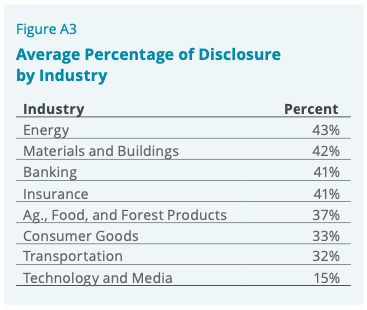

The global insurance industry ranked joint third (with banking) in the TCFD Climate-related annual survey, with an average level of disclosure of 41% across the 11 recommended TCFD disclosures in 2021.

The Task Force on Climate-related Financial Disclosures Status Report 2022, published earlier this month, reviews the progress of climate-related disclosures of more than 1,400 large companies across the globe.

The review is conducted under four broad headings: Governance, Strategy, Risk Management, and Metrics and Targets, which include a number of subsections.

Insurance industry climate disclosures

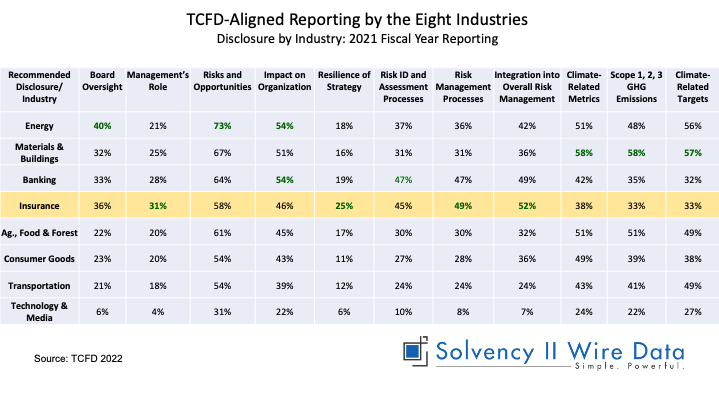

A review of the public reports of 118 insurers found that the industry ranked first in four of the 11 TCFD recommendations: Management’s Role, Resilience of Strategy, Risk Management Processes, and Integration into Overall Risk Management. All four are part of Governance and Risk Management (see chart below).

The report attributes the industry’s strength in these categories, in part, to regulatory practices: “Companies in the insurance industry had the highest levels of disclosure on the Risk Management recommendation, closely followed by banks. This may be attributable to insurance and banking regulators’ general emphasis on risk management processes.”

Insurers rank low on climate Metrics and Targets

In contrast to high performance in governance and risk management, insurers fared poorly in climate metrics and targets disclosures.

In two of the three Metrics and Targets recommendations – Climate-Related Metrics and Scope 1, 2, 3 GHG Emissions – insurers ranked second to last, and third to last in Climate-Related Targets (see above).

Overall improvement in climate-related disclosures

While the authors of the report are broadly positive about the progress being made in climate-related disclosures they raise questions about the scope and usefulness of the information being disclosed.

“The Task Force remains concerned that not enough companies are disclosing decision-useful climate-related financial information, which may hinder investors, lenders, and insurance underwriters’ efforts to appropriately assess and price climate-related risks.”

—

Qualitative analysis of European climate-related disclosures published by Solvency II Wire is available here:

EU climate disclosures 2020 – 2021

Better but not enough: European insurers’ climate disclosures in 2021