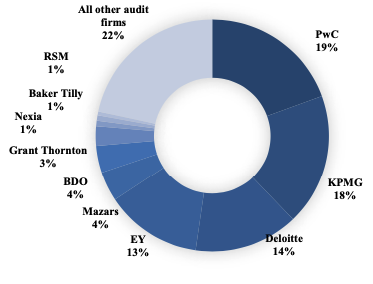

Initial findings of a survey of the European insurance audit market sheds light on the distribution of external audit firms in the sector.

Analysis of the external auditors of the Solvency and Financial Condition Reports (SFCR) of European insurers subject to Solvency II, reveals the extent to which the European insurance audit market is dominated by the ‘big four’ accounting firms.

The initial survey of the SFCRs of over 1,300 insurers in five countries (representing close to 70% of total assets held by both solo and group insurers) shows that together the ‘big four’ are responsible for auditing about 900 SFCRs.

Top external auditors by country

The table below shows the distribution of auditors by country. With the exception of France, where Mazars is the dominant auditor, the top four audit firms cover the largest share of the audit market.

| Auditor | AT | DE | FR | IE | UK | Grand Total |

| PWC | 12 | 128 | 92 | 58 | 75 | 365 |

| KPMG | 19 | 76 | 83 | 27 | 42 | 247 |

| Mazars | 18 | 140 | 23 | 13 | 194 | |

| Ernst & Young | 8 | 85 | 25 | 20 | 41 | 179 |

| Deloitte | 15 | 31 | 31 | 39 | 116 | |

| BDO | 17 | 1 | 9 | 25 | 52 | |

| Grant Thornton | 20 | 7 | 27 | |||

| SEC Burette | 19 | 19 | ||||

| Primaudit | 13 | 13 | ||||

| Ostwestfälische Revisions | 7 | 7 |

SOURCE: Solvency II Wire Data

Informing the findings of the audit reform in the EU

The findings, broadly echo those of the European Commission survey of the EU market for the provision of statutory audit services published in February 2021 (see chart below). The Commission survey is part of its work on the EU Audit directive.

SOURCE: European Commission

Full survey of EU auditors

The survey, conducted by Solvency II Wire Data draws on the 2020 SFCRs. The full report includes details of over 90 audit firms operating in these markets including lists of external auditors and any other auditors mentioned in the SFCR.

To download a summary of the report click here.