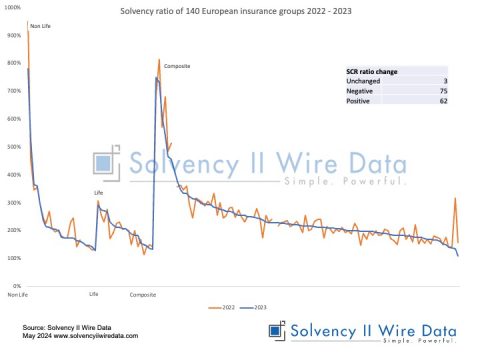

Early reporting of Solvency II SFCRs and QRTs of some of the major European insurance groups continues.

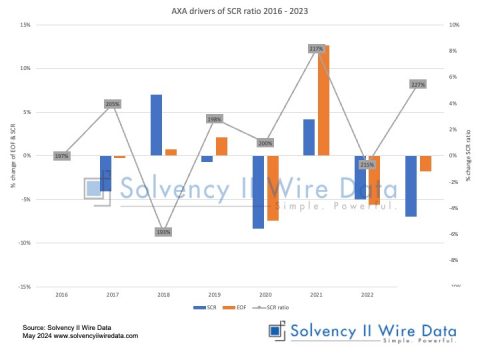

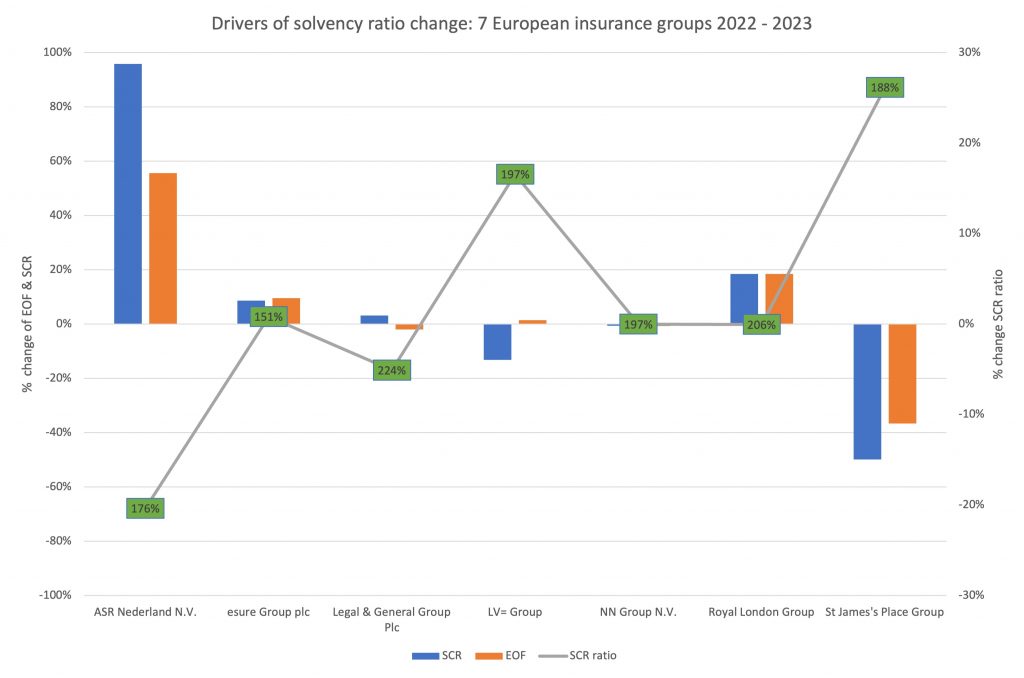

The chart below shows the drivers of Solvency II ratio change of the likes of NN Group, Legal and General, ASR and LV=.

The drivers of the ratio change vary considerably between each firm. The largest ratio increase reported by St Jame’s Place was mostly due to a smaller decrease in its own funds relative to the SCR.

At the other end of the scale ASR saw a significant drop in its coverage ratio, driven mostly by larger increase in its SCR.

More information about the data is available to premium subscribers of Solvency II Wire Data and subscribes to Solvency II Wire‘s exclusive SFCR Spotlight mailing list (subscribe for free here).

SOURCE: Solvency II Wire Data