tag: System features

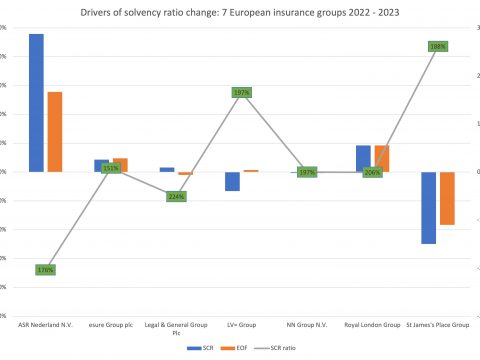

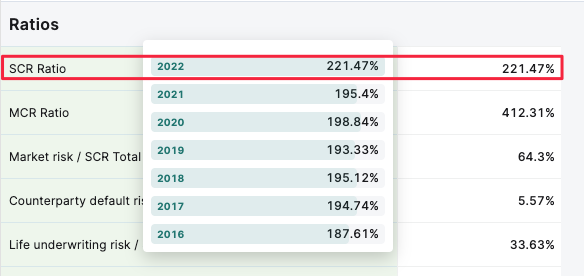

One of the advantages of the Solvency II public disclosures is the consistancy they provide over time. Despite the fact that there are multiple factors that affect key parmeters such as the Solvency II Capital Requirement (SCR), backtesting the SCR for a single company or across the market is helpful to understanding the capital management strategy of insurers.

Solvency II Wire Data provides a simple and powerful SCR history tool, which displays the history of the SCR and other QRT cells in the company view.

In addition, for Standard Formula firms a set of presets displaying the proportion of each of the SCR components as part of the SCR (e.g. Market risk as a proportion of the SCR). Here too historic values are easily accessible.

The anaylsis is even more powerful when when viewing these figures in the multi SFCR comparison tool, which allwos easy and quick analysis of the SCR breakdown across an unlimited number of firms.

To find out more about these and other powerful analysis tools click here to request a free demo.

Solvency II Wire Data is an innovative insurance database of the Solvency II SFCR data provided by Solvency II Wire.

To view a list of features see the Solvency II Wire Data Innovation Timeline.