Initial analysis of Lloyd’s syndicate data extracted from annual reports sheds light on size and scope of the Lloyd’s insurance market.

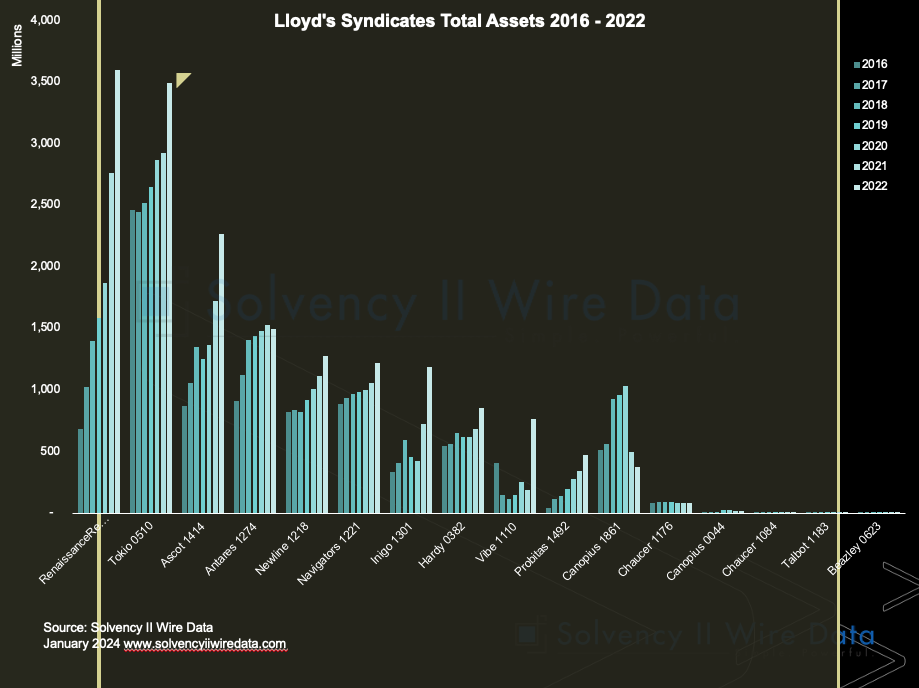

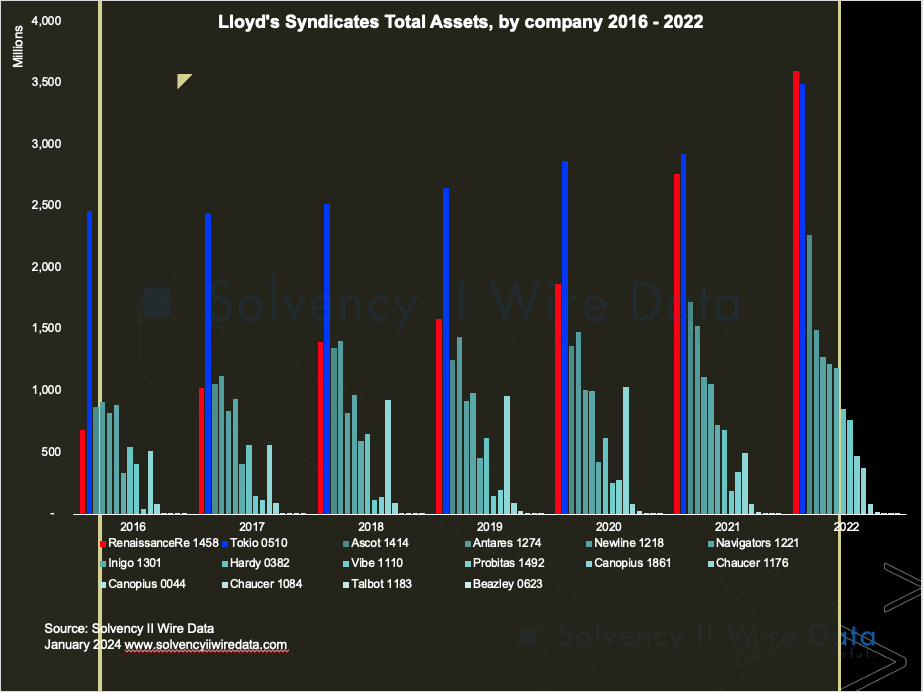

The chart below shows total asset distribution of a sample of 16 Lloyd’s syndicates between 2016 – 2022.

While Tokio Marine Syndicate 0510 has been consistantly the largest syndicate in the sample, in 2021 and 2022 RenaissanceRe 1458 total assets grew rapidly, overtaking the former in 2022.

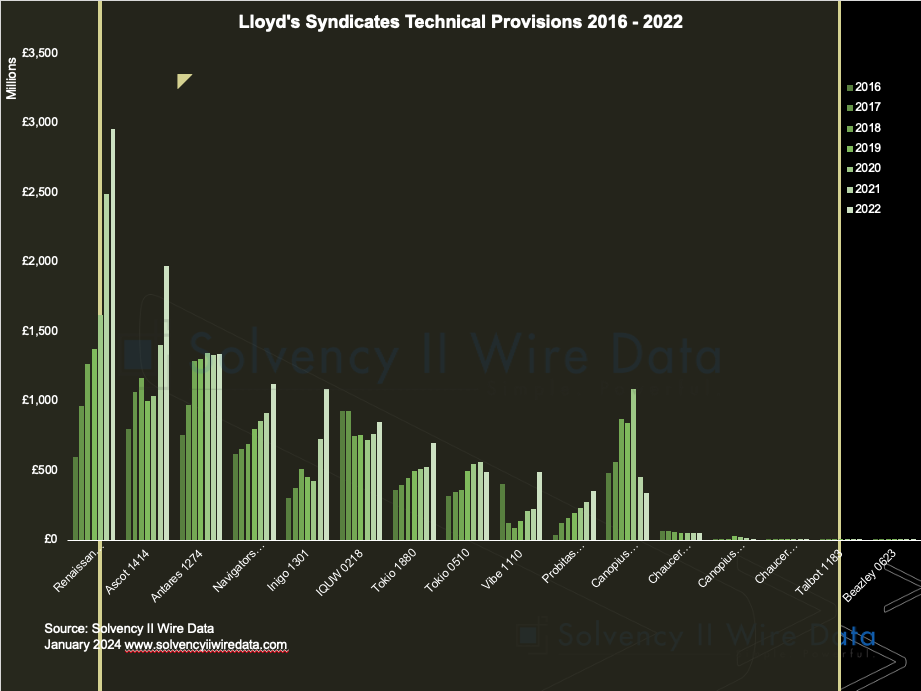

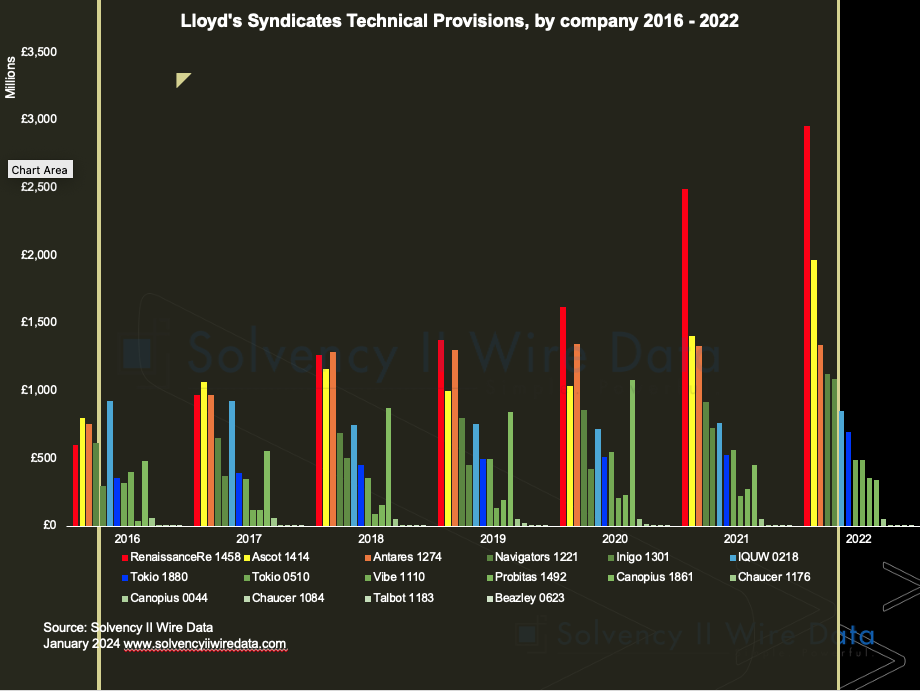

Lloyd’s market technical provisions sample

Analysis of technical provisions between 2016 – 2022 of a similar sample shows the distribution across the same time frame.

Over the period RenaissanceRe 1458 experienced strong growth of technical provisions. It was the largest in the sample since 2019, overtaking IQUW 0218, Ascot 1414, and ultimately Antares 1274.

The Lloyd’s market data is the latest dataset added to the Solvency II Wire Data database.

Other markets include, Bermuda, Israel and Switzerland.