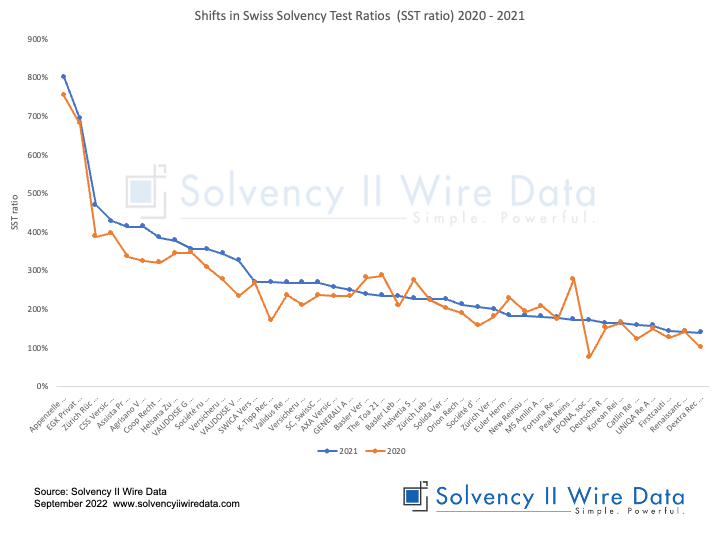

Changes in Swiss Solvency Test ratios (SST ratios) of 41 Swiss insurers show an overall strengethening of ratio relative to last year.

SST data collected by Solvency II Wire Data shows the average ratio for the sample increased from 254% in 2020 to 277% in 2021.

However, 8 Swiss insurers reported a decrease in the ratio over the period. Peak Reinsurance AG reported the largest decrease of 278% to 173%.

Data from the following templates were extracted for the sample:

- Performance life/non-life/reinsurance

- Market-consistent Balance Sheet

- Solvency

All data is available for export from Solvency II Wire Data.

Solvency II Wire Data is an innovative insurance database of the Solvency II SFCR data provided by Solvency II Wire.

To view a list of features see the Solvency II Wire Data Innovation Timeline.