Category: Uncategorized

Swiss Insurance Asset Investment Distribution

November 4, 2022

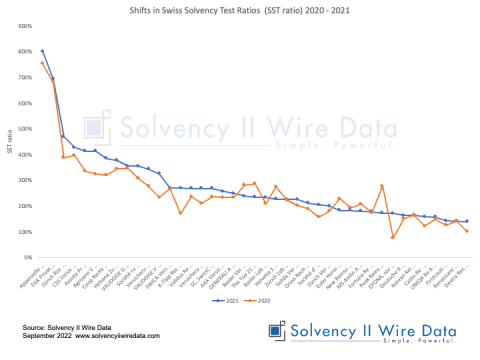

Shifts in Swiss Solvency Test Ratios (SST ratio) 2020 – 2021

October 13, 2022

Webinar: Climate risk management for insurers

November 16, 2021

#resist

October 8, 2018