L&G is another of the large groups that have published their 2023 SFCR early.

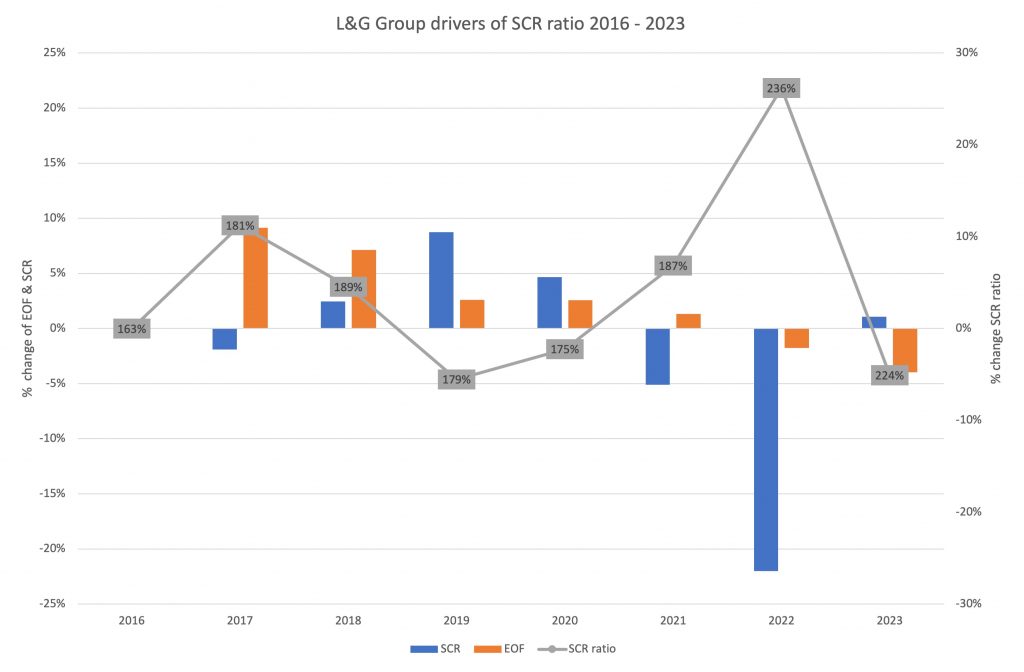

The company reported a drop in its SCR ratio from 236% in 2022 to 224% in 2023.

The main drivers of the ratio change were a reduction of the insurer’s Eligible Own Funds (EOF) and a slight increas in its Solvency Capital Requirement (SCR).

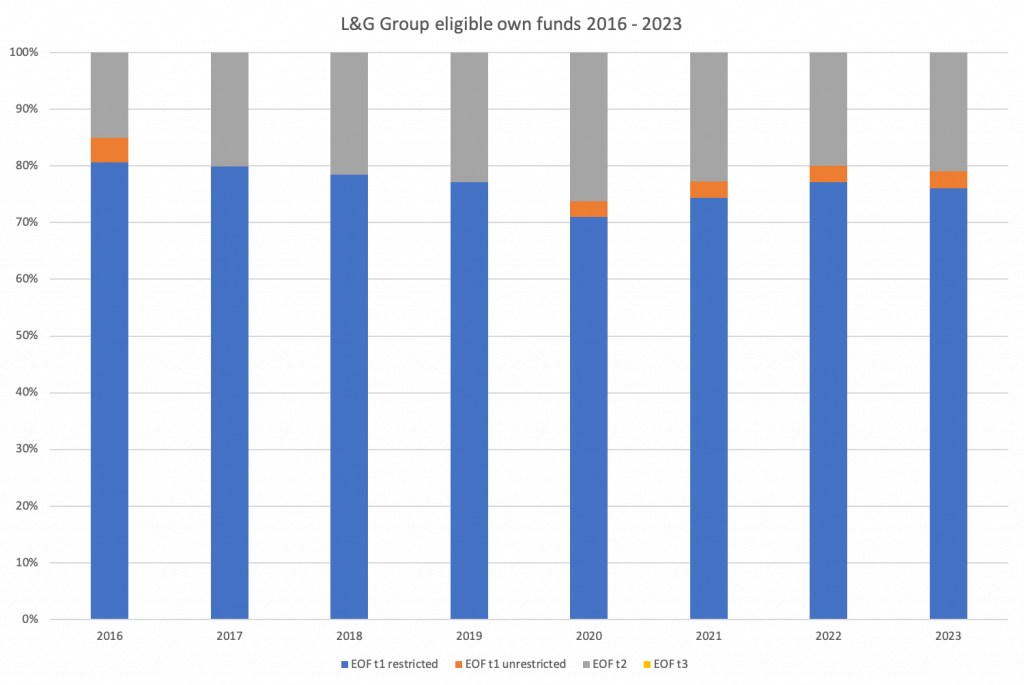

The group’s EOF capital has increased by 18% between 2016 (GBP 14,070 million) an 2023 (GBP 16,546 million).

The proportion of Tier 1 unrestricted capital remained relatively stable. Over the period the group reduced its tier 2 capital. L&G does not have any tier 3 capital.

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

SOURCE: Solvency II Wire Data