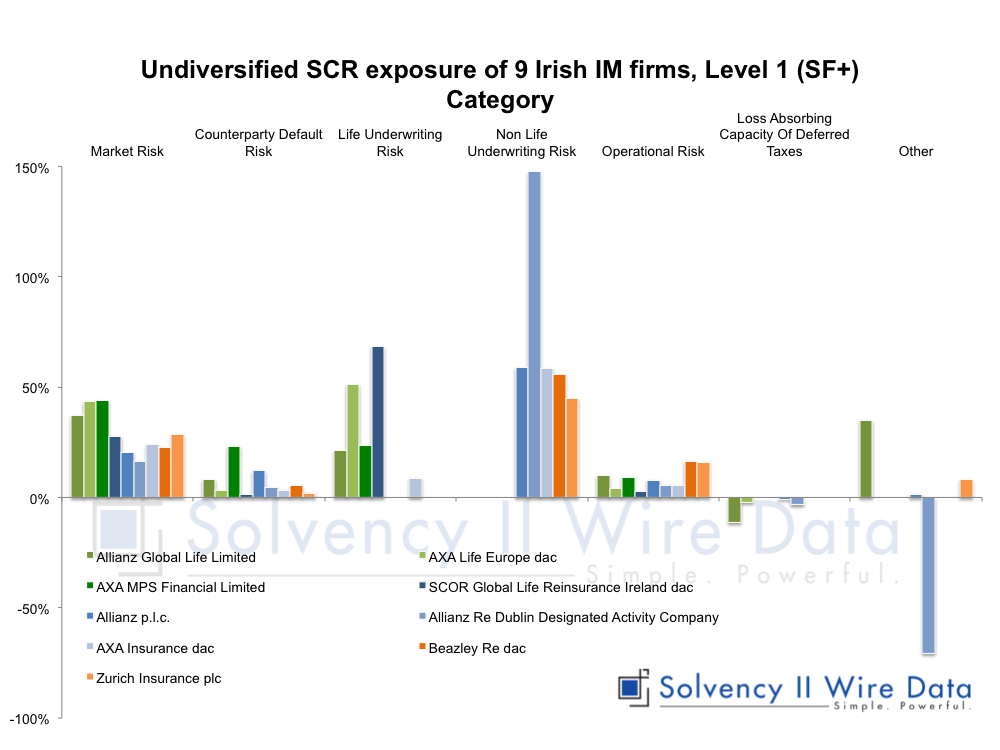

A key challenge in analysing the Solvency II data is comparing internal model SCR components between companies. Internal model (and partial internal model) firms can publish their own risk categories of the SCR to better suit their own risk profile.

Using the Solvency II Wire Data insurance database we are able to obtain exactly such a snapshot for comparison. The SFCR database applies a simple algorithm to create a grouping based on the name of the category as defined in the QRTs; template S.25.02 (SCR Partial Internal Model) and S.25.03 (SCR Full Internal Model).

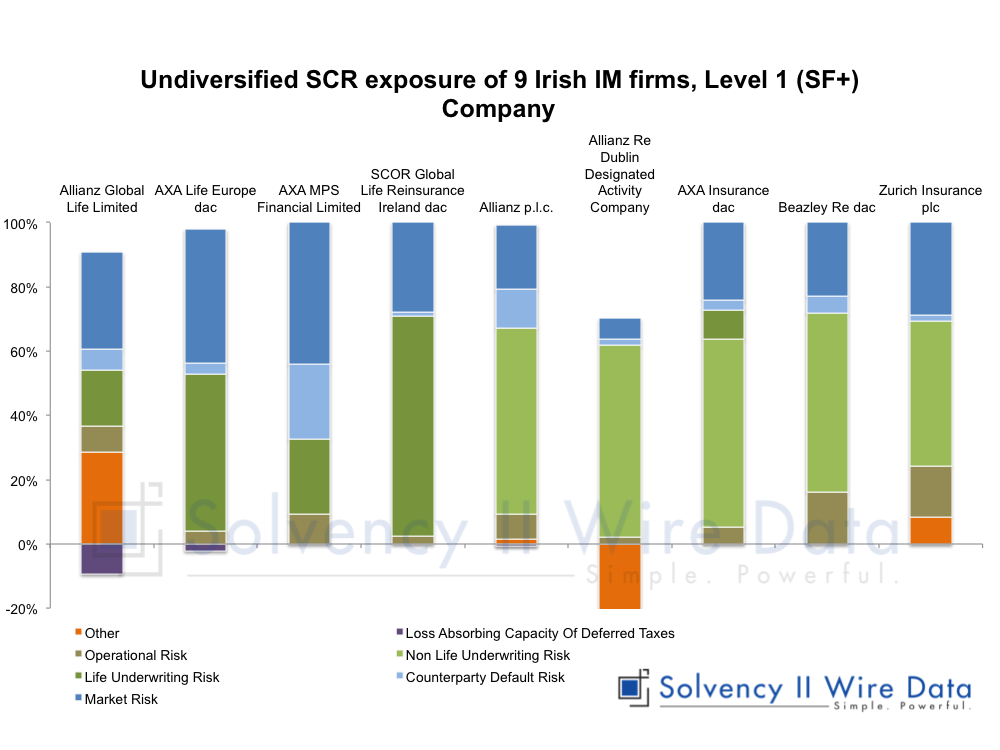

The items are listed in column C0020. The charts below shows the results for the 9 Irish Internal Model firms.

SF+

The aggregation used here is the Standard Formula Plus (SF+) method, which is based on the 6 risk categories in the Standard Formula with an extra category, ‘Other’, for all items that do not fit into these groups.

The chart below shows that underwriting risk is by far the largest risk across the sample, followed by market risk. Broadly speaking the underwriting risk is more dominant for the non-life firms, and market risk for life firms.

It is also evident that the Standard Formula risk categories are mostly appropriate for the firms in the sample. Only 3 firms, Allianz Global Life Limited, Allianz Re Dublin DAC and Zurich Insurance plc, have significant ‘Other’ categories. The ITS on the SFCR (2015/2452) does provides instructions on the numbering of the ‘Unique number of component’ (C0010) to be assigned to each risk component description (C0020). However, in practice the filings are too inconsistent to form a reliable guide.

Scratching beneath the surface

While such analysis is useful, it can only be used as a starting point to making meaningful comparisons between firms. Looking at the descriptions for underwriting risk serves as a typical example.

Three firms (Allianz Global Life Limited, Allianz Re Dublin Designated Activity Company, Allianz p.l.c.) reported “Underwriting Risk” without specifying an allocation to a line of business. However, as the first is a life company and the other two non-life, the underwriting risks were allocated respectively.

Allocation for composites may require more judgment. Beazley Re dac is one of two composite firms in the sample. It reported two items relating to underwriting risk: ‘Premium risk’ and ‘Reserve risk’. In order to allocate these to relevant risk categories we need to understand what type of business the company writes.

Template S.05.01 ‘Premiums, claims and expenses by line of business’ provides a breakdown between life and non life business. Using Gross Written Premiums (GWP) as a measure for comparison we can see that non life GWP are USD 1.749 billion (S050102__C0200_R0110), which dwarf the firm’s life GWP, USD 23 million (S050201__C0300_R1410). We therefore allocate both Premium and Reserve risk to Non life underwriting risk.

Other

The proprietary nature of the Internal Model means that inevitably there will be risk items that do not fit into an easily defined category. These include items such as Business Risk, Scenarios or Pension Risk.

In some cased there is sufficient information in the SFCR to make a judgment on category allocation. The Pension Risk item was reported by Zurich Insurance plc. The company describes Pension Risk as follows on page 34 of its SFCR: “This risk relates to the potential loss of economic capital due to the assets in defined benefit pension funds being insufficient to meet the obligations to the members of the pension funds when they become due, resulting in the company being required to make up the shortfall.”

It further states that the components of this risk in the Internal Model calculation are ‘Longevity Risk’ and ‘Market Risk’. Assuming the latter is the larger of the two risks we allocate Pension Risk to Market Risk category.

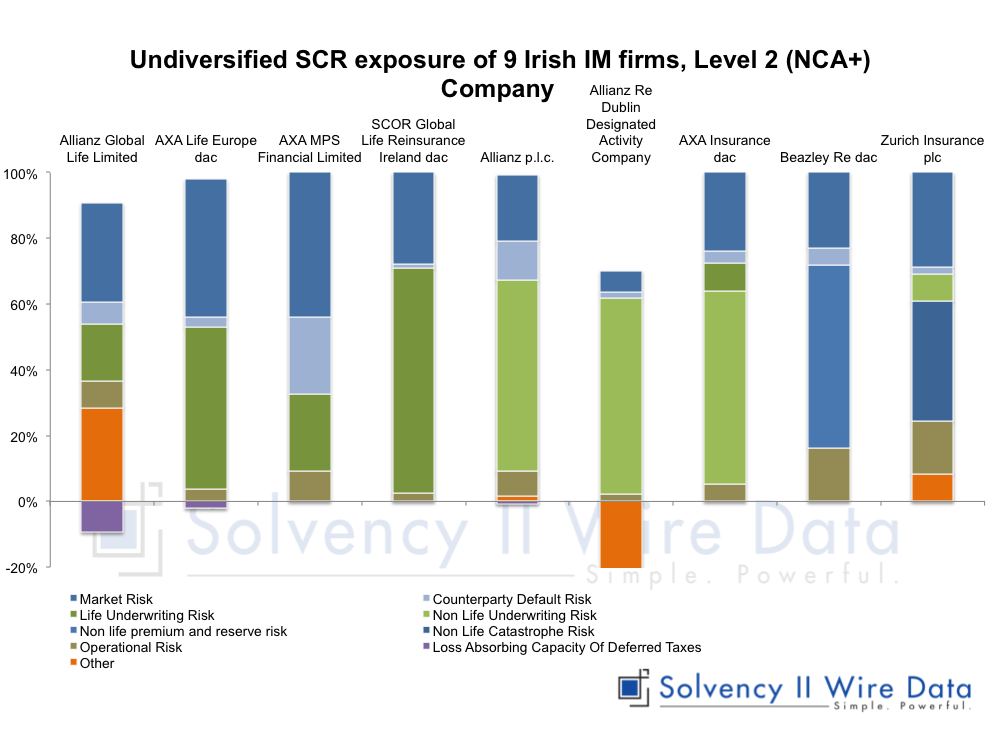

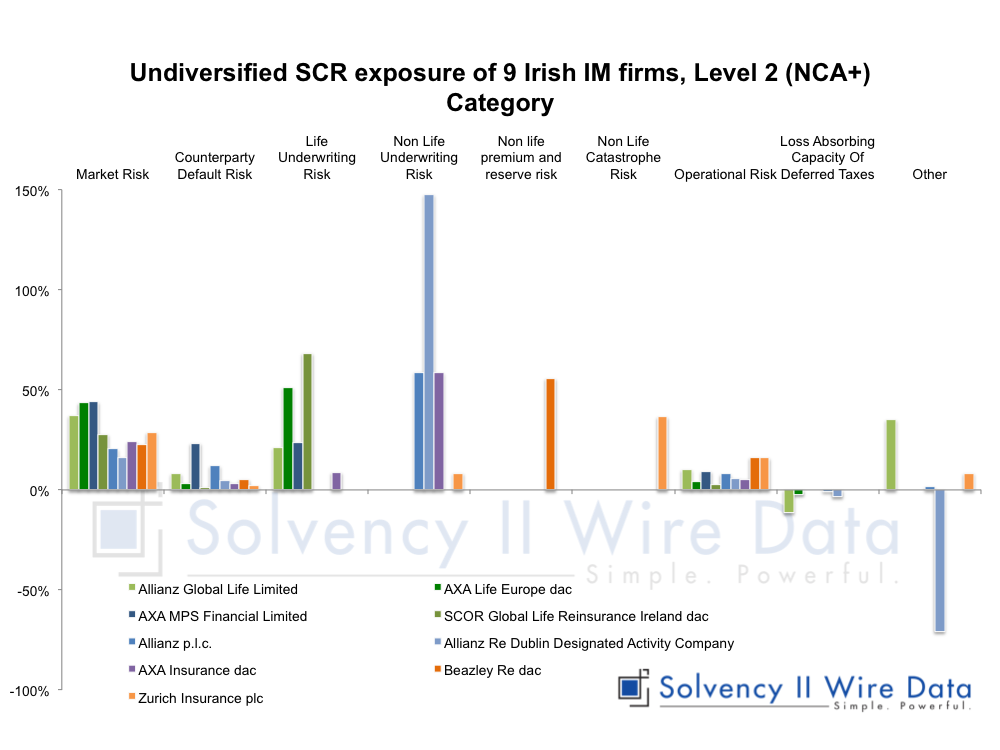

NCA+

The analysis can be extended to a further level of details called NCA Plus (NCA+) which draws on a wider range of risk categories. The charts below show the risk categorisation using some more criteria from the private reporting.

True to the spirit of Solvency II

Both sets of analysis demonstrate that it is possible to create some meaningful comparisons of internal model SCR components between Internal Model and Partial Internal Model firms, but some judgment and interpretation is required. In that sense they remain true to form in the Solvency II world.

The full breakdown of the risk items used in this analysis is available to premium subscribers of Solvency II Wire Data. How to export data for the Irish IM analysis:

- In the solo Filter select Global Filters (Ireland and Internal Model)

- Export all data for selected companies.

- The C0020 risk items and risk allocations SF+ and NCA+ will display in the set of tables below the main data export table.