Government policy set with best intentions to reduce carbon emissions may falter if not thought through properly. David Rorrison, director of enterprise risk, Just Group, shows how missing historical data and a lack of clarity from government limits a lender’s ability to comply with future energy efficiency targets of a mortgage portfolio.

Introduction: Energy Performance Certificates and lifetime mortgages

Growing concerns about climate change exacerbated by the sharp rise in energy costs have brought the need for more energy efficiency in our homes into focus. To help this process, over the past nine years homeowners have been required to provide an Energy Performance Certificate (EPC) for a residential property before it can be sold (unless exempt). The buyer is then made aware of the building’s strengths and weaknesses from an energy efficiency viewpoint as well as the potential costs of making improvements.

Lifetime mortgages

A lifetime mortgage is a loan secured on a person’s home, that only needs to be repaid when the property is sold after they die or enter long term care.

In most cases, no interest payments are payable by the customers during the mortgage term and the compound interest rolls up on the loan. Hence the longer the lifetime mortgage lasts, the greater the outstanding balance.

To make this work, the maximum loan to value of the property offered is limited based on the customer’s life expectancy according to their age and, in the case of Just Retirement, health and medical history.

It is still possible for the eventual debt to exceed the property sale price especially if the value of the property is impaired by unforeseen factors. To reassure borrowers, a no-negative equity guarantee is offered by most lifetime mortgage lenders meaning that, when the customer dies, the estate is not required to make up any excess of loan over the sale price. Such circumstances would lead to a loss for the lender.

Ambitious EPC targets set by government

EPC ratings range from “A” for the most energy efficient properties to “G”, the least energy efficient property. Rating by an accredited energy assessor considers such factors as the property’s insulation and the type of heating. Properties built in recent years tend to be very energy efficient and would typically have high ratings of A or B.

The UK government has stated its ambition for all residential properties to be rated EPC C or above by 2035 (where economically viable) and for mortgage portfolios to have an average EPC C rating by 2030.

The challenges

This represents a challenge to us and other lifetime mortgage lenders in modelling the transitional risks that could arise if energy efficiency and government’s related measures impact property values in an unexpected way. EPC ratings are also necessary to enable lenders to assess the emissions from the property portfolio for disclosure purposes. The ability to do this is affected by the data gaps relating to the energy performance of our mortgage portfolio. We need to address these gaps to be able to model the data and then find ways of improving the overall rating of the portfolio.

Assessing the portfolio

We estimate that about three-quarters of the properties in our lifetime mortgage portfolio have an EPC rating below the level desired by the government, broadly in line with UK housing stock overall. This is not surprising given that many will be older properties. A good proportion of these mortgages are likely to still to be in force in 2030.

Missing data

A common reason for taking out a lifetime mortgages is the desire to stay in the family home rather than downsize. Where the property has not been sold since before energy efficiency assessments became mandatory, an EPC rating will not exist for the property (unless the owners have commissioned one for their own information which is uncommon).

This is the case for many of the properties in our lifetime mortgage property portfolio, which limits our ability to make climate transitional risk and carbon emissions assessments.

Overcoming data gap challenges

Improving the data lenders hold is key to managing the climate risks. Even if a lender made sure property EPC ratings were obtained for new mortgages, the proportion of their portfolio covered will only change slowly year by year, and it is likely that many of these properties will prove to be below the target EPC rating.

The position with existing customers is an even greater challenge as they are not obliged to obtain an EPC assessment. Instead, we will need to find opportunities to encourage EPC ratings as part of a package of measures to help and encourage them to improve their properties’ energy efficiency.

Modelling with limited data

In the meantime, we have to make assumptions based on nearby comparable properties that have an EPC rating. In a small number of cases, there isn’t a suitable proxy so these properties have to be left out of the equation.

In theory…

An obvious solution to improving the average energy efficiency for the entire portfolio would be for a lender to restrict all new lending to properties rated EPC C or higher.

However, this in itself would almost certainly not be enough to bring the portfolio within reach of the government target and in any case, such an approach (even if commercially viable) could disadvantage customers without the financial means to improve their homes’ energy efficiency.

Clarifying government policy is all-important

The government has yet to indicate how it expects its targets to be achieved, including whether it will offer grants or tax breaks to help homeowners improve their properties’ energy efficiency. This means that climate transitional risks to lifetime mortgages are a matter of speculation until the government provides clarity on its intentions.

The recent change of prime minister could even result in a rethink of government climate policies either creating even more onerous requirements or alleviating pressure on lenders (indeed an independent review into net zero was announced by the UK government only recently).

Any future negative measures introduced by the government, such as requiring properties to meet certain levels of energy efficiency before they can be sold (as previously proposed by the Committee for Climate Change) could impact property values due to the expense of such improvements.

Having said that, even without mandatory measures, soaring energy costs and an increased focus on climate change have enhanced the perceived value of more energy efficient properties. These properties are likely to come at an increasing premium with the values of poorly rated properties lagging behind the market.

In the meantime, we can analyse various scenarios to assess the potential financial impacts on us as a lender, but the outlook remains uncertain until the government clarifies its expectations and the support it will provide to make this work.

—

The author is director of enterprise risk at Just Group. The views expressed are the author’s own.

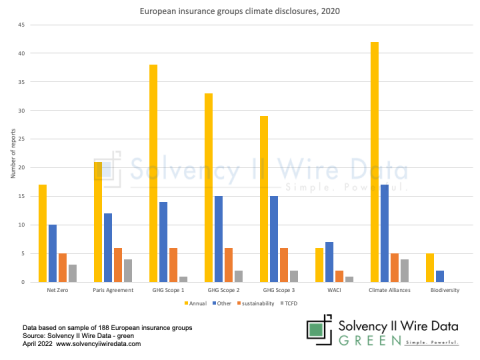

David Rorrison participated in an expert panel discussion on insurance climate disclosures. Insurance Climate Disclosures – present state and future outlook, is a collaboration between Solvency II Wire, Royal London Asset Management and Slaughter and May, bringing together senior regulators and industry figures to discuss the challenges of ESG reporting in the insurance industry.

Insurance Climate Disclosures: present state and future outlook, was held at the offices of Slaughter and May in London, on 14 June 2022.

Articles in the series

- Insurance Climate Disclosures: present state and future outlook, an introduction

- Climate-related risks – a coordinated response to a global challenge, FSB

- Climate change scenario analysis in the ORSA – a key tool for (re)insurers, EIOPA

- Better not more ESG information, FRC

- Managing climate policy uncertainty, Just Group

- Climate and sustainability data quality – an insurance perspective, Marsh

- Shining a light on the Path to Sustainability, RLAM

- Position paper: Conflicts of climate disclosure

- Media Release: Insurance Climate Disclosures – present state and future outlook

Get the next article directly to your inbox, sign up to the Solvency II Wire mailing list.