Text analysis of the 2023 SFCR reports of Italian insurers Allianz S.P.A, Generali Italia and Unipol details plans for the transfer of the Eurovita life portfolio to a new Italian insurer Cronos Vita Assicurazioni S.p.A. (LEI 9845002B5D8A1BD9B472).

According to the Cronos Vita website (translated) the new entity, which will take over Eurovita’s policy portfolio is owned by five insurance companies: Allianz Italia, Intesa Sanpaolo Vita, Generali Italia, Poste Vita and Unipol SAI.

Three of the insurers mentioned the transfer in their 2023 Solvency and Financial Condition Reports.

Unipol SAI 2023 SFCR on Eurovita portfolio transfer to Cronos Vita

Unipol dedicated an entire section of its 2023 SFCR to the Eurovita portfolio transfer:

UnipolSai participates together with the main Italian insurance companies in the Eurovita rescue operation

“On 29 June 2023, the Board of Directors of UnipolSai Assicurazioni approved the Company’s participation in the rescue operation scheme to protect Eurovita policyholders, together with Allianz, Assicurazioni Generali, Intesa Sanpaolo Vita and Poste Vita (jointly, the “Companies”).

On 3 August 2023, the Companies established the NewCo Cronos Vita S.p.A. Following the receipt of IVASS authorisation to carry out insurance activities, the NewCo was renamed Cronos Vita Assicurazioni S.p.A. (“Cronos Vita”).”

The report details the share ownership structure of the new company.

“At 31 December 2023, the share capital of Cronos Vita amounted to €60m and was subscribed in equal shares of 22.5% by UnipolSai, Generali Italia, Intesa Sanpaolo Vita and Poste Vita, with Allianz subscribing the remaining 10%. The total payments made by UnipolSai in the form of share capital in favour of Cronos Vita amounted to €49.5m. At 31 December 2023, UnipolSai’s investment in Cronos Vita Assicurazioni consisted of 13,500,000 shares for a carrying amount of €49.5m.”

It further details regulatory and run-off approvals and processed.

“With effect from 30 October 2023, Eurovita S.p.A. transferred a company complex to Cronos Vita comprising the entire portfolio of Eurovita policies, placed under compulsory administrative liquidation on 27 October 2023.

Cronos Vita is managing the run-off of this portfolio for the time strictly necessary (i) for the precise identification of the distinct business units making up the company complex to be assigned to the Companies and (ii) the subsequent transfer of these units to them (or, subject to the approval of the banks involved in the transaction, their subsidiaries).

The deadline established for completing the transfer of the business units to the Companies is 24 months from the above-mentioned effective date of the transfer to Cronos Vita of the business unit, without prejudice to any delays caused by objective technical or authorisation issues.

As of 31 October 2023, IVASS Measure of 6 February 2023, which had temporarily suspended the right of Eurovita policyholders to exercise their right to Redemptions, stopped being effective. To ensure the success of the transaction and a balancing of the respective risks and charges between the parties involved, 30 banks, including the banks distributing Eurovita products and certain system banks, have indicated their willingness, subject to the issue of specific guarantees by part of Eurovita and, alternatively, its shareholders, to grant loans to the company to cover part of the early redemptions relating to the policies linked to segregated funds distributed by the banks and included in the company complex.”

Allianz S.P.A SFCR 2023 on Cronos Vita

The Allianz S.P.A text is translated in the Solvency II Wire Data web application.

“Together with 4 other leading Italian insurance companies (Generali Italia SpA, Intesa Sanpaolo Vita SpA, Poste Vita SpA and UnipolSai Assicurazioni SpA) and 30 credit institutions, Allianz SpA was an active part of an important system solution which involved Eurovita. In particular, on 27 October 2023, the deed of transfer of a business unit from Eurovita to Cronos Vita Assicurazioni SpA (hereinafter Cronos Vita) was signed.

The transfer, which includes the entire Eurovita policy portfolio, became effective with the obtaining of the final authorizations from the competent authorities. Cronos Vita is therefore the new reference company for the Eurovita policy portfolio. At the same time, with a decree of 27 October 2023, the Ministry of Business and Made in Italy placed Eurovita in a state of forced administrative liquidation.” (Trranslation)

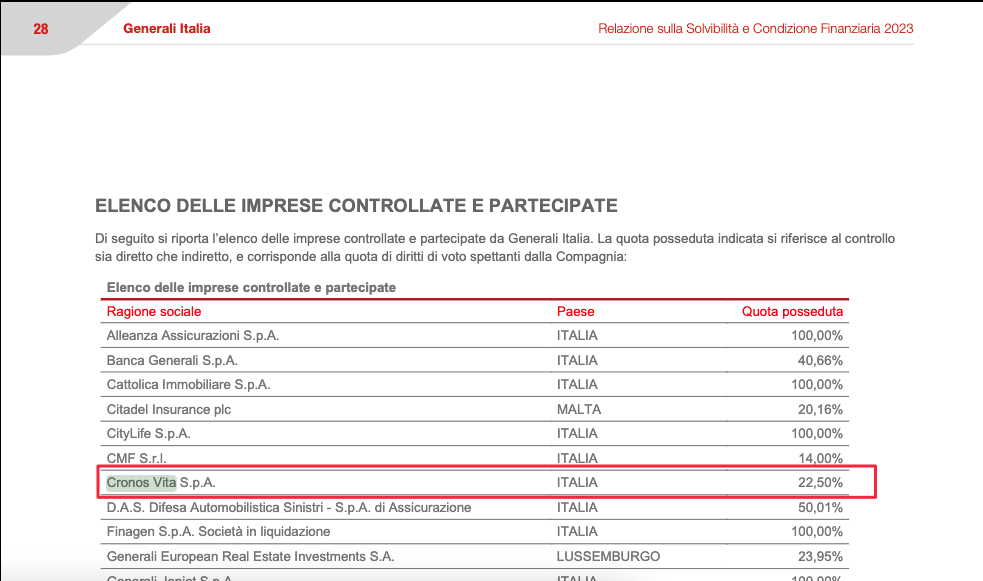

Generali Italia SFCR 2023 on Cronos Vita

Generali Italia SFCR 2023 lists Cronos Vita in its list of subsidiary and invested companies: 22.50% shares owned.

At the time of writing Intesa Sanpaolo Vita and Poste Vita have yet to publish their 2023 SFCR.

Further analysis of 2023 SFCRs published by Solvency II Wire Data:

- German SCR ratio down in 2023

- European insurance market insights 2023: 1,000 QRTs fully processed

- European insurance market insights 2023: 1st 500 QRTs

- SFCR 2023: LV= returns to tier 3 capital

- Drivers of Solvency II ratio change 7 European insurance groups 2022 – 2023

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

Datasets available on Solvency II Wire Data

-

- Swiss Solvency Test (SST): all available data 2016 – 2022

-

- Bermuda Financial Conditions Reports (BSCR): all available data 2016 – 2022

-

- Bermuda Financial Statements: data for 226 insurers 2016 – 2022 (1090 reports) selected tables

-

- Israel Economic Solvency Ratio Reports: all available data 2016 – 2022

-

- Lloyd’s Syndicate filings: data for 143 syndicates 2016 -2022 (767 reports) selected tables

-

- SOLVENCY II WIRE DATA Captive Hub