The second annual survey of Solvency II implementation across the UK and Ireland published by consultancy Lane Clark & Peacocks (LCP) has found significant improvements in the data quality of the QRTs.

According to the survey: “Overall, the quality of the disclosures appears to have improved over the year, with fewer firms publishing QRTs with obvious errors. 10% of the QRTs we reviewed contained errors, down from 25% last year.”

The survey, which was compiled using data from Solvency II Wire Data, examines the QRTs and SFCRs of the top 100 non-life insurers in the two markets. The findings reflect a broader trend of improved data quality across the Solvency II disclosure universe and echo findings by Solvency II Wire Data in its 2017 data collection.

The problem with monetary unit amounts

The improvements in the QRT data quality are notable for some of the most common errors such as wrong values in a template or missing data. But one critical error remains persistent – that of the unit amounts used in the disclosures.

Article 2 of the Commission Implementing Regulation (EU) 2015/2452 laying down implementing technical standards with regard to the procedures, formats and templates of the SFCR states: “When disclosing the information referred to in this Regulation figures reflecting monetary amounts shall be disclosed in thousands of units.”

However, in processing over 2,400 QRTs for 2016 and 2017 Solvency II Wire Data found a remarkable lack of consistency in the unit amount used in the reports. These vary from single units, thousands or millions.

Furthermore, in several cases the units used are not stated anywhere in the QRTs. This can be frustrating for users who have to rely on the SFCR to confirm or validate figures. While this is easily done for the larger and well-known firms, for the many of firms it often requires validation across a wider sample of data. It does however appear that in most cases firms have been consistent in the unit amount used in the 2016 and 2017 QRTs.

Low probability, high impact errors

A more critical and yet more difficult error to detect is in those cases where a different unit amount is used in different templates within the same QRT. Or, in some extreme cases, where different unit amounts are used in different cells within the same template.

So far at least 30 such cases have been detected and corrected. While the number of these errors is relatively small they can significantly distort market totals and other aggregate calculations. These errors are very much of the low probability high impact variety.

Improvement in the SFCR narrative disclosures

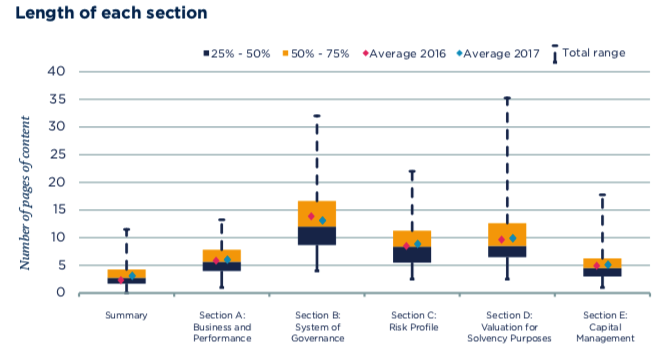

The LCP survey also found improvements in the quality of the narrative reporting in the SFCR (Solvency and Financial Condition Report). It notes that the average length of the Summary section increased for most of the SFCRs reviewed.

It is assumed that this is, in part, driven by the guidance issued by EIOPA last year (EIOPA-BoS/17-310 18 December 2017) in which it called on firms to produce a more “fit-for-purpose” Summary. The chart below shows the length of each section.

One area where little progress has been made is in the disclosure of the amount of expected profit included in future premiums, which a third for firms surveyed failed to disclose again in 2017.

Reflecting on the findings of the report, Cat Drummond, Partner in LCP’s General Insurance team, notes there is still a while to go to make sure the SFCRs become more useful documents: “Firms must continue to develop SCFRs to bring greater clarity and consistency in insurance company regulatory disclosures, not just to conform to this third pillar of the Solvency II on disclosure requirements, but to reassure stakeholders that their houses are in order.”

Regulators getting serious about Solvency II compliance

The observations about the narrative reports and data quality come at a pertinent time. Earlier this month the Central Bank of Ireland issued its first fine in respect of breaches of Solvency II and the Corporate Governance Requirements for Insurance Undertakings.

The fines and reprimands were issued to PartnerRe Ireland Insurance dac and Partner Reinsurance Europe SE in respect of: “Breaches of the Solvency II regime relating to the calculation of their Solvency Capital Requirement for 2016,” and “The submission of incorrect information to the Central Bank in respect of their solvency for 2016.”

While the enforcement does not directly relate to the firms’ public disclosures it is a show of intent by the regulator on the need to comply with Solvency II. As noted by the Central Bank’s Director of Enforcement and Anti-Money Laundering: “This enforcement action demonstrates the importance the Central Bank places on firms meeting their regulatory obligations under Solvency II and the Corporate Governance Requirements.”

—

The LCP survey can be accessed here: One year on: financial strength improves, yet risks remain; Solvency II reporting across the UK and Ireland August 2018

The CBI enforcement action can be found here: Enforcement Action: PartnerRe Ireland Insurance dac and Partner Reinsurance Europe SE fined €1,540,000