ANALYSIS

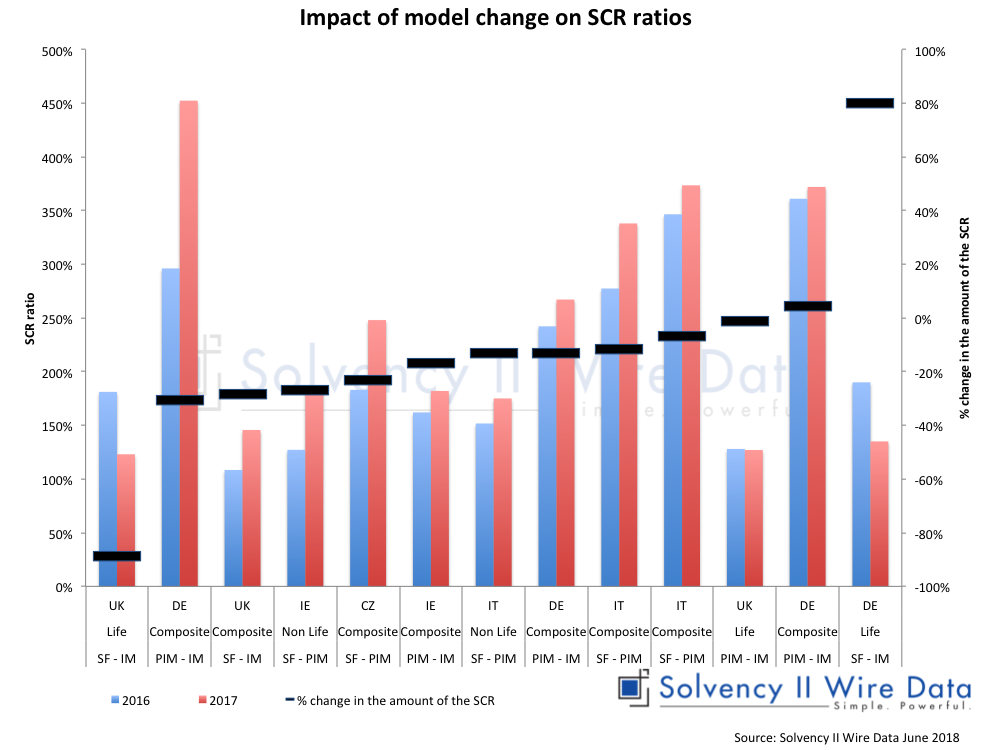

Analysis of 13 firms that changed their Solvency II capital model in 2017 reveals the benefits of using an internal or partial internal model, when looking at the impact of model change on the SCR ratio.

However, that impact can vary significantly. A review of close to 800 solo firms conducted by Solvency II Wire Data has identified 13 firms that changed their capital model in 2017. Of these, 8 had a standard formula in 2016.

5 standard formula firms converted to a partial internal model and 3 to a full internal model. The 5 partial internal model firms all switched to a full internal model. The chart below shows the impact of the change on the SCR ratio and amount of the SCR.

The vertical bars (left axis) show the SCR ratios in 2016 and 2017 for each firm. In most cases the model change resulted in an increase in the SCR ratio. However, in two cases the ratio dropped following the model change. The right axis of the chart shows the percentage change in the amount of the SCR between 2016 and 2017. While most firms experience a reduction of up to 20% in the SCR amount, one firm experienced a dramatic increase in the SCR amount (over 80%).

This is likely to be due to factors beyond the model change. Two other firms experienced very moderate change in both the SCR ratio and the SCR amount. The sample is dominated by composite firms (8 firms) and includes 4 German firms, and 3 firms based in Italy and the UK.

In order to fully assess the impact of a move to an internal model (or partial internal model) a more comprehensive cost benefit analysis will be required, taking into account the short and long term costs of creating and maintaining the model.

The full data set used for the research is available to Solvency II Wire Data premium subscribers.