The Irish Central Bank (CBI) recently published the remaining 2019 SFCRs as well as the raw data from key public QRTs. The CBI and the Dutch Central Bank (DNB) are currently unique in that they publish QRT data in aggregated electronic form. However, the data does not include all the information from the QRTs, such as itemised SCR components for Partial and Full Internal model firms (templates S.25.02 & S.25.03 respectively) and group structure data (template S.32.01).

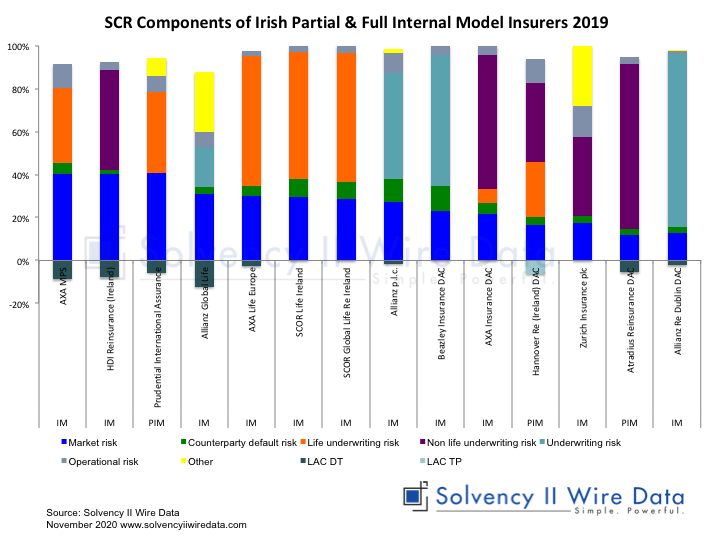

Analysis of the SCR Sub-Module components of Irish solo firms using a Partial or Full Internal Model conducted by Solvency II Wire Data reveals a detailed picture of the SCR components (see chart below).

The Solvency II Wire Data Comparator Tool allows for quick aggregation of the individual SCR Sub Module components published in templates S.25.02 and S.25.03. Partial and Full Internal Model firms can use company specific SCR Sub Module components to better reflect their risk profile in the SCR calculation.

The chart shows the SCR Component aggregated to match the Solvency II Standard Formula capital model calculation (template S.25.01).

Items that do not match specific categories, for example Business Risk or Model Risk, are allocated to the Other category. There are also some cases where the items are too broad. For example, Allianz p.l.c. and Beazley Insurance DAC did not specify a breakdown of life and non-life underwriting risk and are grouped under a more general Underwriting Risk category.

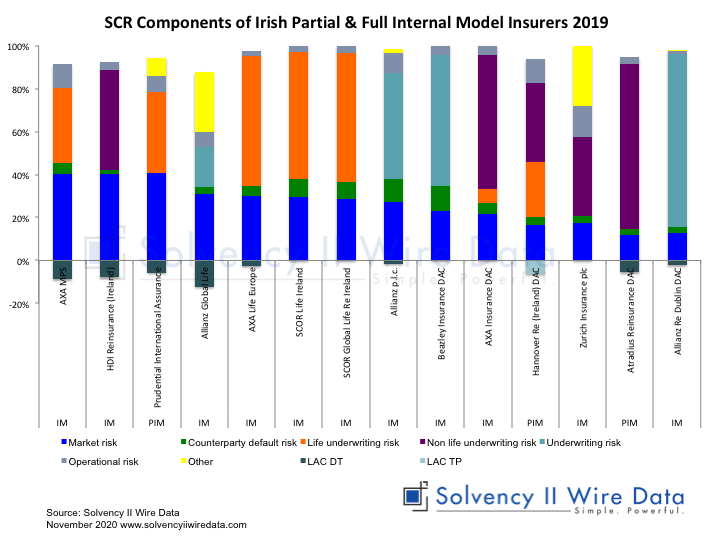

The Comparator Tool also aggregates the individual SCR components at a more granular level. The SCR Market Risk is broken down to its sub modules: Currency Risk, Equity Risk, Interest Rate Risk, Property Risk and Spread Risk, for example.

The chart below shows the SCR Sub Modules QRT of Irish insurers using a Partial or Full Internal Model in 2019.

Prudential International Assurance has provided the most comprehensive detail of these components with figures for Currency risk, Equity risk, Interest rate risk, Property risk and Spread risk. Hannover Re (Ireland) DAC provided figures for Mortality risk as well as Non Life Catastrophe risk.

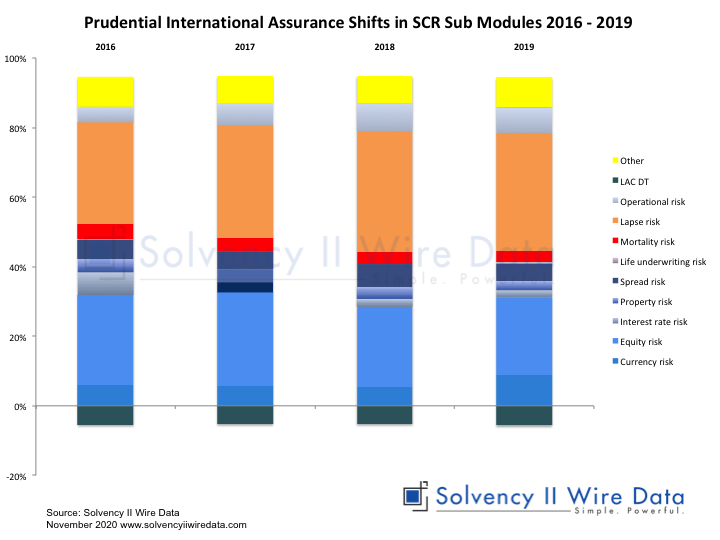

The chart below shows the proportion shift of the SCR Sub-Modules for Prudential International Assurance from 2016 – 2019.

The level of granularity of the Solvency II SCR Sub Module component reporting varies greatly across companies and markets. As reporting levels and granularity improve, these offer greater insights into the capital position of European insurers.

Solvency II Wire Data collects all available public QRT templates for group and solo.

QRT templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.12.01 Life and Health SLT Technical Provisions

S.17.01 Non-life Technical Provisions

S.19.01 Non-life Insurance Claims Information

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern Models

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group