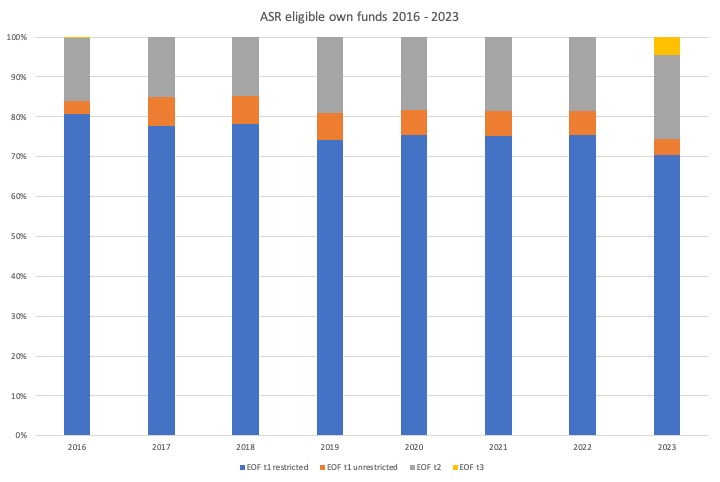

The Solvency and Financial Condition Report (SFCR) for ASR Group shows that in 2023 the group introduced the use of tier 3 capital for the first time.

Since 2016 the group’s solvency capital was mostly made up of restricted tier 1 capital and in recent years the firm increased its use of tier 2 capital.

According to the ASR 2023 SFCR: “Tier 3 of a.s.r. capital consists of Deferred tax assets. a.s.r. has Tier 3 own fund items amounting to € 529 million at year-end 2023 (2022: nil)”

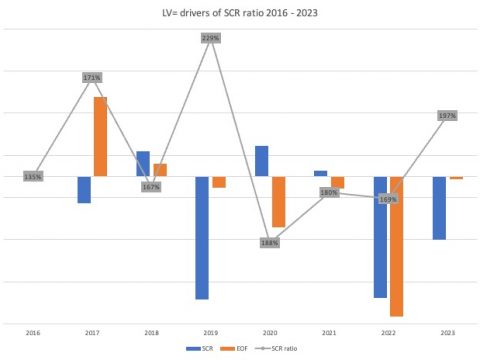

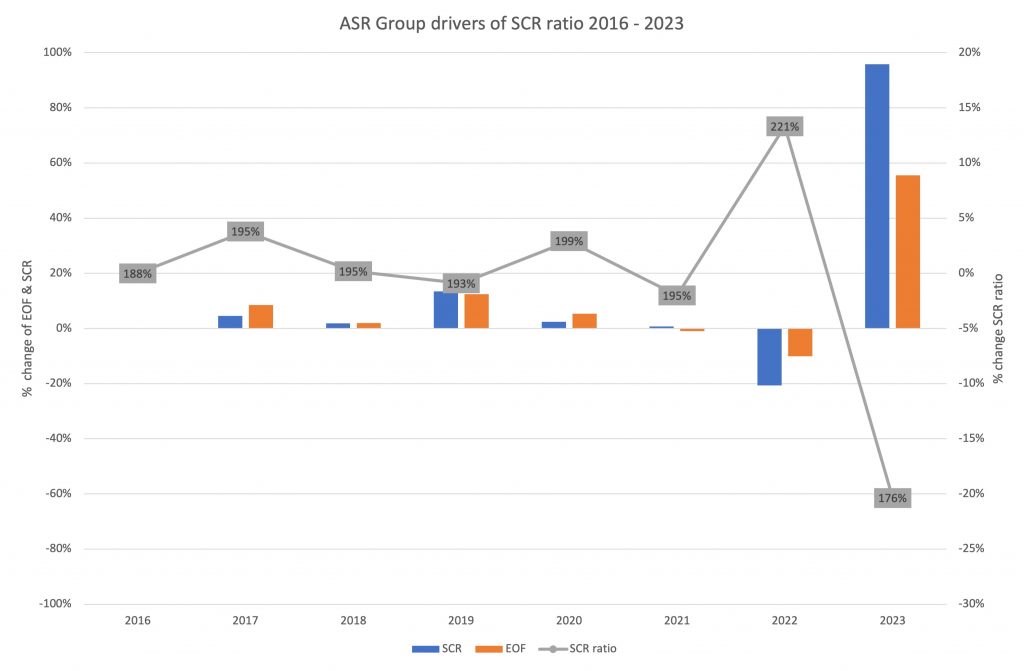

ASR Solvency II ratio drivers

The ASR Solvency II ratio was 176%, down from 221% in 2022.

The main downward drivers of the ratio was an almost doubling of its Solvency Capital Requirement (SCR) and a much lower increase in own funds.

The change was mostly due to the aquisition of Aegon NL.

“The solvency ratio stood at 176%1 as at 31 December 2023 including a 31%-points decrease due to the acquisition of Aegon NL and the deduction for proposed dividend, as a result of € 11,578 million EOF and € 6,581 million SCR.

The EOF increased to €11,578 million (31 December 2022: €7,441 million), mainly driven by the acquisition of Aegon NL and organic capital creation, which was partly offset by market and operational developments and by the proposed dividend. The SCR increased to €6,581 million (31 December 2022: € 3,360 million), primarily due to the addition of the Aegon NL business.”

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).