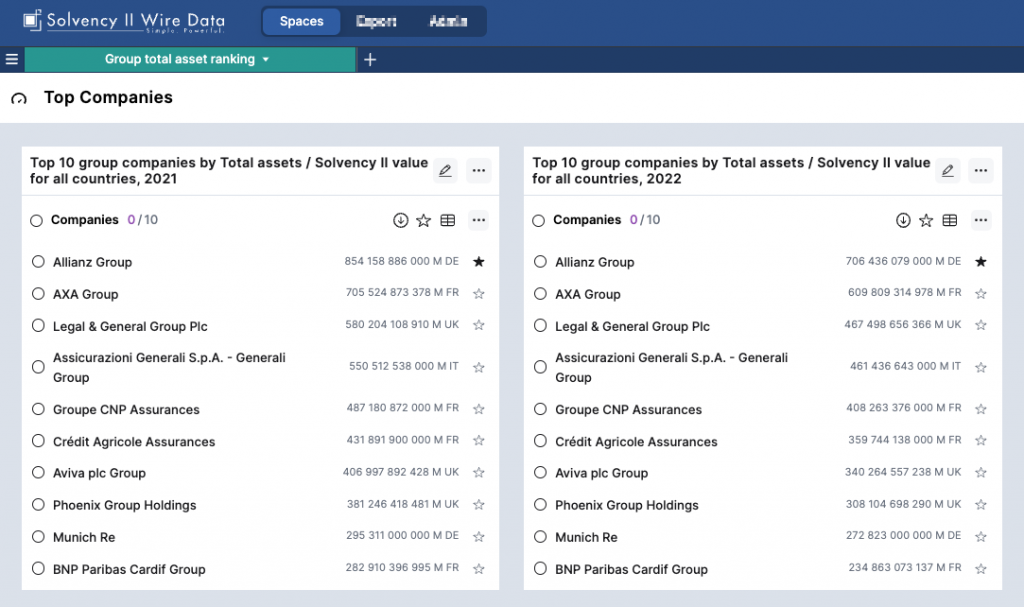

Figures reported in the 2022 SFCRs reveal that the total assets reported in the Solvency II balance sheet of the ten largest European insurance groups reduced by 16% relative to 2021.

Last year the groups accounted for EUR 4.9 trillion AUM, nearly half the group total assets in Europe (EUR 9.7 trillion, according to the official EIOPA insurance statistics), this compared to EUR 4.1 trillion in 2022.

Largest European insurance groups 2022

The ranking of the groups remains unchanged, however they all reported lower figures in 2022.

SOURCE: Solvency II Wire Data company ranking tool

In 2022 most of the groups reported decreases of between 14% – 19% of total assets. The largest was reported by Legal & General and Phoenix (both 19%), Munich Re reported the smallest decrease (8%).

The chart below shows the changes in total assets based on the Solvency II balance sheet (template S.02.01.02_R0500_C0010) since 2016.

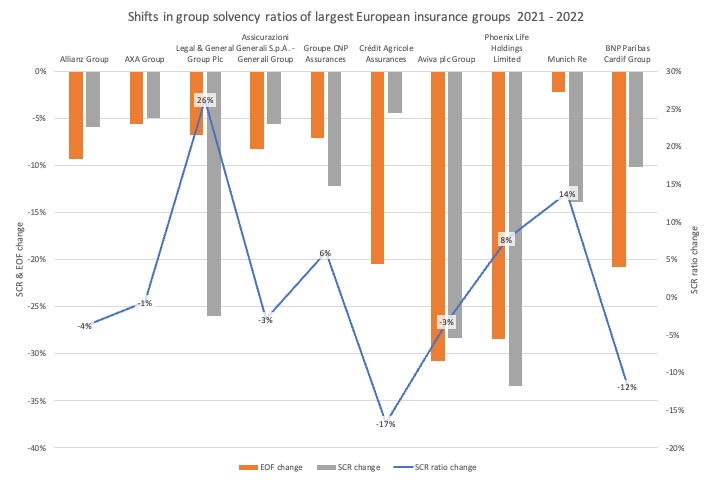

Group Solvency II ratios in 2022

Despite the reduction in total assets the change in Solvency ratios has been more varied.

The chart below shows the changes in the drivers of the SCR ratio between 2021 – 2022 for the 10 largest groups.

Six groups reported a decrease in the Solvency ratio. The largest drop was reported by Crédit Agricole Assurances; -17% from 245% in 2021 to 204% in 2022.

Of the four groups that reported an increase in the ratio, Legal & General Group reported the strongest increase; 26% from 187% in 2021 top 236% in 2022.

While all groups reported a decrease in both the SCR and EOF, larger drops in the latter are responsible for an increase in the Solvency ratio.