUR 11.2m and almost doubled its underwriting profits from EUR 1.7m to EUR 3m. There were also substantial increases in exposure to certain geographical areas, especially France (EUR 0.028m to EUR 0.31m) and other territories (from EUR 0.015m to EUR 0.22m).

The SFCR does explicitly refer to the rapid growth, however it does not explain its drivers. The only clue to the source of this rapid growth can be found in the final paragraph of Section A, Business and performance, where there is a somewhat opaque reference to ”an insurer domiciled in a jurisdiction which is affected by the ‘Brexit’ decision (Gibraltar).”

Using a variety of sources including court documents released after the company had gone into administration, it was possible to establish that the Gibraltar based insurer was Elite Insurance Company Limited (Elite), a company that went into run-off on 5 July 2017. The Elite Insurance Company Limited 2016 SFCR was published on 4 August 2017 (financials as at 31 March 2017).

The SFCR shows that Elite had breached its SCR coverage ratio (eligible own funds to SCR ratio of 77.2%) although the MCR ratio remained strong at 308.7% (breaching the MCR ratio would give sufficient power to the Gibraltar regulator to force the company to stop trading). Elite was much larger than CBLIE (GBP 266m total assets and GBP 122m technical provisions). It wrote business in multiple countries in Europe, although by far its largest business exposure was in France.

The report contains little information on the company’s exposure by region except that in 2016 it made an underwriting loss of c. GBP 15m, of which GBP 13m was in France. But the QRTs (published as an annex at the end of the document) show that exposure to France was almost half Elite’s total GWP (template S.05.01.02 – Premiums, claims and expenses by line of business, cell R0110_C0100).

The SFCR also reveals that Elite was subject to an onsite inspection by the Gibraltar Financial Services Commission (FSC), in October 2016 and a subsequent Skilled Persons Report in early 2017. This increased regulatory scrutiny was undertaken, in part, in respect of the Company’s reserving of a book of French construction business.

The French connection

The book of French construction business was made up of a variety of compulsory construction liability insurance contracts in France. Most of the business was originated through Securities and Financial Solutions Europe (SFS), a Luxembourg based Managing General Agent, and European Insurance Services Limited (“EISL”), a UK based broker operating in France.

The CBL Corporation acquired EISL in 2011 and SFS in early 2017 (through a controlling stake). It is this book of business that was effectively passed on to CBLIE in Ireland, and which is very loosely referenced in the CBLIE SFCR.

Elite connections

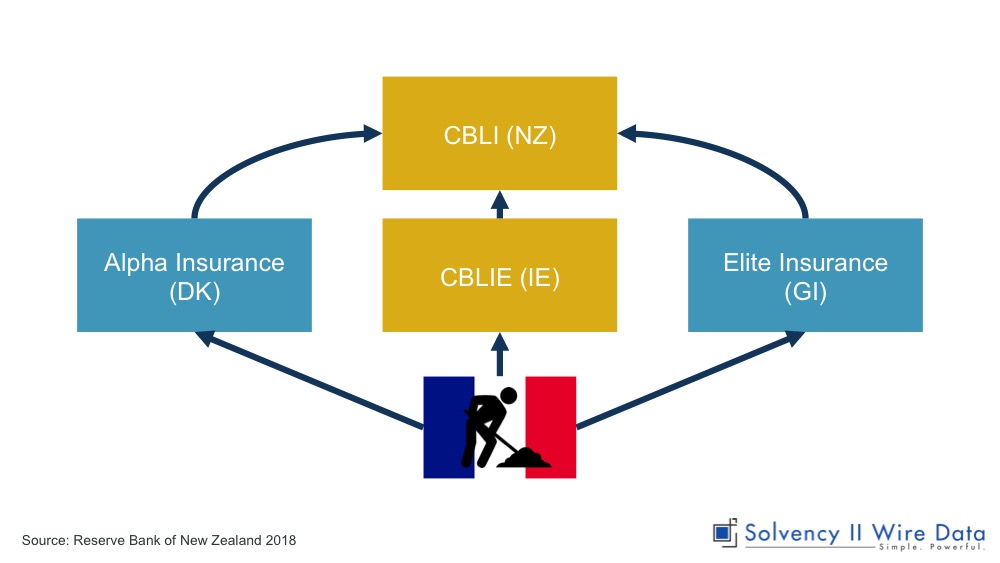

Elite also had reinsurance arrangements with the New Zealand based group. According to the SFCR: “The Company has quota share reinsurance arrangements in place across most lines of business to varying degrees. The highest exposure the Company has with any lines of business to one counterparty is 80% (CBL).”

That counterparty is CBL Insurance Limited. The same New Zealand based insurer that made the inter company loan to CBLIE. Further investigation, revealed that a Danish insurer by the name of Alpha Insurance A/S (Alpha) was also connected to the group.

Alpha made headline news when it collapsed earlier this year. The BBC reported that on Tuesday 8 May 2018, at 11.30 pm, over ten thousand black cab and minicab drivers received a text message, informing them that their insurance cover was cancelled with immediate effect. The following morning concerned drivers were queuing outside the firm’s UK offices seeking compensation, and desperately looking for alternative cover to be able to carry on working.

Alpha failure

Alpha was similar in size to Elite (EUR 345m total assets and EUR 213m technical provisions). The Alpha Insurance A/S 2016 SFCR, which was published as at 31 December 2016, makes no mention of the CBL Group or its exposure to CBLI in New Zealand or the French construction business.

The Alpha SFCR does, however show that about 11% of its business was written in France. The attached QRTs show an exposure of a about DKK 147m GWP in France (template S.05.02.01 Premiums, claims and expenses by country, cell R0110_C0100).

The extent to which Alpha was connected to the CBL Corporation is revealed in court documents published in New Zealand showing that the company was writing cover for the same underlying French construction business that was also reinsured with CBLI Insurance in New Zealand.

A cross-border spiral

The three companies – CBLIE in Ireland, Elite in Gibraltar and Alpha in Denmark – had all been involved with the New Zealand based CBL Insurance through various reinsurance arrangements. What linked them together was their exposure to the book of French construction insurance.

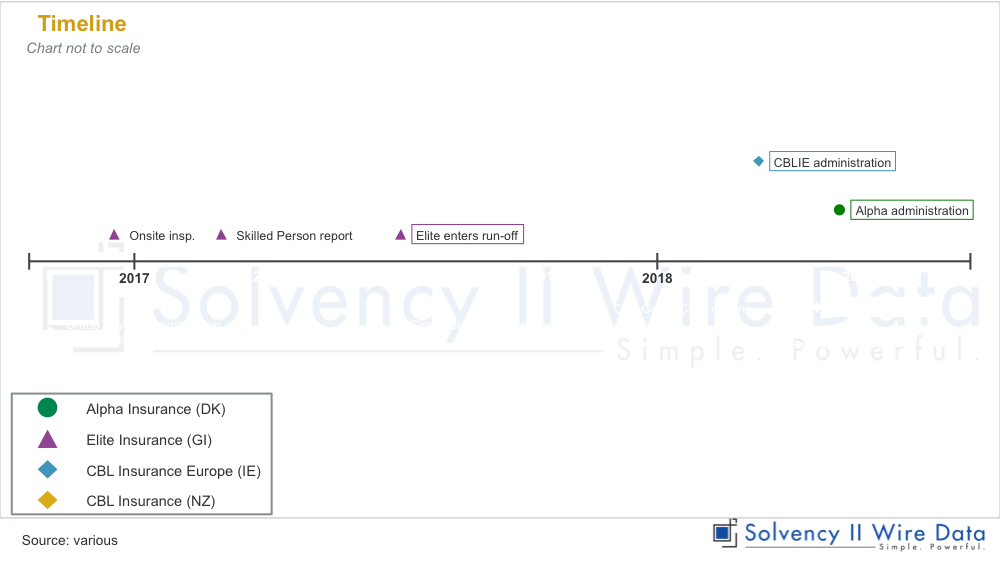

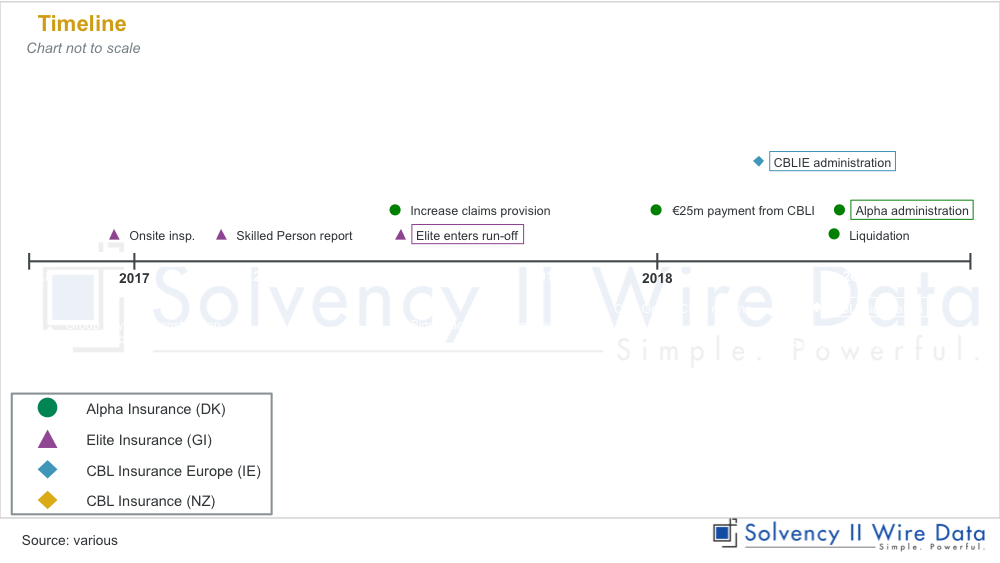

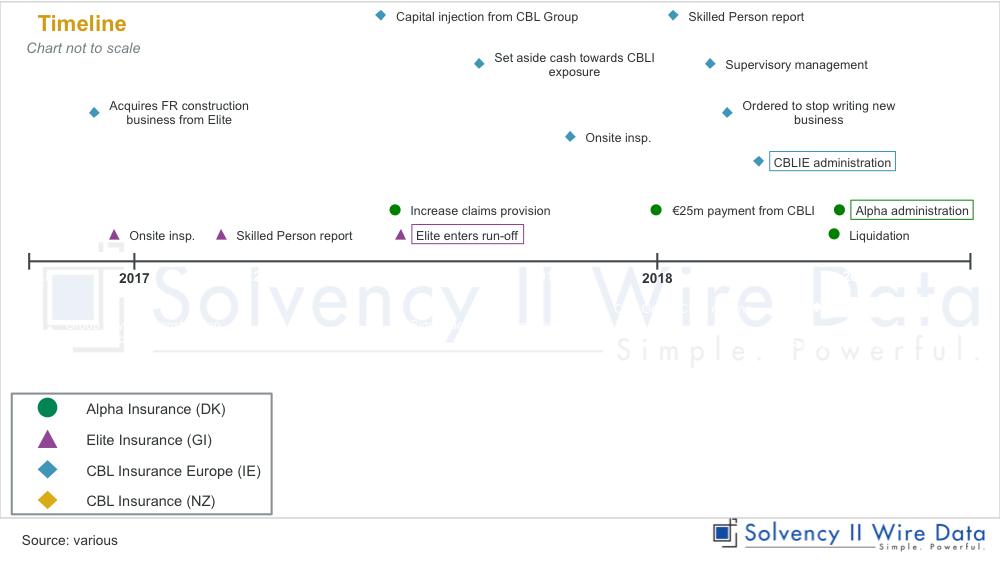

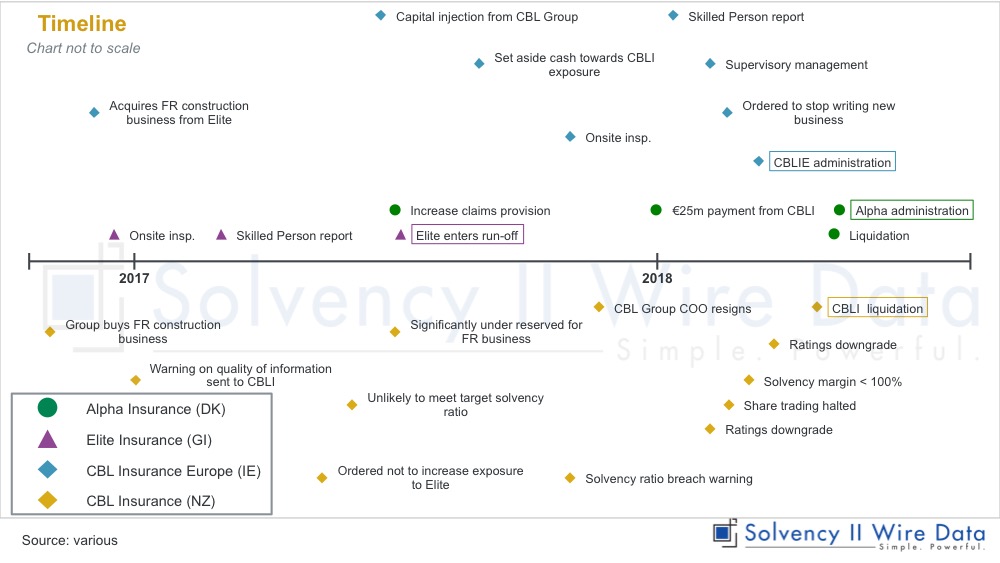

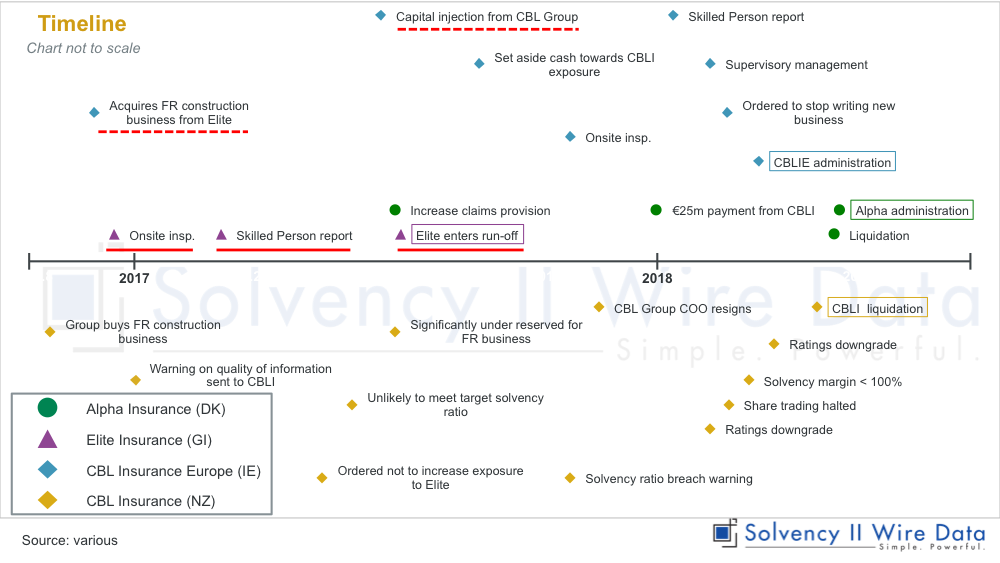

The firms were all subject to local regulatory attention in respect of their – seemingly unrelated – exposure to the book of French construction business. The extent to which these events, and their fates, were connected is revealed when plotting the events on a timeline. The timeline below (not to scale) demonstrates the sequence of events leading to the collapse of each firm. The regulators involved all appeared to be aware of the exposure of each of the entities to the French construction business, and had taken various actions in that respect. As noted above, the Gibraltar regulator had concerns about Elite’s reserving practices in respect of that business, almost a year before entering run-off.

Alpha was also asked to increase claims provisions in respect of its exposure to the French construction business by the Danish Financial Services Authority (DFSA) during 2017. The company also received a payment of EUR 25m from CBIL in February 2018. But on 4 May 2018 Alpha was placed in liquidation and went into administration 4 days later. In Ireland, CBLIE was required to strengthen its balance sheet by the Central Bank of Ireland in the summer of 2017 and was subject to an onsite inspection and a capital add on later that year. The company was then requested to produce a Skilled Persons Report, in a trajectory echoing that of Elite.

CBLIE entered “supervisory management” on 7 February 2018, a month before going into administration. Over the same period the Reserve Bank of New Zealand was monitoring the position of CBLI and the CBL group. As early as January 2017 the Bank had concerns that: “CBLI was not receiving reliable data from its ceding insurers, which includes CBLIE, or its agents in Europe,” the court documents reveal. In July 2017 it ordered CBLI not to increase its exposure to Elite as well as required it to raise its solvency ratio to 170% (under New Zealand’s solvency regime).

The following month the Bank concluded that CBLI was significantly under reserved in respect of the French business and that: “its adjusted capital for solvency purposes … was most likely to be less than zero, and that there was a material likelihood that the wider CBL group had insufficient resources to meet the shortfall.” By 7 February 2018 both the group and CBLI suffered the first ratings downgrade followed by a second on 23 February 2018.

CBLI’s rating dropped to AM Best ‘Issuer Credit Rating of E’ and ‘Financial Strength Rating of E’ (under regulatory supervision). A spectacular fall from the upgrade to a– and A- (Excellent) respectively in June 2016. Ultimately it was a NZD 100m adjustment to the reserves by CBLI in New Zealand that rippled through the three European insurers linked by ownership and reinsurance arrangements and caused their failure.

The story … retold

Identifying the causes of failure and the relationships between the multiple entities connected to the story above required the use of several sources, some of which (e.g. court documents) would have only been produced after the fact.

The SFCRs did provide some details about what happened at the three firms, but certainly, at least in this case, they did not give sufficient warning of the difficulties ahead or the wider context in which each had operated. Trying to retell the story using only information from the SFCRs helps to answer the question: are the SFCRs fit for purpose as a tool for signalling potential troubles ahead?

The analysis examines both information about the sequence of events and about financial strength and counterparty dependencies.

Timeline information

There were only a handful of events that are explicitly mentioned in the SFCRs relating to the story outlined above. The SFCRs give a point in time snapshot of the company and a major limitation of the analysis is that to date the companies have only published one SFCR.

Alpha and CBLIE published reports as at 31 December 2016. Elite published on 4 August 2017, with financials as at 31 March 2017. This gives a cut off line somewhere after Elite went into run-off in July 2017 (see timeline). As can be observed, there is no information about Alpha and a bit of information about timings of the shifting of the Elite business to CBLIE, although no dates are mentioned.

Elite provide by far the most amount information, including details and dates of the onsite inspection and Skilled Person Report and of course the notification that it was entering run-off.

Capital strength and counterparty

The information in the public disclosures about the financials of each company is more helpful, but by no means comprehensive or sufficient.

Elite

The Elite SFCR provides the most amount of financial information related to the story. The SFCR details its quota share reinsurance arrangements with CBLI, as noted above, and acknowledges the associated counterparty risk. It also details information on risk mitigation measures in this respect, stating: “The Company’s counterparty exposure in respect of CBL [Insurance] was further reduced through the Company holding £24m cash by way of loss fund.”

The information about the onsite inspection and Skilled Persons Report make the only direct link with the book of French construction business in the public disclosures: “During March 2017 and ahead of the Company’s response [to the draft findings of the onsite review], the FSC requested that a Skilled Persons Report (“SPR”) be undertaken covering the same areas as the FSC’s on-site inspection, and the Company’s reserving of its French ‘decennial’ construction business.”

The report also states that the company did not intend to publish another SFCR unless there was a material change in its circumstance: “Following its entry into run-off, the Company is reviewing the appropriate reserving for its lines of business against the underlying data. If there is any major development significantly affecting the relevance of this SFCR, the Company will publish an updated SFCR.”

CBLIE

The CBLIE SFCR gives some background information about the company, including that it belonged to the CBL Corporation (although the full organisational chart was sourced elsewhere) and the group’s listing on the stock exchange.

It also includes information about the capital support from the group and CBLI in the form of a capital injection and intercompany loan.

Overall the language is quite bland even though it could be argued that an intercompany loan amounting to 20% of total assets (EUR 4m) should have at least warranted some consideration.

The SFCR also provides information about CBLIE’s reinsurance arrangements with the group, and acknowledges the concentration risk: “The intercompany investment to CBL Insurance represents a concentration risk, although it is considered acceptable due to CBL Insurance’s strong credit rating.”

The connection with Elite is mentioned, “jurisdiction which is affected by the ‘Brexit’ decision (Gibraltar)”, but Elite is not named in the report.

Alpha

The Alpha SFCR does not provide any information that can be clearly identified with the story. The word “France” is mentioned once in the entire document (in a table on page 3) revealing that 11% GWP is written in France. The QRTs show a DKK 147m exposure to France.

There is no mention of any of the other companies or territories related to the story nor of construction or building insurance.

SFCR story conclusions

Overall the SFCRs provide some information about the conditions that led to the failure of the three companies involved in the story. But it is fairly sparse.

Yet it is possible to draw a number of conclusions from the investigation.

The first is that any supervisory investigation or involvement should be added to the SFCR. As demonstrated in the case of Elite, it pointed directly to the underlying cause of the problem, and arguably should extend to related entities. For example, when CBLIE took over the book of French insurance construction from Elite, the latter had already been subject to the onsite review relating directly to this book of business in October 2016. It would seem appropriate that this would be reported in CBLIE’s SFCR, which was published as at 31 December 2016.

It is also clear that the lack of historical data has severely hamstrung the telling of the story. As more reporting cycles and standardisation develop it should be easier to identify missing information or cases where language is particularly opaque or “bland” for identifying potential difficulties.

However, even if further information were available the picture would not be complete without reviewing the quantitative data in the QRTs.

Part 2 of the article ‘Putting the Solvency II QRTs to the test examines the QRTs of the companies involved and builds a set of KPIs to help identify potential failures and difficulties.