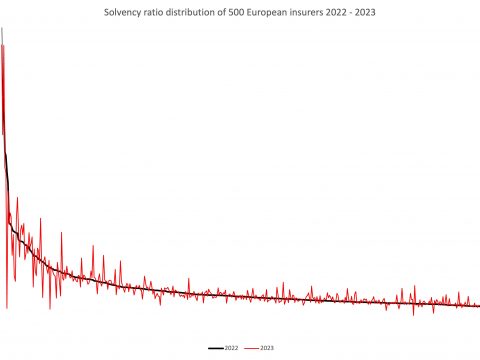

SFCR data of over 1,700 solo European insurers reveals the number of firms that shed over half their solvency ratio in the last year.

The analysis, conducted by Solvency II Wire Data, shows that 11 solo insurers in the sample had reduced their solvency ratio by more than half. The insurers span 8 countries, 5 were life insurers, 4 non life and 2 composite insurers.

Three insurers reported a significant spike in their solvency ratio in 2022, which led to the drop in 2023.

Historic data dating to 2016 (where available) does not point to a clear downward trend in the value of the ratios, and none of the firms reported a consistent year on year drop across the range.

Two firms reported a drop of their solvency ratio below 100%.

See also SFCR 2023: 30 days on, 14 European insurers with SCR ratio below 120%

Analysis of Group SFCRs 2023

SFCR 2023: Solvency II template S.25.05 partial and full internal model reporting

AXA Group reports highest Solvency II ratio to date

Eurovita portfolio transfer to Cronos Vita details

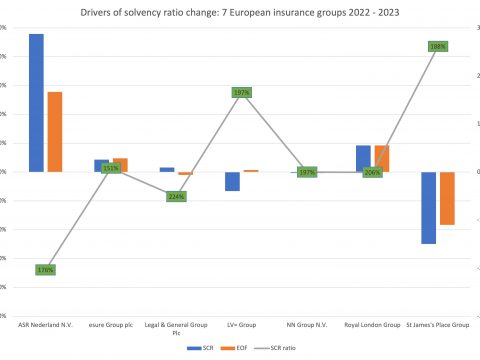

Drivers of Solvency II ratio change 7 European insurance groups 2022 – 2023

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

Datasets available on Solvency II Wire Data

-

- Swiss Solvency Test (SST): all available data 2016 – 2022

-

- Bermuda Financial Conditions Reports (BSCR): all available data 2016 – 2022

-

- Bermuda Financial Statements: data for 226 insurers 2016 – 2022 (1090 reports) selected tables

-

- Israel Economic Solvency Ratio Reports: all available data 2016 – 2022

-

- Lloyd’s Syndicate filings: data for 143 syndicates 2016 -2022 (767 reports) selected tables

-

- SOLVENCY II WIRE DATA Captive Hub