Search Results for: sst

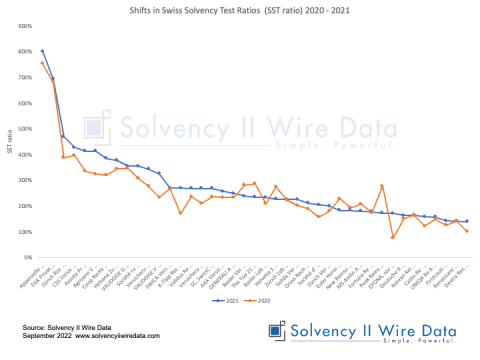

Shifts in Swiss Solvency Test Ratios (SST ratio) 2020 – 2021

October 13, 2022

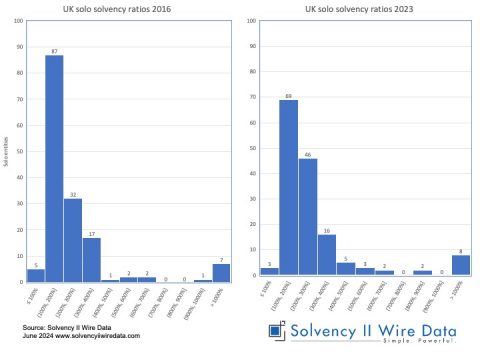

UK Solvency ratio distribution 2016 – 2023

June 18, 2024

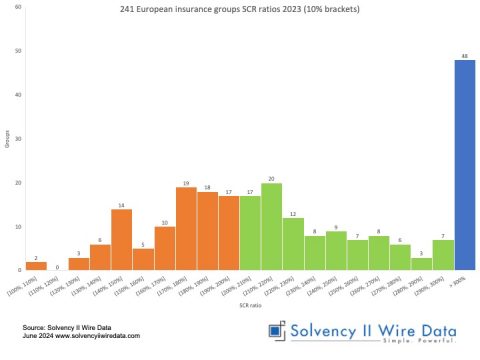

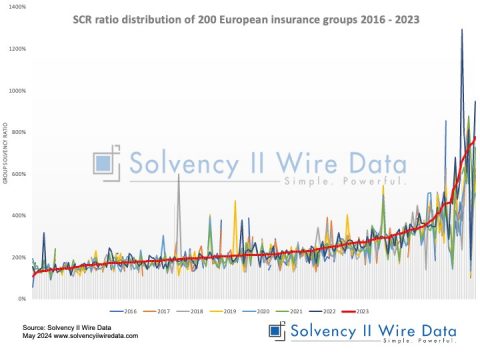

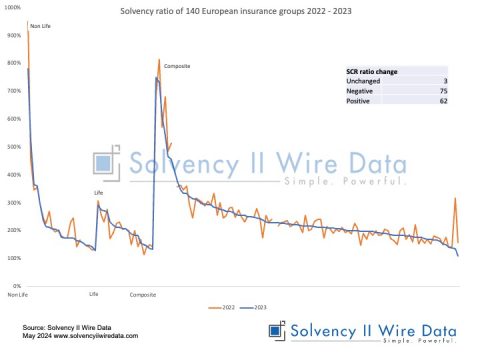

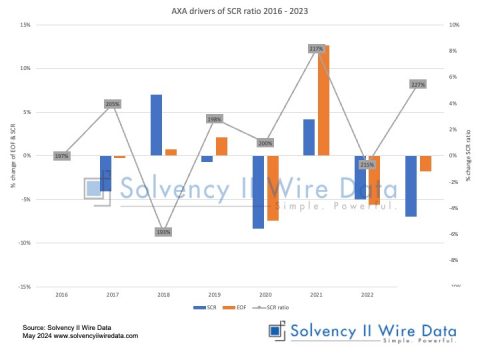

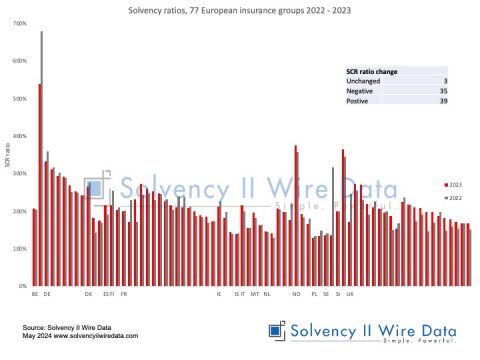

Group Solvency II ratios 2016 – 2023

May 27, 2024

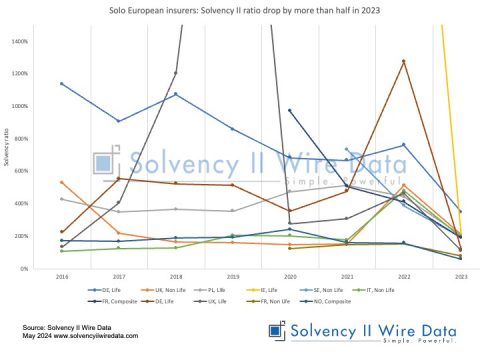

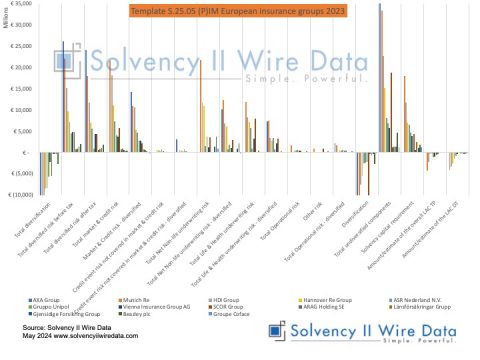

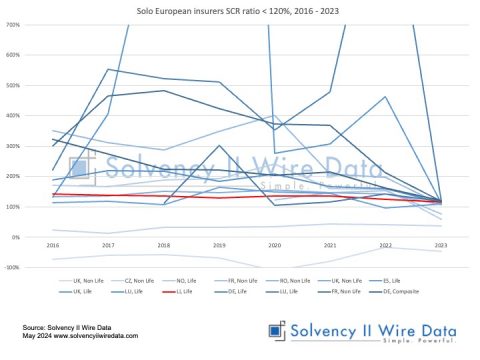

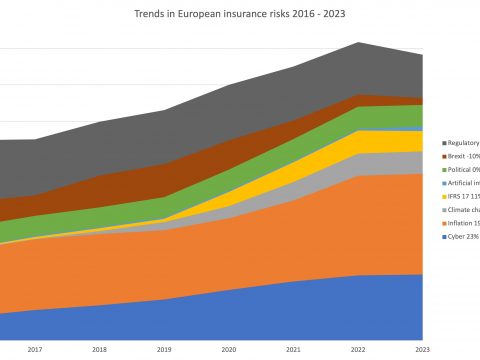

Trends in European insurance risks 2016 – 2023

April 21, 2024

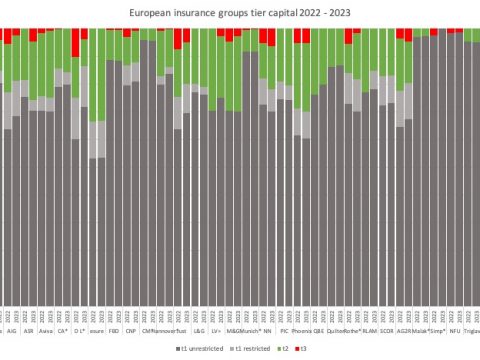

European insurance market insights 2023: group tier capital

April 19, 2024

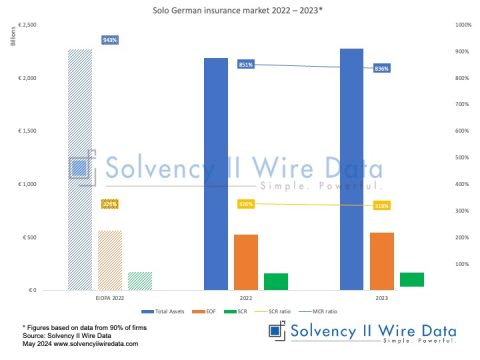

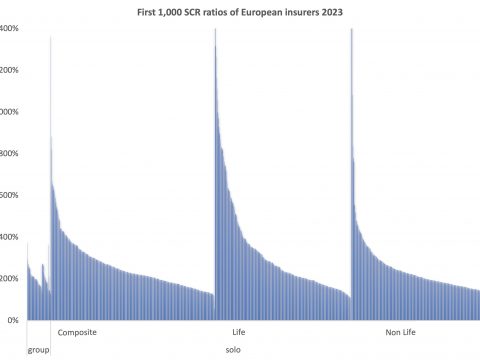

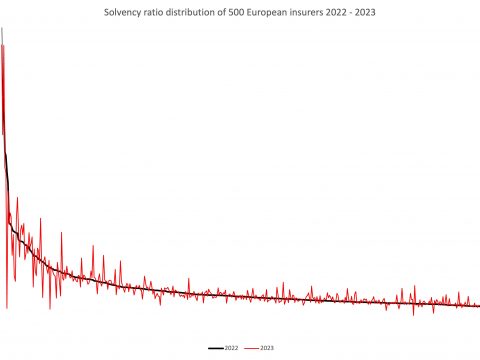

European insurance market insights 2023: 1st 500 QRTs

April 15, 2024

Swiss Insurance Asset Investment Distribution

November 4, 2022

The hard edge of the ORSA

October 26, 2015