Contents: Level 2 implementation, reporting & stress testing , market survey

Markets and reporting key concerns for Level 2

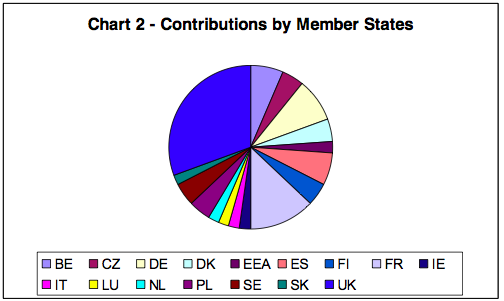

The effect on markets and the reporting burden on insurers are among the main concerns expressed by respondents to the European Commission’s consultation on the Level 2 implementing measures for Solvency II. A summary of the responses was published on 5 May 2011 by the European Commission. [caption id="attachment_960" align="alignright" width="302"] Contribution by member state SOURCE: European Commission[/caption]

The majority of the 68 respondents came from industry and national and European interest groups, with the largest portion of participants based in the UK.

“It is clear from the nature and the volume of the comments received that stakeholders’ concerns relate to a small number of key issues,” the Commission said. The issues include:

Contribution by member state SOURCE: European Commission[/caption]

The majority of the 68 respondents came from industry and national and European interest groups, with the largest portion of participants based in the UK.

“It is clear from the nature and the volume of the comments received that stakeholders’ concerns relate to a small number of key issues,” the Commission said. The issues include:

- Impact on long-term products

- Volatility and pro-cyclicality

- Proportionality and reporting requirements

- Transitional measures

Stress tests to evaluate reporting under Solvency II

The current stress tests for European insurers will evaluate reporting capability under Solvency II, not capital adequacy. RiskNet reports that according to Gabriel Bernardino, chair of EIOPA, these tests will evaluate how insurers will cope with the five reports they will have to produce each year. Solvency II will require firms to produce four quarterly reports and an annual report. “Both in the Solvency II directive and in the EIOPA regulations there is the need to perform stress tests as part of the supervisory regime. So what we are doing by stress-testing insurance for the first time is testing how to implement a programme of stress tests on top of the Solvency II framework,” Mr Bernardino said. The European Central Bank and European Systemic Risk Board are working with EIOPA in the design of the stress tests. Results of the current test will be published in July.Is the industry ready to meet the Solvency II deadline?

[caption id="attachment_938" align="alignright" width="268"] Confidence in meeting the Solvency II deadline SOURCE: Economist Intelligence Unit[/caption]

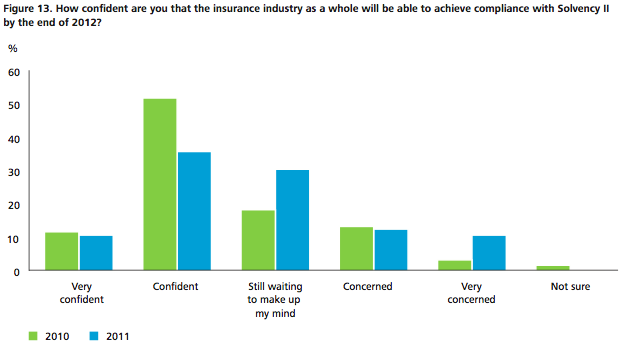

UK insurers are losing confidence in the industry’s ability to meet the Solvency II implementation deadline on 1 January 2013. The annual Deloitte Solvency II Survey 2011 reports that only 46% of respondents were confident the industry could meet the deadline, down from 63% last year. However 73% were confident their firm would meet it.

The survey was conducted among 60 UK-based firms, 68% of which have their headquarters in the UK. The largest firm reported net written premiums (NWP) of more than £5 billon, and the smallest less than £100 million.

[caption id="attachment_940" align="alignright" width="271"]

Confidence in meeting the Solvency II deadline SOURCE: Economist Intelligence Unit[/caption]

UK insurers are losing confidence in the industry’s ability to meet the Solvency II implementation deadline on 1 January 2013. The annual Deloitte Solvency II Survey 2011 reports that only 46% of respondents were confident the industry could meet the deadline, down from 63% last year. However 73% were confident their firm would meet it.

The survey was conducted among 60 UK-based firms, 68% of which have their headquarters in the UK. The largest firm reported net written premiums (NWP) of more than £5 billon, and the smallest less than £100 million.

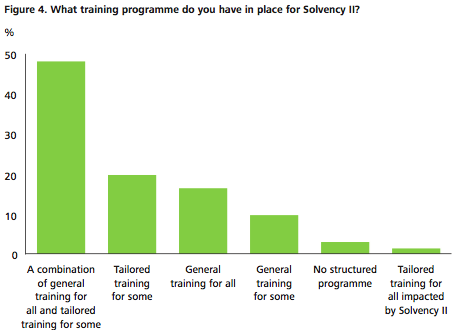

[caption id="attachment_940" align="alignright" width="271"] Solvency II Training SOURCE: Economist Intelligence Unit[/caption]

The survey also sheds light on the state of the industry. 95% of the firms surveyed said their board is fully aware and engaged with the Solvency II process, up from 83% last year.

All but two firms have a training programme for Solvency II scheduled, while only half plan to offer general training for all employees.

The survey also found that anticipated costs for life and non-life companies were broadly the same. The majority of firms expect to spend less than £10 million in total on implementing the Directive.

Solvency II Training SOURCE: Economist Intelligence Unit[/caption]

The survey also sheds light on the state of the industry. 95% of the firms surveyed said their board is fully aware and engaged with the Solvency II process, up from 83% last year.

All but two firms have a training programme for Solvency II scheduled, while only half plan to offer general training for all employees.

The survey also found that anticipated costs for life and non-life companies were broadly the same. The majority of firms expect to spend less than £10 million in total on implementing the Directive.