Despite the calls for firms to conduct climate-related scenarios for a number of years, there is a wide range in the quality and detail of scenarios performed by firms, with many still unclear how to begin to tackle this challenge. In this article Amy Nicholson, Consultant at Milliman describes a simple and pragmatic approach that insurers can use to begin this journey.

A simple approach to climate scenarios

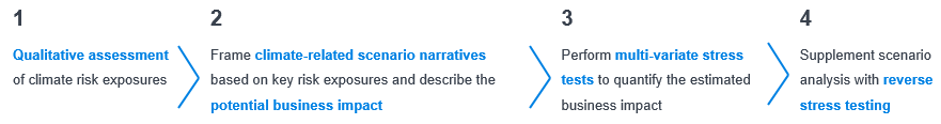

Climate scenarios can, and do, require some complex considerations and calculations, however these can be arranged in a relatively simple and clearly defined process.

Qualitative assessment

The first step is to identify how existing risks are impacted by climate change. For example, the introduction of carbon taxes could adversely affect the value of carbon intensive assets, giving rise to market risk. Climate change could also increase the frequency or impact of extreme weather events, giving rise to underwriting risk.

Focussing on the most material exposures is important, but it is also important to consider less “obvious” risk exposures such as the potential impact of physical risk on health and life insurance liabilities.

Climate risk drivers can have wide-ranging implications across the business and give rise to interactions between assets and liabilities. It is therefore important to develop multivariate scenarios that look at second and third order impacts. At present, common market practice is to perform stress tests on specific risk exposures in isolation, which could limit the ability to understand the wide-ranging interdependencies of climate risk exposures.

Framing the narrative

Once all material climate-related risk exposures have been identified, frame the scenario narratives based on each material risk exposure by describing a plausible set of circumstances that could result in the risks materialising.

For example, under an ‘early policy action’ scenario, UK regulators could impose more stringent requirements around investments marketed as sustainable, resulting in increased lapses, lower new business volumes or regulatory and legal fines for insurers selling investment-based products that do not adhere to these standards. Any potential knock-on impacts of this scenario should also be considered, alongside other possible initiatives that could plausibly arise in conjunction, such as the expansion of carbon taxation.

Initially this exercise should be qualitative, describing how the material exposures could manifest within the scenario narrative in question, and how this may impact the business. This could be carried out via workshops with input from across the business.

Quantifying the impact on the business

Once tailored climate-related scenario narratives have been formed, the most challenging step is to come up with quantitative stresses for each material risk exposure in order to perform multivariate stress tests.

Some firms initially used the PRA’s 2019 life insurance stress test shocks, and the parameters provided in the Climate Biennial Exploratory Scenario (CBES)are another common source of information when determining quantitative stresses. However, for material climate-related risk exposures, firms should now look towards creating stresses more tailored to their own business and risk exposures.

Scenario calibrations will need to be reviewed frequently as the situation may be rapidly changing. For example, what is a 1-in-200-year physical risk event today could well evolve into a 1-in-50-year event in several years’ time if no progress towards transition is made.

Where possible, output of the scenario analysis should then be used to consider the impact on liquidity as well as solvency. To date we have seen considerably less focus on the impact of scenarios on the liquidity position of the firm.

The output of the scenario analysis can then be used to inform discussions around management actions available to the firm, and the implications on company strategy.

Reverse stress testing climate scenarios

Firms should also consider supplementing their scenario analysis with some level of reverse stress testing.

The current climate data gaps mean that insurers struggle to draw firm conclusions on the plausibility of each projected climate risk scenario. In addition, the analysis performed will be limited by the range and severity of the scenarios that are used, and may therefore fail to consider the full extent of climate-related risks to which the firm is exposed.

Reversing the exercise and asking questions such as: “If we were to experience a reduction in solvency or liquidity of X, what climate risks would we expect to have manifested to have this impact?”, could encourage assessment of “extreme” scenarios that may currently be considered too unlikely to warrant analysis.

Effective scenario analysis

The effects of climate change on insurers are uncertain, but they cannot be ignored. Whilst regulation may currently be the primary driver for climate change scenario analysis activity, it should also be viewed as a powerful tool that enables insurers to be as informed as possible about the potential impacts of climate change on their business.

Effective scenario analysis makes it possible to identify the actions that should be taken today which will improve future performance, allows time to implement mitigation strategies before any potential impacts of climate change materialise, and could contribute to lowering the cost of transition.

The author is a consultant at Milliman. The views expressed are the author’s own.

Claire Booth, Adél Drew, Amy Nicholson and Ian Penfold, Consultants at Milliman, explore this emerging topic further in their paper Climate change risk stress and scenario testing.