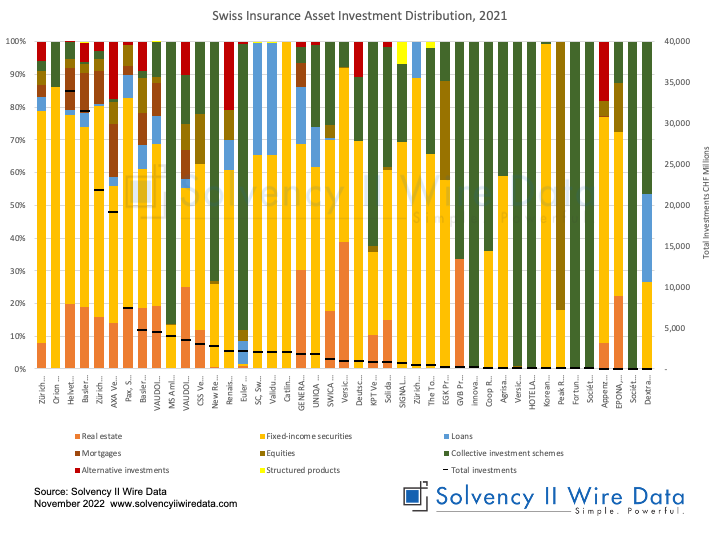

Analysis of the insurance asset investment distribution of 43 Swiss insurers in 2021 reveals the dominance of fixed income securities and collective investment schemes and real estate in their investment portfolio.

The sample covers total investments of CHF 485 billion. The total investments of the two largest companies in the sample Orion Rechtsschutz-Versicherung AG and Zürich Versicherungs-Gesellschaft AG are CHF 200.8 and CHF 125.1 respectively.

Fixed income make up 65% of the total investments of the sample. It is also notable that a number of companies only have collective investments in their portfolios.

The data is extracted from the ‘Market-consistent B Sheet Solo’ template in the Swiss Solvency Test templates. The full SST dataset for the sample is available on Solvency II Wire Data.

Solvency II Wire Data is an innovative insurance database of the Solvency II SFCR data provided by Solvency II Wire.

To view a list of features see the Solvency II Wire Data Innovation Timeline.