This year will see the publication the first full set of annual figures using the new IFRS 17 insurance contracts reporting standard.

However, Solvency II Wire Data found that only 6% of solo insurers and 10% of groups mentioned IFRS 17 in their 2022 SFCRs. The findings, using the full 2022 SFCR dataset, confirm earlier analysis of lacklustre mention of the new accounting standard.

Annual report analysis of Solvency II firms

A significantly higher mention of the standard can be found in company annual reports.

Solvency II Wire Data analysed the text of close to 2,700 annual reports between 2020 and 2022 and found a steady rise in the mention of IFRS 17: from 17% to 24% in 2022.

Yet the 2022 SFCRs provide some insights into the preparation and approach of insurers to IFRS 17.

IFRS 17 the cost…

Most firms reported steady progress towards implementation of the new accounting standard, while noting the related costs.

For example, the Athora Nederlands SFCR states: “In 2022 we continued to make progress in reducing the underlying operating expense base. Operating expenses increased in 2022 driven by strategic initiatives and expenses related to implementation of IFRS 17”.

Other insures placed a direct cost on the transition to IFRS 17.

Phoenix Group stated GBP 30m (Phoenix Group 2022 SFCR, page 30), while Coface placed the tab at EUR 10m, which it said was mostly related to having to run parallel accounts.

“Other operating expenses, which amounted to €10 million, mainly consisted of costs incurred in connection with the double Run (production of pro forma financial statements for the transition to IFRS 17)” (Group Coface 2022 SFCR, page 24).

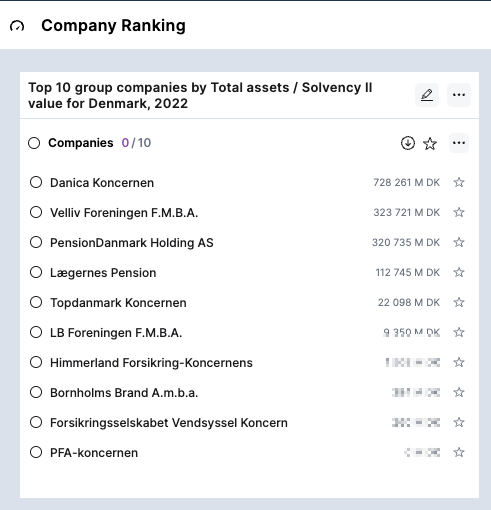

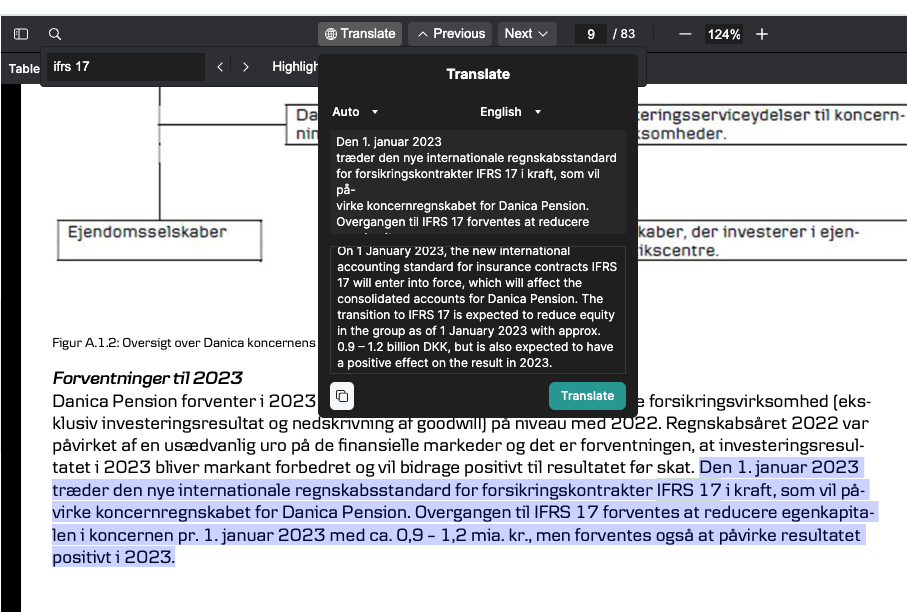

The Danish insurer Danica Koncernen, the largest Danish insurance group (see right), stated that while IFRS 17 will reduce its equity it expects the new standard will have positive impact.

“The transition to IFRS 17 is expected to reduce equity in the group as of 1 January 2023 with approx. 0.9 – 1.2 billion DKK, but is also expected to have a positive effect on the result in 2023” (Danica Koncernen 2022 SFCR, page 8, text translated using Solvency II Wire Data).

Despite the rising costs associated with the implementation, the Aviva Group 2022 SFCR noted: “Corporate centre costs of £310 million (2021: £360 million) decreased primarily due to lower cost reduction implementation and IFRS 17 costs” (Aviva plc Group 2022 SFCR, page 13).

Net insurance margin (NIM), the new combined operating ratio?

Direct Line Insurance Group announced in its 2022 SFCR that it will replace the combined operating ratio with the IFRS 17 Net Insurance Margin (NIM) as its key performance measure.

The group and its solo entities are the only ones announcing the switch to the new measure in the SFCR.

The report details the considerations for doing so.

“The key reconciling items when moving from a combined operating ratio to a NIM are the inclusion of instalment and other income within revenue, alongside the additional benefit from increased discounting of insurance liabilities.

As a result, the NIM is expected to be around 6 percentage points better than the margin implied by the equivalent combined operating ratio.

For example, a 100% combined operating ratio, implying a 0% margin, under the previous accounting standard would translate into around a 6% NIM under IFRS 17” (Direct Line Insurance Group 2022 SFCR, page 17).

The only other mention of the term ‘net insurance income’ in the SFCR is by ABN Amro Life in 2017, in a table detailing the key assumptions in the calculation best estimate technical provisions.

IFRS 17 in the 2023 SFCRs

Although not considered a key risk, the preparation and costs of the transition to IFRS 17 have gradually become a feature in a number of SFCRs. The extent to which, the standard will be featured in the 2023 SFCR reports remains to be seen.

To view the companies and features detailed in the article click here to request a demo of Solvency II Wire Data.