Early analysis of the Irish insurance market, based on the 2021 Solvency II public disclosures of 76 solo insurers, shows an increase in the solvency ratio (SCR ratio) from 176% in 2020 to 188% in 2021.

2021 Irish market sample figures

The sample represents EUR 469.7 billion assets under management (AUM): over 90% of the annual total in 2020 according the EIOPA annual statistics (EUR 489.5 billion). In 2020 the sample reported EUR 430.2 billion AUM.

EIOPA listed 179 solo insurers in Ireland in 2020, over half of these published their SFCRs and QRTs on the CBI website in 2021 Q4.

The sample is made up of 31 non-life companies, 32 life companies, and 13 composite insurers.

The analysis conducted by Solvency II Wire Data is based on collected SFCRs at the time of publication.

Irish market solvency ratio

The average solvency ratio for the entire solo Irish insurance market in 2020 was 178%, according to the EIOPA annual statistics.

The Solvency Capital Requirement (SCR) of the sample decreased by 1% from EUR 24.8 billion in 2020 to EUR 24.5 billion the following year (EUR 28.7 billion, EIOPA 2020).

Eligible own funds to meet the SCR (EOF) rose by 6% from EUR 43.6 billion to EUR 46 billion respectively (EUR 51 billion, EIOPA 2020).

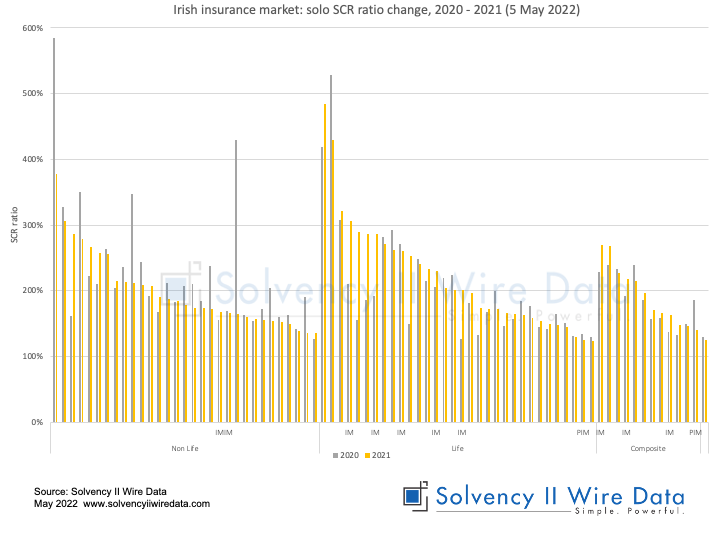

However, the increase in solvency ratio masks significant volatility in the individual ratios of the sample components; 41 of the insurers reported a year-on-year drop in their solvency ratios.

The biggest decrease was reported by Chaucer Insurance Company DAC, whose ratio dropped from 429% in 2020 to 165% in 2021.

The highest solvency ratio increase was reported by Athora Ireland: a shift from 155% to 290% the following year.

Mapping internal models to the standard formula

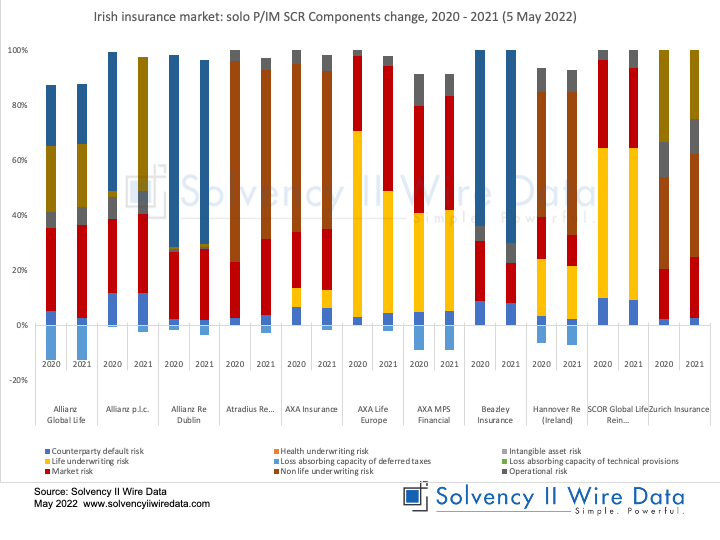

The sample also includes a number of insurers using the a full or partial internal model to calculate their SCR.

The chart below shows the breakdowns of the SCR components mapped to the Solvency II standard formula using the Solvency II Wire Data Comparator tool.

Where internal model components cannot be directly mapped to the standard formula (e.g. pension or business risk) or in cases where insufficient granularity was provided (underwriting risk) these items are mapped to the ‘Other’ and ‘Underwriting’ categories respectively.

Irish market analysis

The Irish market is one of the most top-heavy insurance markets in Europe. For example, in 2020 the 20 largest insurers represented 70% total assets under management in Ireland. While the sample may represent a close proxy for the entire market it will likely mask changes in individual company solvency ratios.