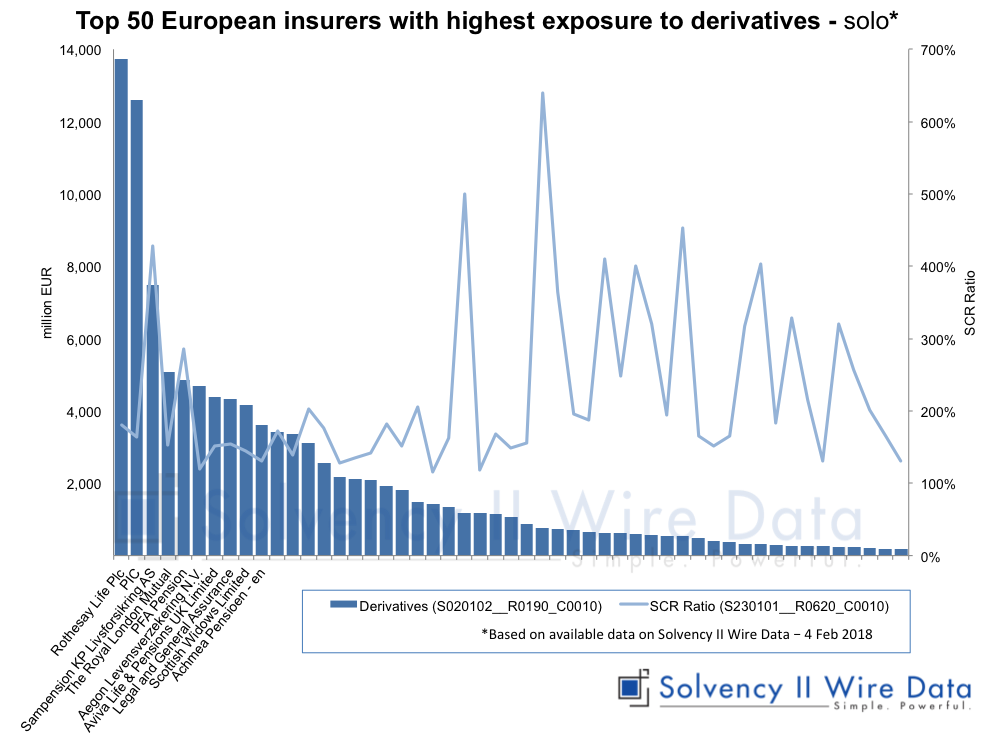

Chart title: Top 50 European insurers with highest exposure to derivative – solo

Description: List of 50 solo European insures with highest exposure to derivatives on their balance sheet (Solvency II balance sheet).

Definition: Derivatives, ITS 2015/2452, page 54

Chart title: Top 50 European insurers with highest exposure to derivative – solo

Description: List of 50 solo European insures with highest exposure to derivatives on their balance sheet (Solvency II balance sheet).

Definition: Derivatives, ITS 2015/2452, page 54

- (a) Its value changes in response to the change in a specified interest rate, financial instrument price, commodity price, foreign exchange rate, in dex of prices or rates, credit rating or credit index, or other variable, provided in the case of a non–financial variable that the variable is not specific to a party to the contract (sometimes called the ‘underlying’).

- (b) It requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors.

- (c) It is settled at a future date.