The Solvency II standard formula Solvency Capital Requirement (SCR) is calculated using six risk modules. Of these, market risk is by far the largest and most dominant.

According to the 2020 EIOPA annual insurance statistics (see chart) market risk accounts for between 25% and 70% of the Basic SCR (BSCR).

Analysis conducted by Solvency II Wire Data shows that in 2020 market risk accounted for 50% or more of the total SCR calculation of over 1,700 insurers using the standard formula.

The market risk module is made up of six sub-modules: concentration risk, currency risk, equity risk, interest rate risk, property risk, and spread risk.

While standardisation of the SCR makes it easy to compare the capital requirements of insurers, there is no requirement for firms to publish information about their SCR risk sub-modules; these can provide valuable insights into the capital and investment structure of an insurer.

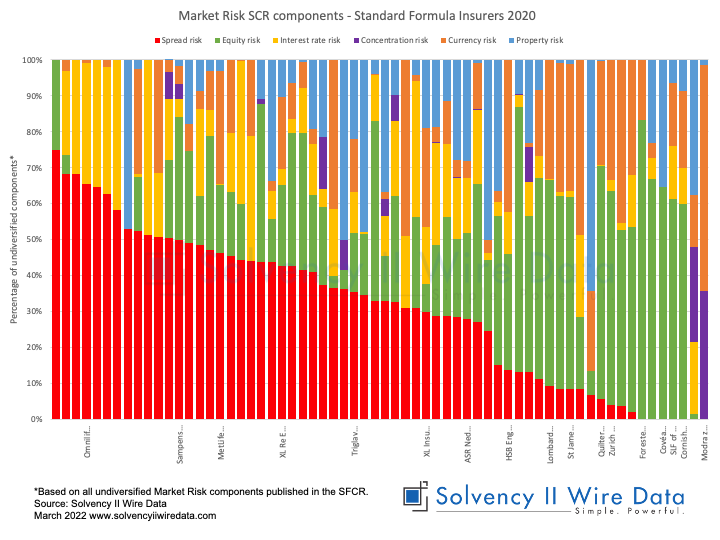

Market risk sub-modules details

A breakdown of the SCR components is disclosed by many firms calculating their capital requirement using a partial or full internal model. Yet some standard formula firms are also disclosing details of the SCR sub-modules in the narrative SFCR reports.

The chart below shows the market risk sub-module components of over 60 standard formula firms. Figures are provided for concentration risk, currency risk, equity risk, interest rate risk, property risk, and spread risk.

The analysis is based on a percentage of all undiversified market risk components in the Solvency II public disclosures of the firms.

The data is extracted by Solvency II Wire Data from the SFCRs. Similar data is available for close to 300 firms ranging across all the standard formula SCR risk modules.

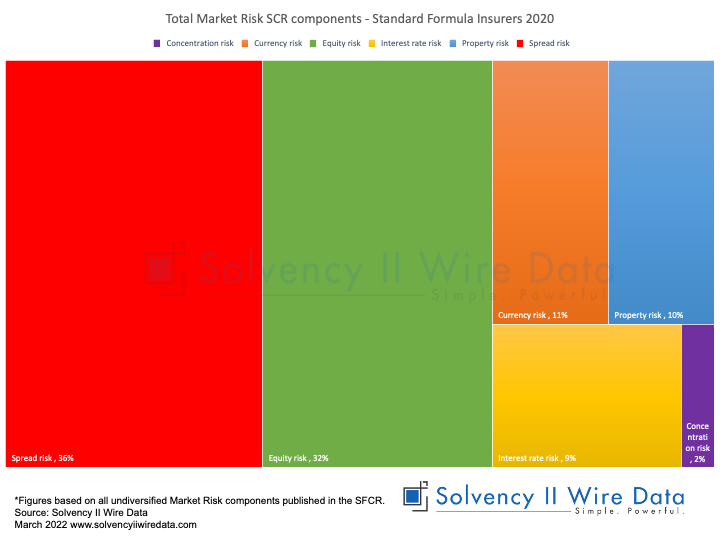

Spread risk and equity risk dominate market risk

Spread risk and equity risk sub-modules account for the largest portions of the market risk of the sample (36% and 32% respectively).

SCR market risk components in context

The figures above are limited to the data available in the SFCRs, published at the discretion of each insurer. However, the level of disclosure is growing (a similar sample has published details of their sensitivity analysis) as companies become more comfortable with the data they publish as well as how it is interpreted by the markets.

Related Articles