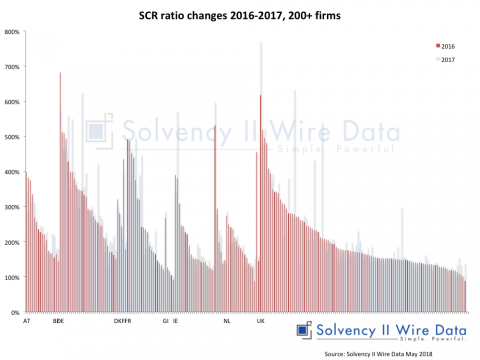

The Bermuda Solvency Capital Requirement (BSCR) closely tracks Europe’s Solvency II capital regime for insurers.

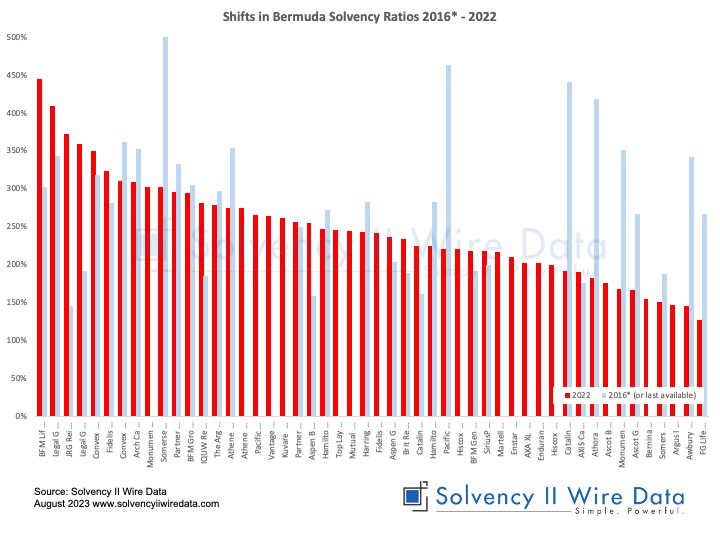

Much like the Solvency II ratio in Europe (often referred to as the SCR ratio or Solvency ratio), the Bermuda Solvency ratio is closely watched as a bellweather for an insurer’s overall financial health.

The Bermuda Solvency Capital Requirement Ratio (BSCR) is the coverage ratio of the Eligible Capital to meet the Enhanced Capital Requirement (ECR) over the ECR.

Unlike Solvency II which stipulates an SCR ratio of 100%, in Bermuda the regulator stipulates a BSCR of 120%.

The chart below shows the distribution of BSCR ratios of 50 Bermudan insurers between 2016 and 2022.

Detailed data for the Bermuda insurance market, including capital requirement, technical provisions and risk margin is available on Solvency II Wire Data. Click here to request a demo.

Solvency II Wire Data is an innovative insurance database of the Solvency II SFCR data provided by Solvency II Wire.

To view a list of features see the Solvency II Wire Data Innovation Timeline.