Analysis of early Solvency II disclosures of 50 insurers in the UK and Ireland sheds light on the emerging impact of COVID-19 on the European insurance industry. Key findings include likely impacts on the level of capital coverage, underwriting, investments and operations.

The sample analysed is a subset of SFCR reports reviewed as part of the fourth annual survey of Solvency II implementation across the UK and Ireland published by consultancy Lane Clark & Peacock (LCP). Reporting deadlines were extended by EIOPA this year due to the impact of COVID-19.

Despite the uncertainty created by the pandemic over half the insurers surveyed confirmed they expected to meet their regulatory capital requirement.

Other lines of business such as motor, home and public liability are expected to see better than expected claims experience as a result of the lockdown measures in place.

Cat Drummond, Partner in LCP’s Insurance Consulting team commented on the shifting insurance landscape as a result of COVID-19: “Concerns around the impact on claims experience and investments are rightly top of the agenda. The impact of the pandemic will have severe fallout for a number of business lines including travel, business interruption and income protection.”

Reduced SCR ratios in 2019

The average SCR ratio for the sample of 50 insurers is 199%, which is the lowest since disclosures began in 2016 (203%). In 2017 and 2018 the ratio remained stable at 208%.

The results echo similar findings for a wider sample of 300 European solos, published by Solvency II Wire (see Solvency II News: SCR ratios lower in 2019).

Impact of COVID-19 on insurance investments

This year firms were asked to produce additional information about the impact of COVID-19 on their business (COVID-19 Note).

The LCP survey shows that all but one of the 46 December year end firms included in the analysis produced a COVID-19 Note, although the level of details varied significantly, noting that all insurers agreed that it was too early to assess the full impact of the pandemic as the situation was still developing rapidly.

About half of the insurers surveyed mentioned the impact of market volatility on their investment holdings in their COVID-19 Notes. Key drivers include widening of credit spreads, decreases in interest rates and falls in equity markets.

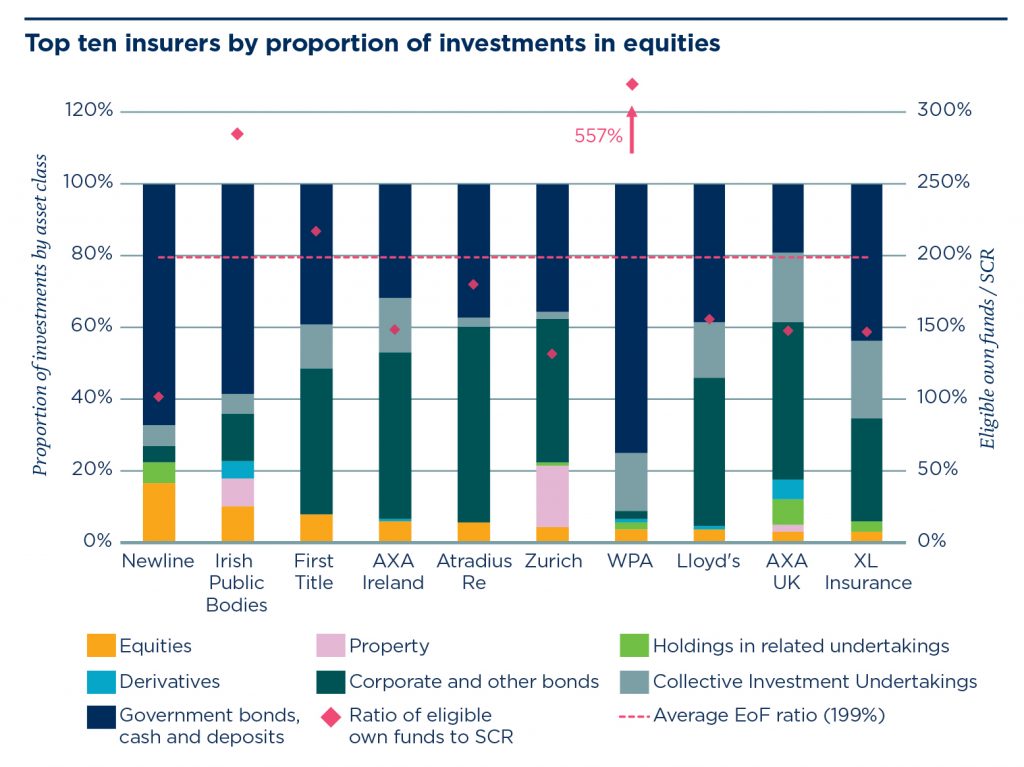

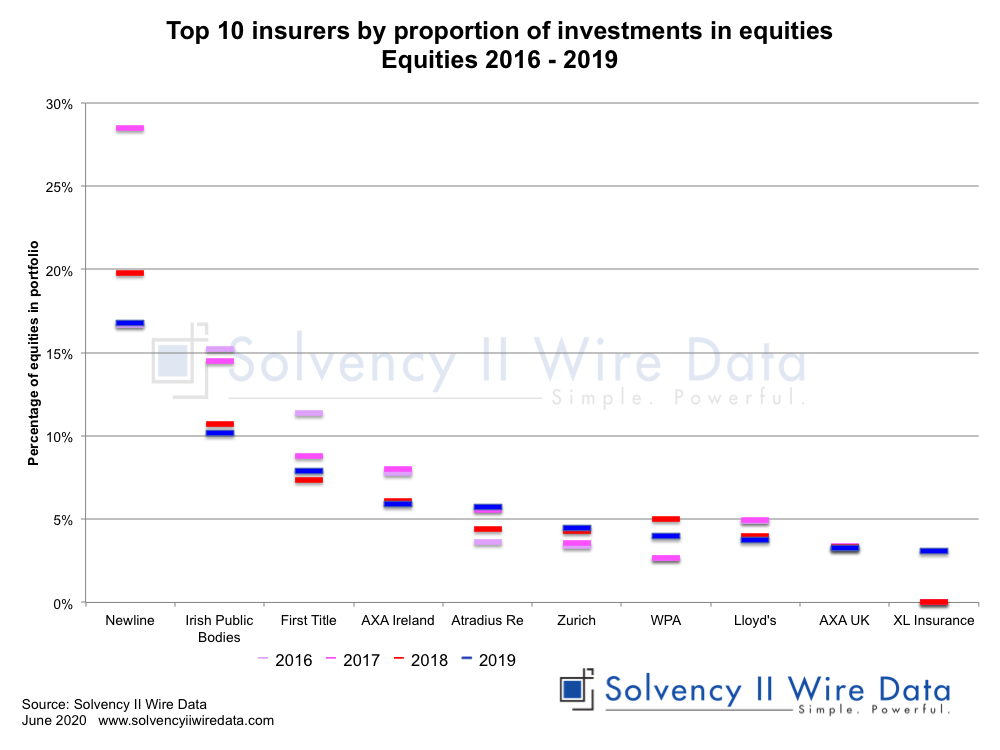

Analysis of 10 insurers with the largest exposure to equities revealed that all but three have an SCR ratio below the sample average of 199% (see chart).

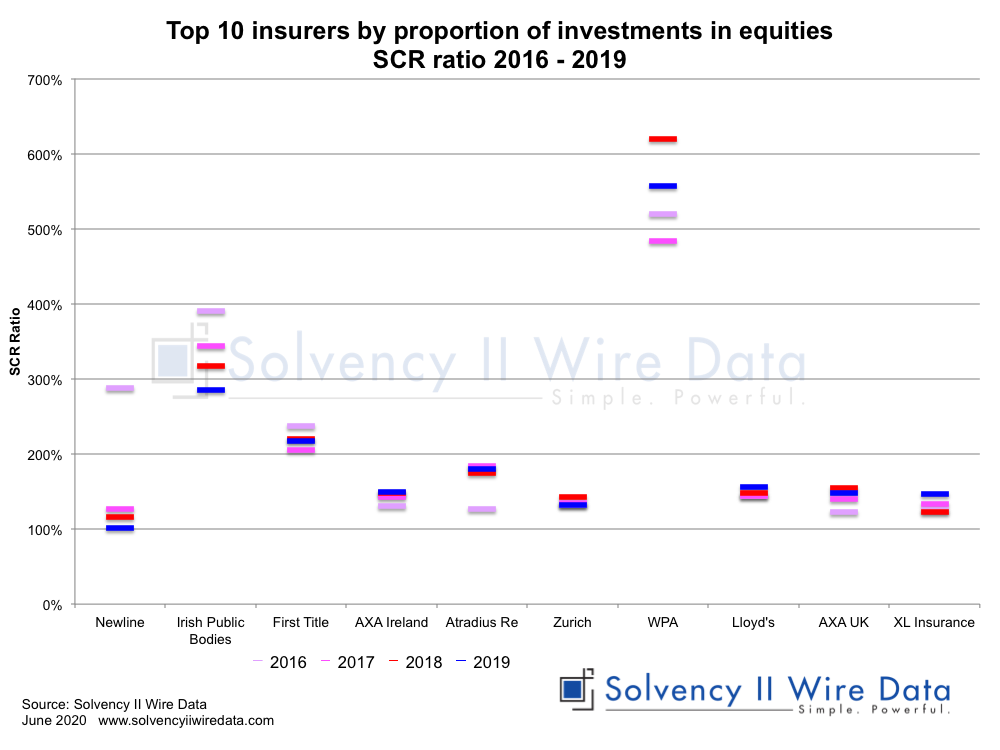

Further analysis conducted by Solvency II Wire Data shows that 6 of the insurers had a lower SCR ratio compared to 2018 (see chart).

The 2 insurers with the largest proportion of equities in their portfolio (Newline and Irish Public Bodies) experienced a consecutive drop in their SCR ratio since 2016. The third largest, First Title, also experienced a drop between 2016 and 2019 although the ratio rose in 2018.

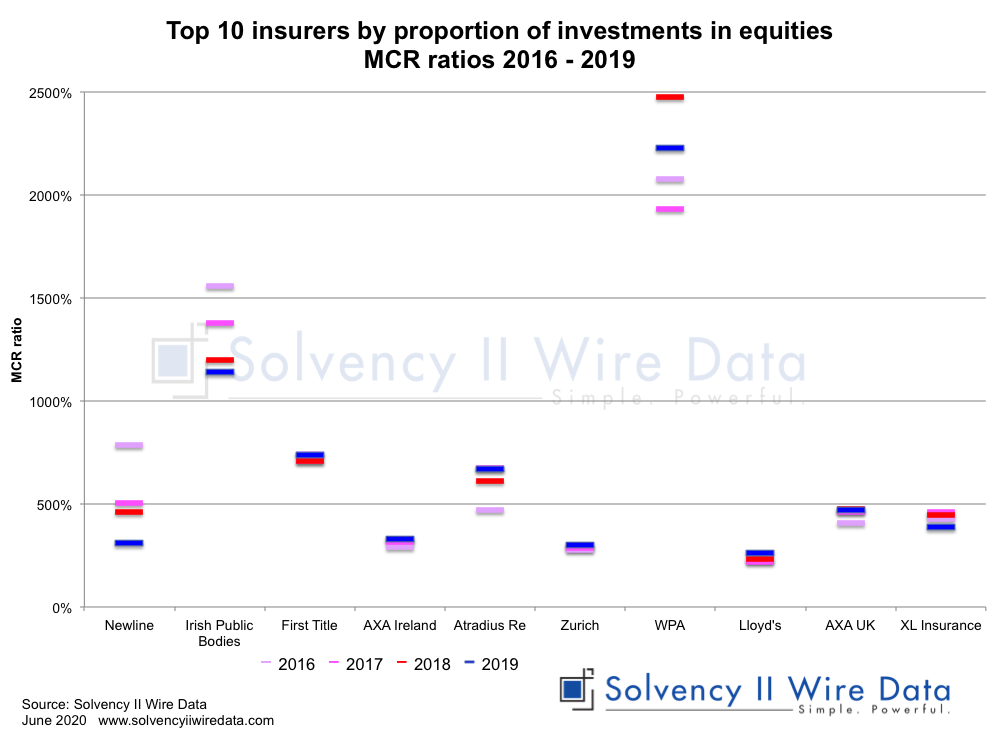

The MCR ratios of the sample (see chart) exhibited similar changes to the shifts in SCR ratios relative to 2018.

Two notable exceptions are Zurich, which increased its MCR ratio, despite a drop in the SCR ratio, and XL Insurance, which conversely decreased its MCR ratio, while its SCR ratio increased in 2019.

Interestingly there appears to be no clear correlation between the shift in SCR ratios and the changes in the proportion of equities in the portfolio as can be observed in the chart below, which plots the proportion of change between 2016 – 2019.

The full set of data and extracted COVID-19 Notes are available on Solvency II Wire Data (subscription required).

Solvency II Wire Data collects all available public QRT templates for group and solo.

QRT templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.12.01 Life and Health SLT Technical Provisions

S.17.01 Non-life Technical Provisions

S.19.01 Non-life Insurance Claims Information

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern Models

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group