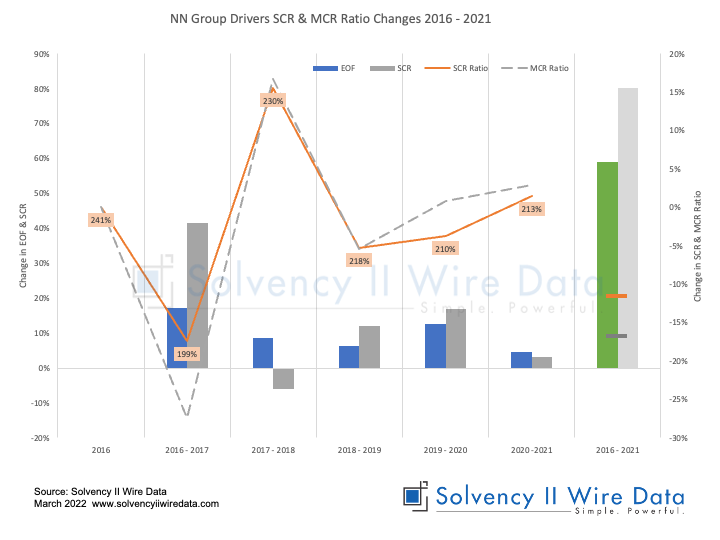

NN Group is the first of the large European insurance groups to publish its 2021 SFCR earlier than the official publication date. The 2021 Group Solvency II ratio is 213%, up from 210% last year.

However, the ratio is down from its highest value of 241% in 2016, the first year the full QRTs were published (see table).

The main driver reducing NN Group’s Solvency II ratio is an almost twofold increase in the Solvency Capital Requirement (SCR) compared to a more moderate increase in the Eligible Own Funds (EOF) to meet the SCR (see chart below).

The chart shows the year-on-year proportional percentage change in the SCR ratio and MCR ratio of the group (lines, right axis) plotted against the percentage change of the SCR and EOF (bars, left axis)*.

Over the entire period, the SCR rose from EUR 5.5 billion in 2016 to EUR 9.8 billion in 2021, while the EOF rose by two thirds over the same period; from EUR 13.1 billion to EUR 20.9 billion in 2021.

The chart also highlights the fluctuations in the SCR ratio and MCR ratio over time.

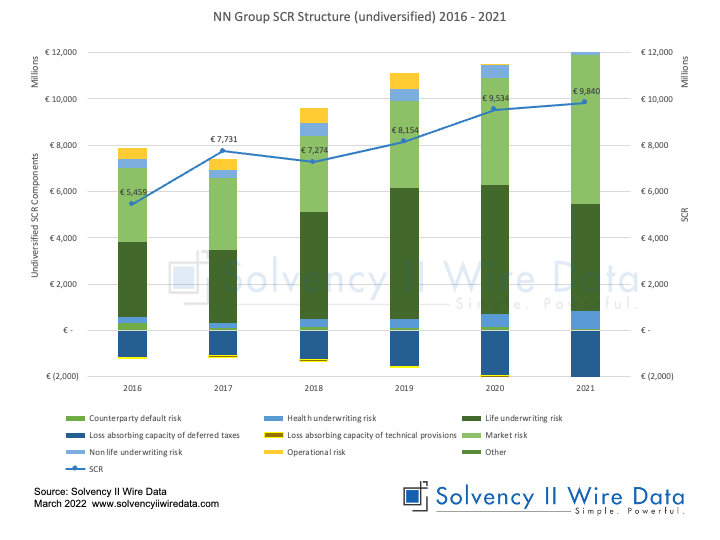

Drivers of change in SCR components

The main driver for the increase in the SCR appears to be the doubling of the market risk component.

The undiversified market risk component of the SCR rose from EUR 3.1 billion in 2016 to EUR 6.4 billion in 2021.

At the same time the proportion of the life underwriting risk in the SCR decreased relative to market risk in 2020.

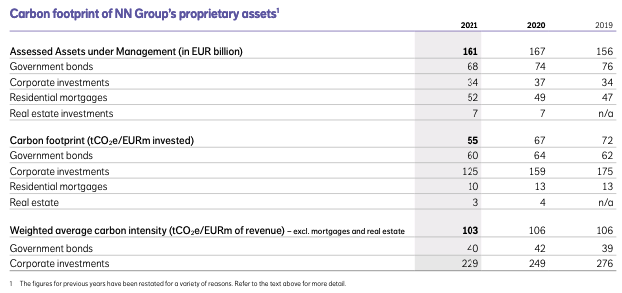

NN Group Climate Disclosures

The group continues to publish and update its climate-risk and ESG disclosures in its other publications, including a table of the carbon footprint of the group’s proprietary assets.

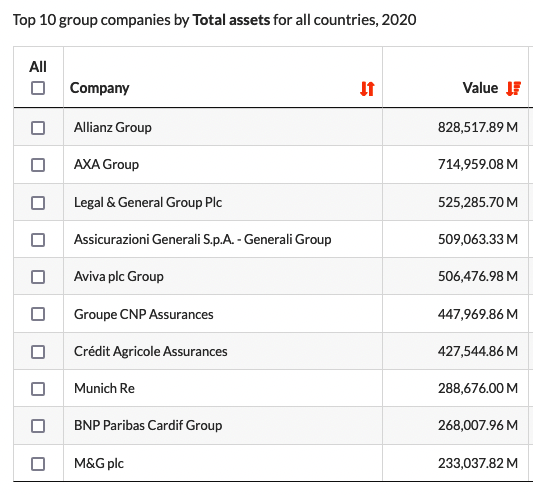

Waiting for the 2021 SFCRs of the largest European insurance groups

As European insurers begin to publish their 2021 SFCR reports ahead of the deadline of 20 May (8 April for solo) we expect to see further disclosures related to climate risk and ESG analysis.

* The SCR ratio is the ratio of EOF over the SCR.