A review of the public disclosures of close to 500 European insurers for the year-end 2020 and 2021 reveals the rising trend in climate disclosures of the industry.

Solvency II Wire Data – green (the climate disclosure portal of Solvency II Wire Data) conducted systematic text analysis of annual reports, TCFD reports and other climate related disclosures in several of the major European insurance markets.

The disclosures of 470 insurers were reviewed for year-end 2020 and 300 for year-end 2021. Close to 60% of the disclosures reviewed included some reference to climate-related information. Several insurers had not yet published their annual reports and other disclosures, which are subject to local regulations and timelines.

The data echoes the findings of qualitative disclosure analysis of twenty of the largest European and UK groups conducted recently by Solvency II Wire Data and Royal London Asset Management.

Text analysis of climate related reporting

Text analysis of climate-related themes shows that in both years close to 80% of the reports made reference to climate alliances, the most reported metric. In many cases the recent disclosures included further details on the company’s work and actions.

For example, in its recent annual report Achmea makes 32 references to various climate initiatives that the company supports or is involved with (see below).

The report states: “Together with Oxfam America and ICCR (an international investor organisation), Achmea IM submitted a shareholder resolution to Johnson & Johnson’s annual general meeting. The proposal requested greater transparency on the prices and accessibility of vaccines (the Janssen vaccine). Our resolution subsequently received 31% of the votes. This is a high percentage for an ESG resolution. Achmea IM will therefore use this in follow – up talks with Johnson & Johnson on this topic.”

Reporting on biodiversity

One of the growing themes in climate activity and reporting is biodiversity.

23% of reports analysed included information about biodiversity, a rise from 18% in the previous year.

The Achmea 2021 annual report , for example, also includes more information on the company’s activities in this area, adding biodiversity to Achmea’s list of engagement areas. By comparison, the 2020 report only includes two references to biodiversity in a broader context.

Year on Year climate reporting analysis

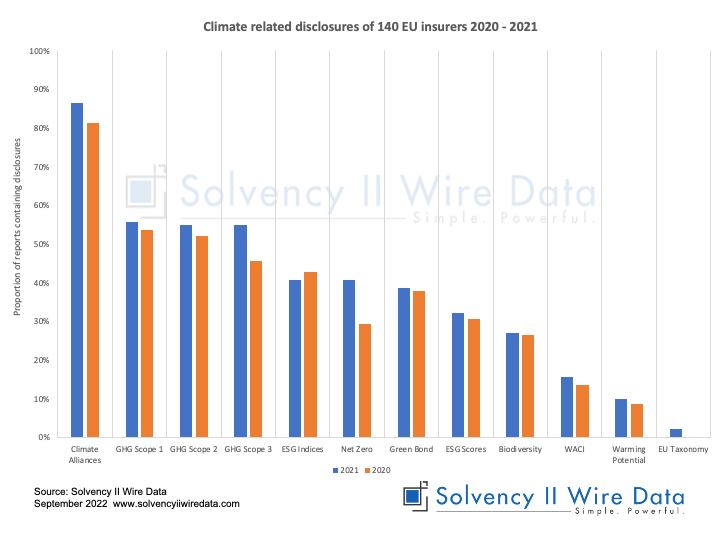

The extent to which the level of climate disclosures has increased can be seen in a comparison of the disclosures of 140 firms that published data for both 2020 and 2021 year-end (see chart below).

The most prevalent reference made was to climate alliances, either in the form of active participation (see above) or acknowledgement and a commitment to adhere to their principles.

The number for reports that referenced Net zero rose from 30% to 40% over the period, the largest increase for all themes.

As has been pointed out in previous qualitative research (REF RLAM REPORT) the amount and quality of disclosures varies across insurers.

EU Green Taxonomy

So far the research identified 25 reports that make reference the EU Green Taxonomy regulation in their 2021 year end disclsoures.

The taxonomy is a framework for classifying “green” or “sustainable” economic activities executed in the EU and is considered an important component of the European Green Deal.

While the majority of reports make a general reference to the regulation or describe an intention to apply the taxonomy a handful of companies have started to publish quantitative taxonomy data on a mandatory basis.

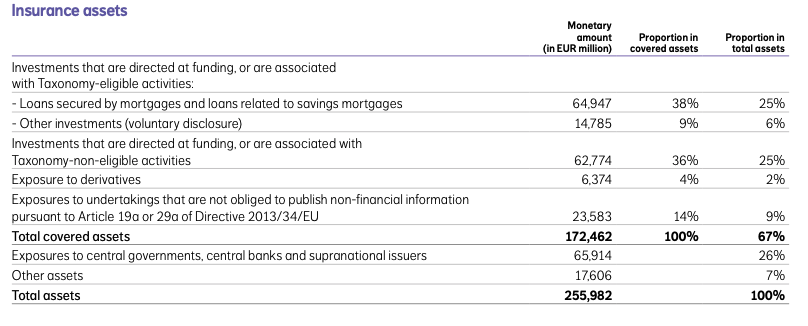

NN Group, for example, provided details of insurance assets based on eligibility and non-eligibility of the taxonomy.

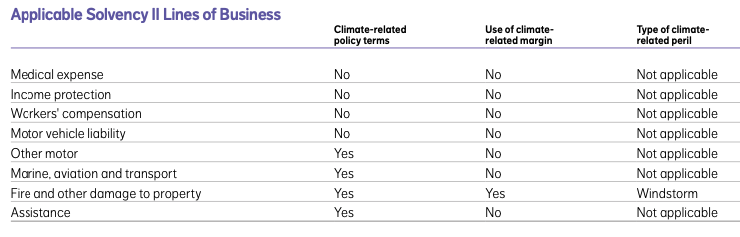

The group also provided a table of applicable Solvency II lines of business relating to the taxonomy.

Steady progress of climate reporting

Comprehensive and systematic research of climate related disclosures by European insurers shows steady progress in both levels and details of the disclosures. At a time when the concepts of “green” and ESG investing is under, what may not always be considered an unfair challenge, the data trends continue to support the engagement and commitment of the European insurance industry to climate change.

Click here to request a demo of Solvency II Wire Data & Solvency II Wire Data – green