Category: Slider

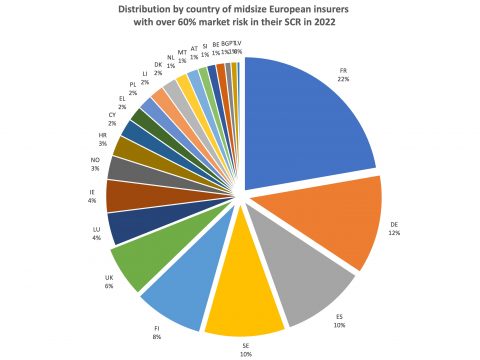

SCR market risk sub-module of 1,000 midsized European insurers

February 29, 2024

IFRS 17 in the SFCRs

February 21, 2024

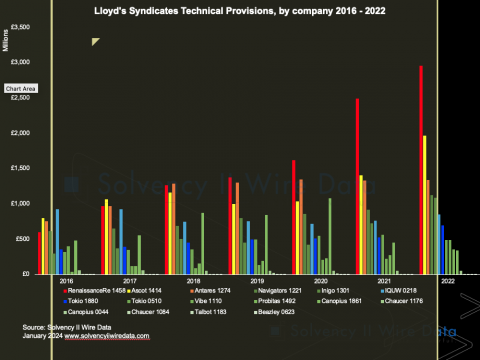

Lloyd’s Syndicate Report data

January 22, 2024

Tools for backtesting the SCR

December 4, 2023

Bermuda insurance technical provisions and risk margin

September 20, 2023

Solvency II News: 7th annual Solvency II survey

September 7, 2023

Bermuda Solvency Ratios 2022

August 24, 2023

IFRS 17 reporting lagging in Solvency II SFCRs

May 24, 2023

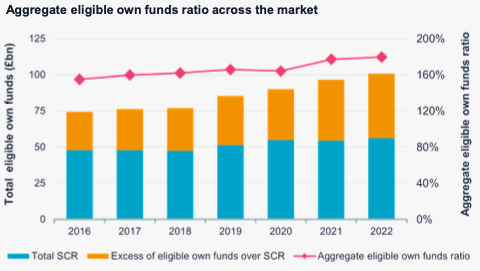

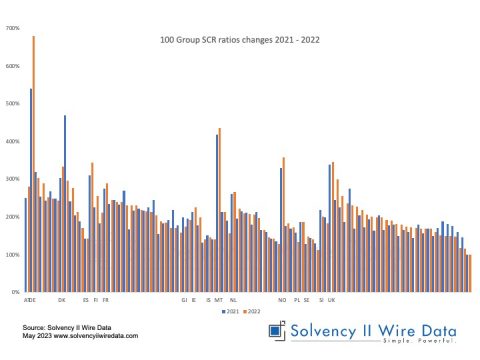

2022 Group SCR Ratios

May 19, 2023

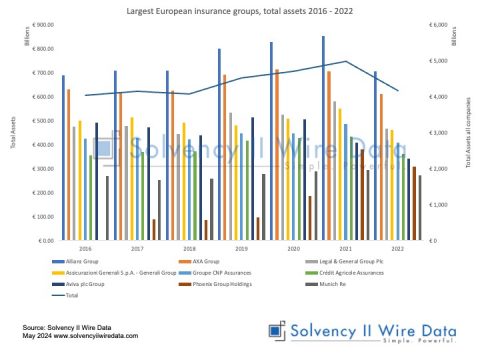

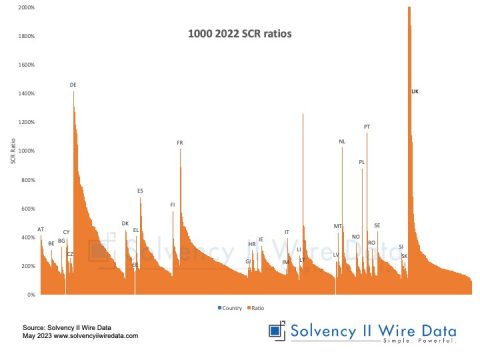

1000 2022 SFCR

May 15, 2023

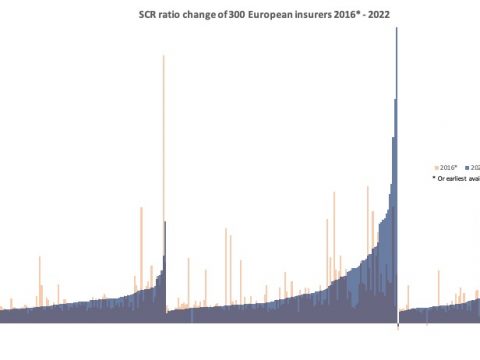

First 2022 Solvency II SCR ratios

April 17, 2023

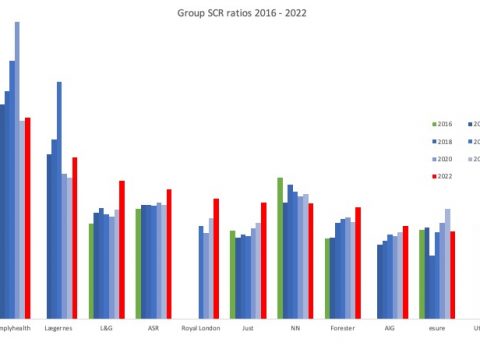

2022 Group SFCRs

April 11, 2023

A simple approach to climate scenarios

March 8, 2023

Second European Captive annual survey

February 8, 2023

Insurers rank third in 2021 TCFD Climate Disclosure Survey

December 22, 2022

Climate-related risks – a coordinated response to a global challenge

October 10, 2022