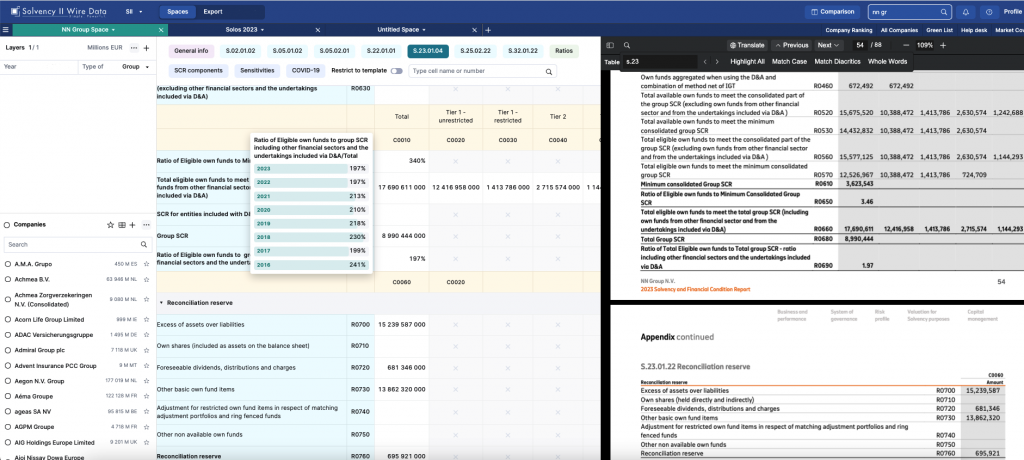

NN Group published its 2023 SFCR earlier than the official publication date for groups (19 May). It is one of the few groups, alongside a handful of solo entities, releasing their 2023 Solvency II public disclosures early.

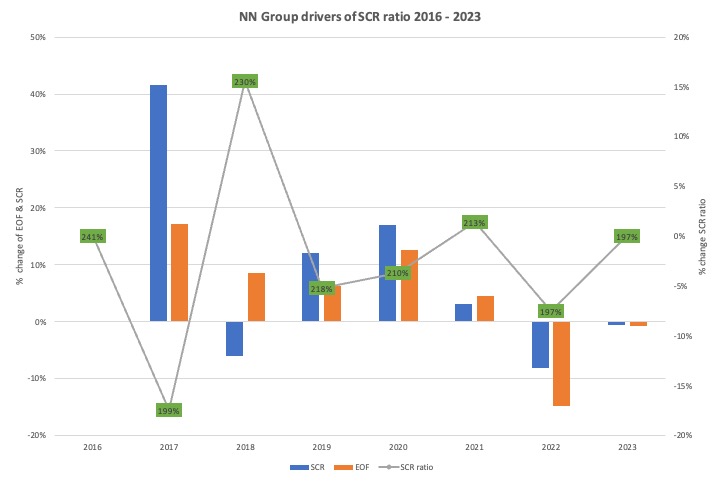

NN Group SCR ratio unchanged in 2023

The group’s SCR ratio remains unchanged from last year at 197%, which is the lowest it has been since the first publication in 2016 (241%).

Over the period the ratio fluctuated peaking at 230% in 2018. The chart below shows the SCR ratio drivers over the entire period.

The main SCR ratio driver in 2018 was a 9% increase in Eligible Own Funds (EOF) and a 6% drop in the Solvency Capital Ratio (SCR).

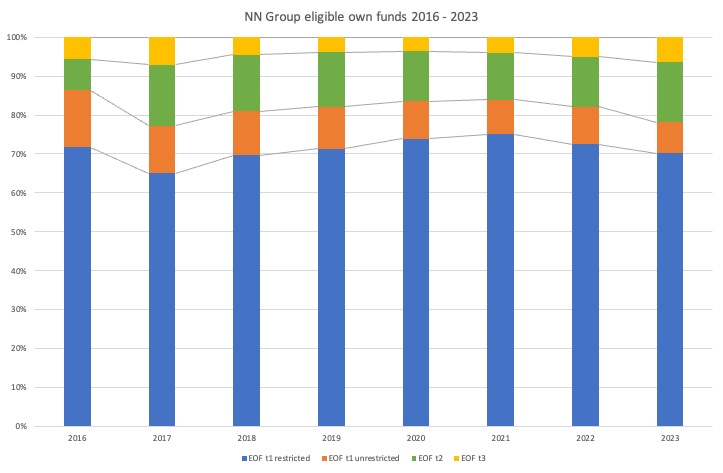

Eligible own funds

NN Group reported EOF of EUR 17, 691 million, an increase of 35% since 2016. The group reported an increase in both tier 2 and tier 3 EOF (see chart below)

The group did not use any of the new QRT templates and reported partial internal model information in template S.25.02.

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).