Category: Slider

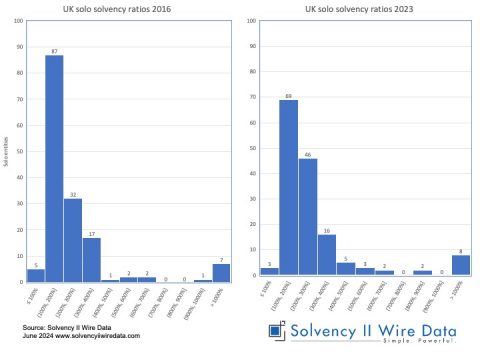

UK Solvency ratio distribution 2016 – 2023

June 18, 2024

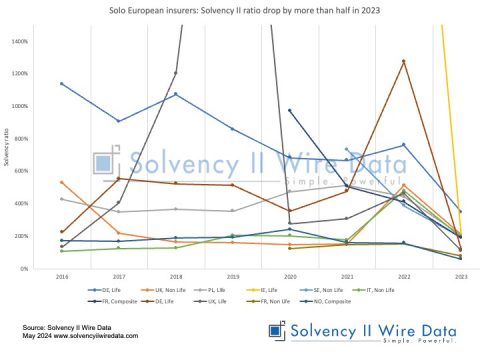

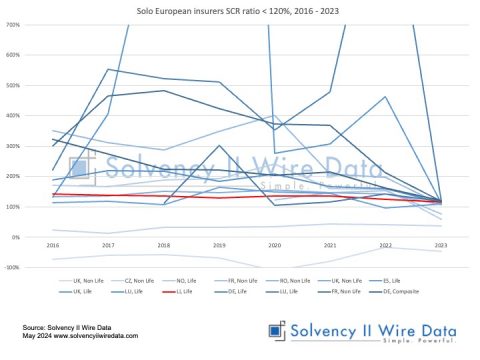

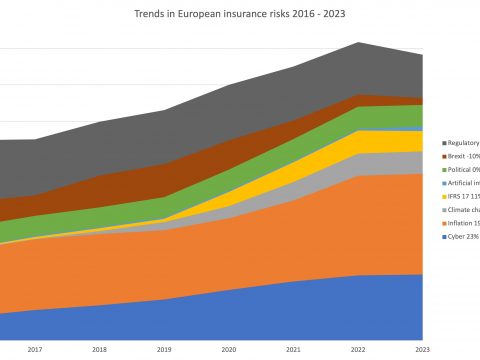

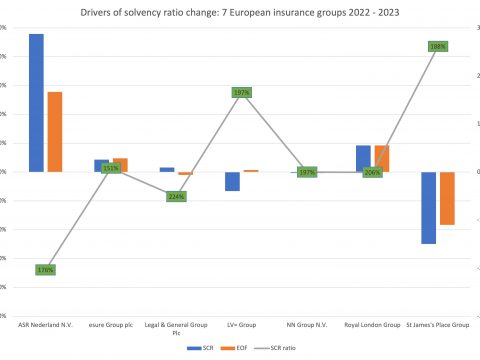

Trends in European insurance risks 2016 – 2023

April 21, 2024

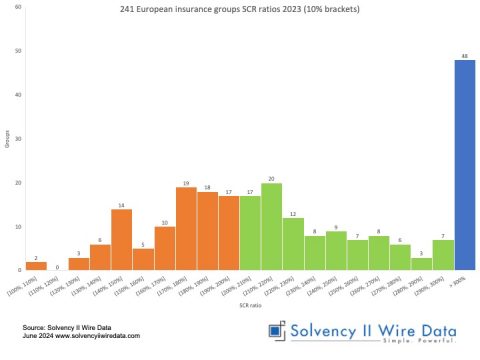

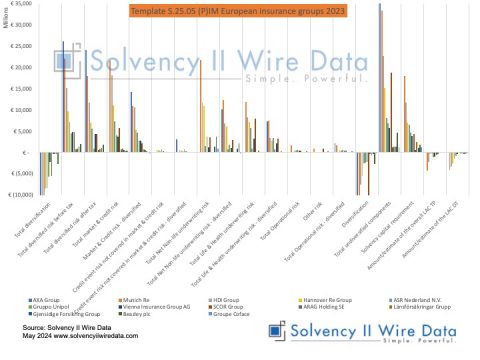

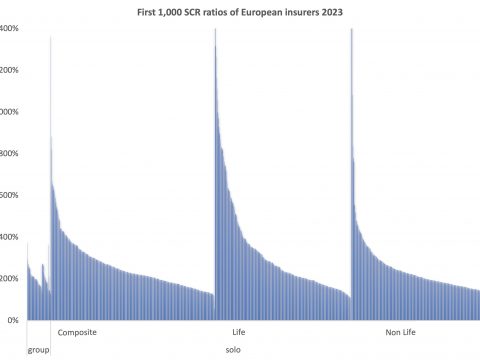

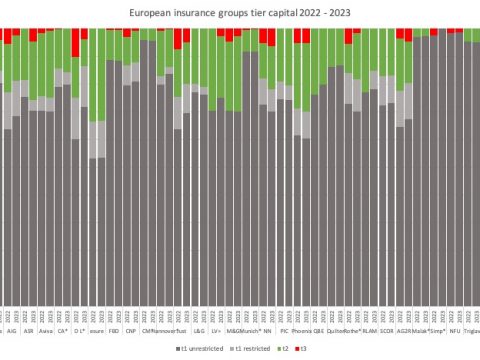

European insurance market insights 2023: group tier capital

April 19, 2024

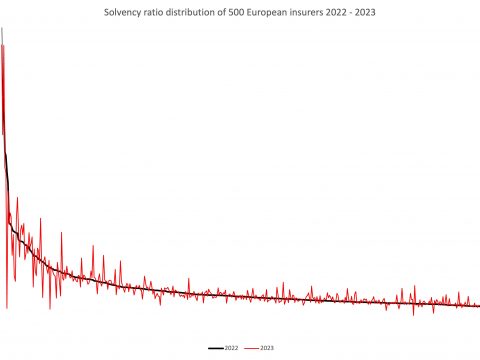

European insurance market insights 2023: 1st 500 QRTs

April 15, 2024

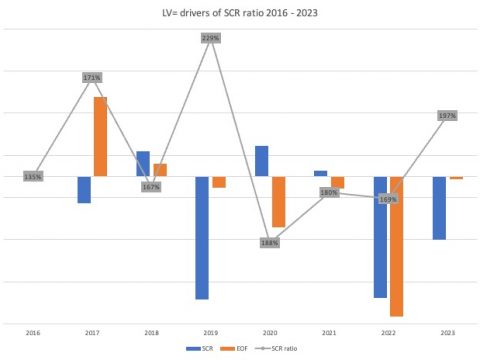

SFCR 2023: LV= returns to tier 3 capital

April 9, 2024

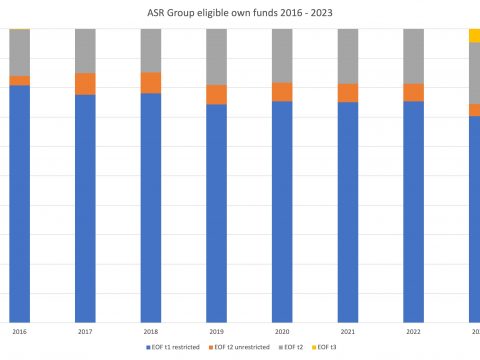

SFCR 2023: ASR introduces tier 3 capital

April 9, 2024

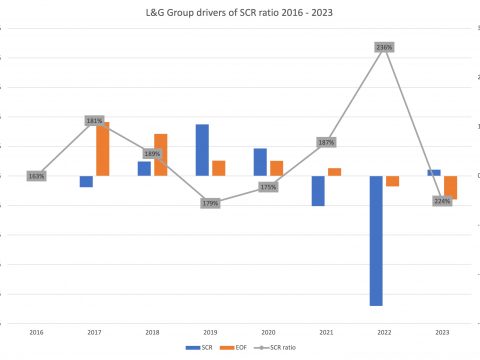

SFCR 2023: L&G solvency ratio down

April 4, 2024

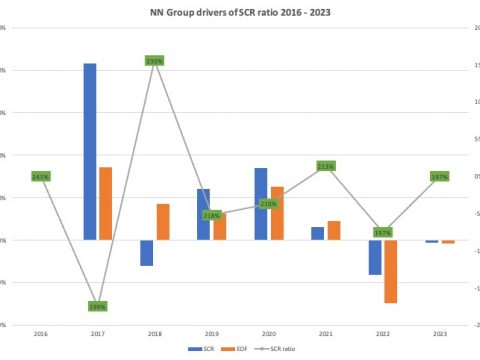

SFCR 2023: NN Group solvency ratio unchanged

April 1, 2024

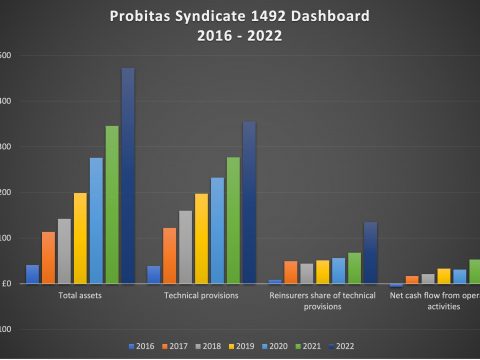

Aviva Probitas acquisition – a Lloyd’s market dashboard

March 5, 2024