Liquidity Liquidity denotes the ease with which an asset can be traded. Conversely, illiquidity is the measure of difficulty of trading the asset. Therefore liquidity is a measure of the ‘tradability’ of an asset. Illiquid assets are generally cheaper because their owner carries the risk involved in disposing of it.

The liquidity premium

So if you hold two bonds with the same duration and coupon (the stated interest rate) but one of them is more difficult to sell (thus illiquid) you would demand a premium as compensation for taking on the additional risk – the risk you might encounter when trying to sell the bond. That premium comes in the form of a reduced price of the illiquid bond. The liquidity premium is the difference in the price (the spread) of two identical assets with different liquidities. Identical assets have the same characteristics (duration, risk, cash flows, etc.) they only differ by the ease with which they can be traded.Liquidity premium or illiquidity premium?

The terms ‘liquidity premium’ and ‘illiquidity premium’ are interchangeable depending on where you apply the premium (because the interest rate and price have an inverse relationship):- illiquidity premium – attributes the premium to the illiquid asset’s yield (or interest),

- liquidity premium – attributes the premium to the liquid asset’s price.

Liquidity premiums in an insurance context

In an insurance context, assets are held to match liabilities (various payouts on claims). The level of liquidity of both the assets and liabilities can affect the market consistent valuation of the firm – total value of assets less total value of liabilities. Just as investors demand a premium for holding illiquid assets, so it could be argued that liabilities with different levels of liquidity should be costed accordingly when calculating the firm’s market consistent valuation. The difficulty lies in calculating the liquidity of an insurance liability, because it cannot be easily compared with that of an asset. An insurance liability is paid out to an individual who would not ordinarily look to sell it on. If we accept that illiquidity is effectively a measure of ‘tradability’ this poses a problem in evaluating the liquidity of the liability.The problem with liquidity premiums

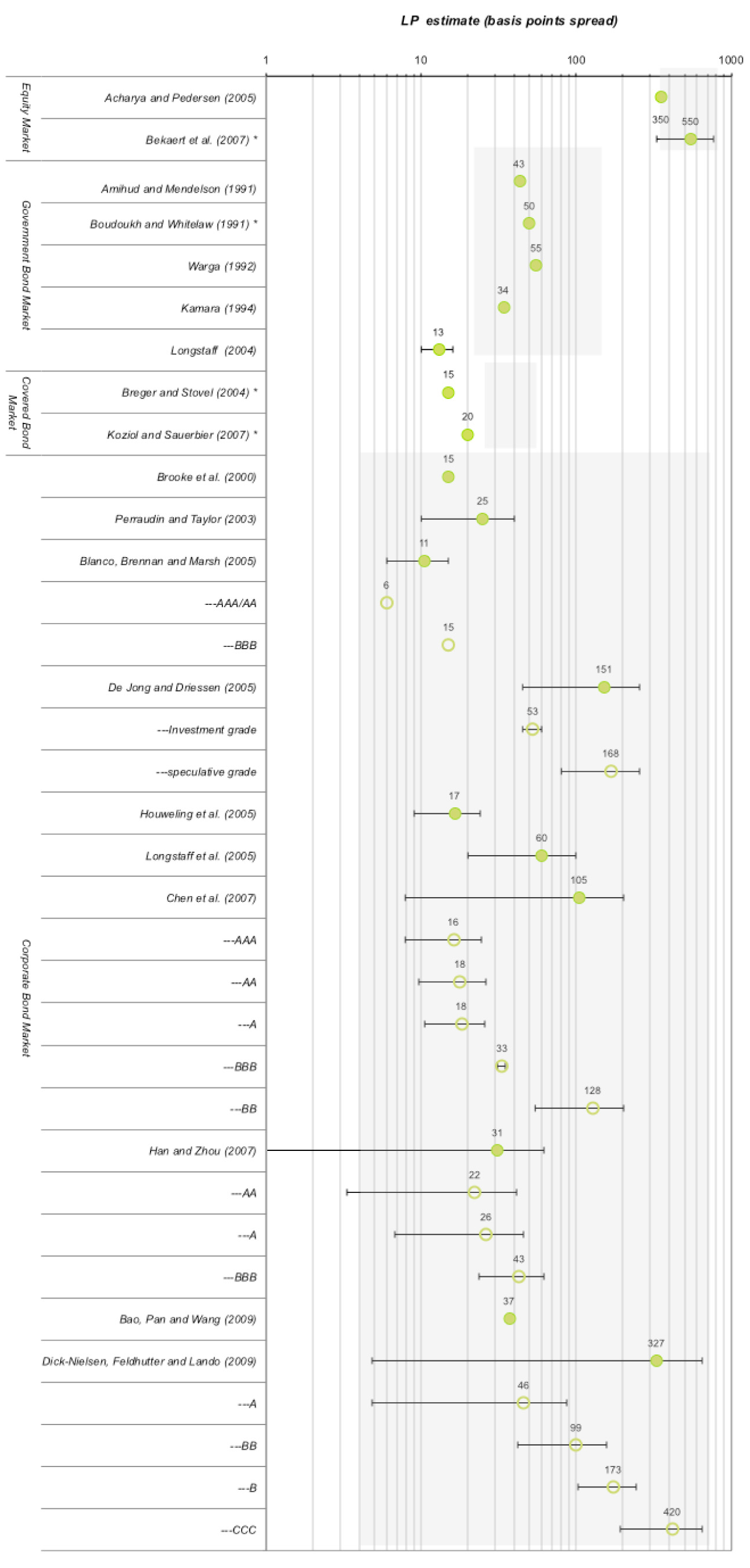

[caption id="attachment_1240" align="alignright" width="227"] LP estimates SOURCE: Liquidity premium: myth or reality by John Hibbert ©Barrie & Hibbert Ltd[/caption]

Much of the illiquidity premium debate raging today is about defining the liquidity premium of a liability and then finding a meaningful way of applying it against an insurer’s assets to get the market consistent valuation.

However, this is far from the only issue in the debate. Firstly, liquidity premiums are notoriously illusive. Isolating the premium from other factors that affect the price spread has proved a difficult task. Research from Barrie & Hibbert (see chart) reviews some of the academic literature on the range of liquidity premiums attributable to different asset classes.

A report from the EIOPA Task Force on the Illiquidity Premium lists the following components that can affect the spread: expected credit risk, credit risk uncertainty, management expense risk and a “residual” element (due to e.g. taxes, conversion costs or costs of market imperfections).

“Thus,” the report states,”to determine the part of the spread attributable to liquidity risk, the challenge that has to be faced is the accurate breakdown of this spread into its components.”

At the moment Brussels is in discussions with the industry and regulators to find an acceptable way of applying the liquidity (or illiquidity) premium to firms’ market consistent valuation. The difficulty of isolating the liquidity premium from the asset price, coupled with the challenge of defining the illiquidity premium for liabilities is making this an area of high priority in implementing the regulation.

LP estimates SOURCE: Liquidity premium: myth or reality by John Hibbert ©Barrie & Hibbert Ltd[/caption]

Much of the illiquidity premium debate raging today is about defining the liquidity premium of a liability and then finding a meaningful way of applying it against an insurer’s assets to get the market consistent valuation.

However, this is far from the only issue in the debate. Firstly, liquidity premiums are notoriously illusive. Isolating the premium from other factors that affect the price spread has proved a difficult task. Research from Barrie & Hibbert (see chart) reviews some of the academic literature on the range of liquidity premiums attributable to different asset classes.

A report from the EIOPA Task Force on the Illiquidity Premium lists the following components that can affect the spread: expected credit risk, credit risk uncertainty, management expense risk and a “residual” element (due to e.g. taxes, conversion costs or costs of market imperfections).

“Thus,” the report states,”to determine the part of the spread attributable to liquidity risk, the challenge that has to be faced is the accurate breakdown of this spread into its components.”

At the moment Brussels is in discussions with the industry and regulators to find an acceptable way of applying the liquidity (or illiquidity) premium to firms’ market consistent valuation. The difficulty of isolating the liquidity premium from the asset price, coupled with the challenge of defining the illiquidity premium for liabilities is making this an area of high priority in implementing the regulation.

4 thoughts on “Liquidity premium and illiquidity premium in the insurance context”

Comments are closed.