More analysis of SCR ratios of European Insurance Groups

Shifts in SCR and MCR Ratios 2016 – 2020 80 European Insurance Groups

Shift in Eligible Own Funds vs change in SCR Ratio: 95 European insurance groups

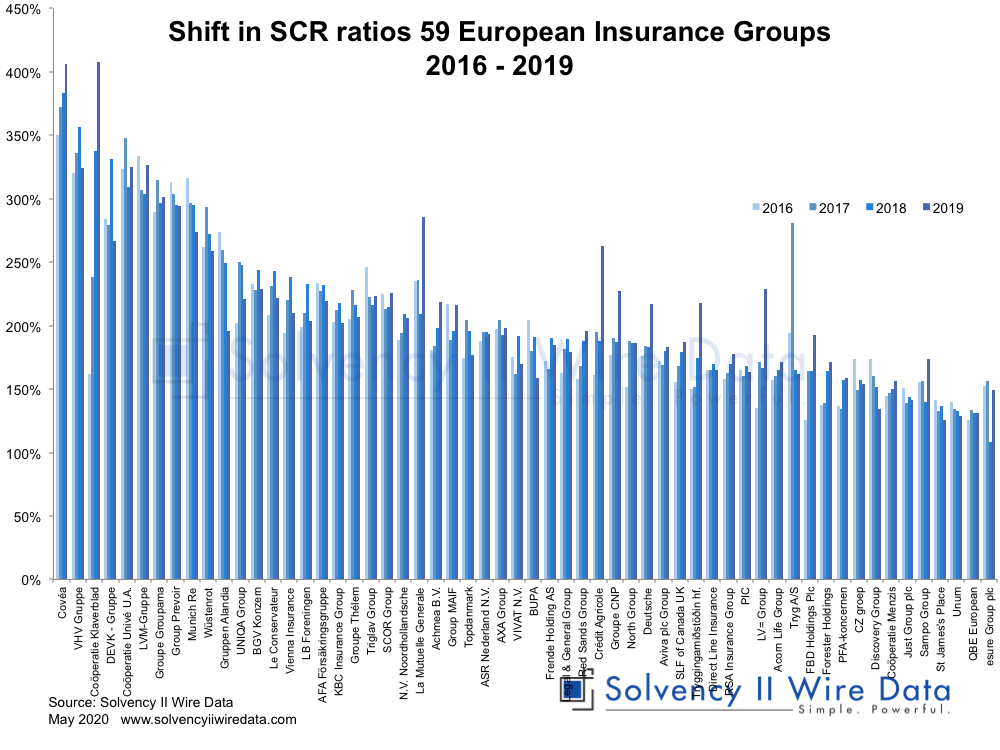

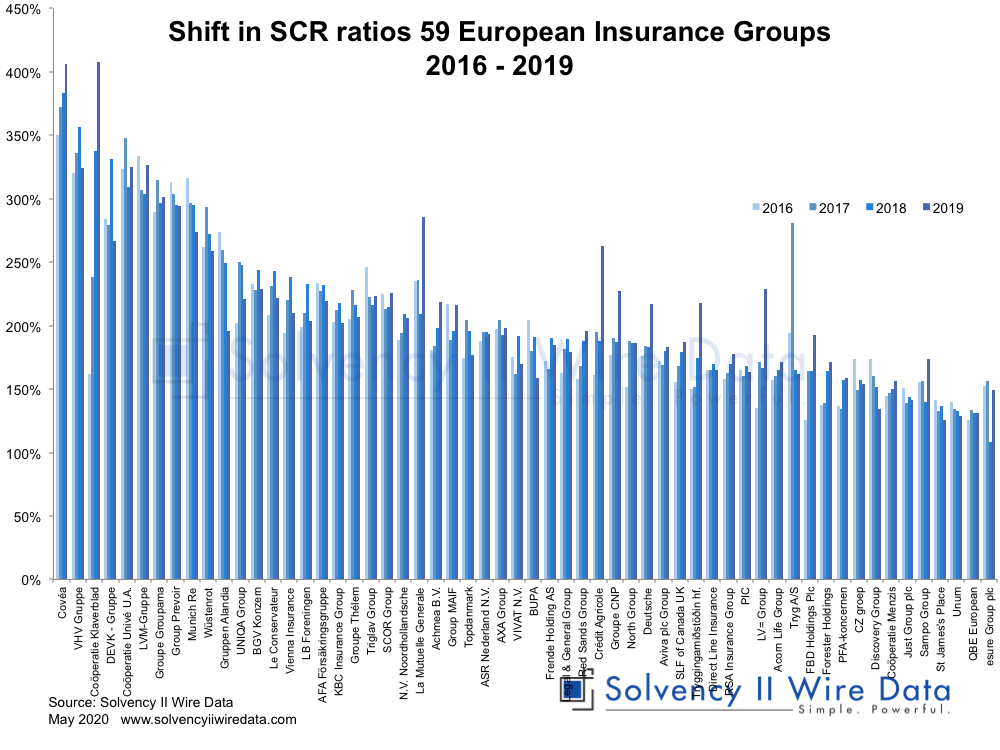

Home » SFCR Analysis » Data Analysis » Shift in SCR ratios 59 European Insurance Groups 2016 – 2019

Shifts in SCR and MCR Ratios 2016 – 2020 80 European Insurance Groups

Shift in Eligible Own Funds vs change in SCR Ratio: 95 European insurance groups

Archive

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

analysis asset allocation Basel III bonds climate-risk Comment counter-cyclical premium Data EIOPA Equivalence European Commission European Parliament Extrapolation FSA Groups IAIS Illiquidity Premium implementation Insurance Europe Interim measures Internal model Investment Level 2 look-through LTG Matching adjustment MCR Omnibus II ORSA Pillar I Pillar II PIllar III Proportionality QRTs Regulation Reporting SCR SFCR SFCR 2023 Solvency II standard formula Stress test timeline trilogue XBRL

Copyright © 2024 Solvency II Wire