Full results of the fourth annual survey of Solvency II implementation across the UK and Ireland published by consultancy Lane Clark & Peacock (LCP) shed light on the current and potential future impacts of COVID-19 pandemic on European insurers.

Analysis of the COVID-19 notes of the 100 top non-life insurers in the UK and Ireland found that all but one company provided information about the impact of COVID-19 on their business. Levels of disclosure varied significantly between firms.

COVID-19 insurance capital strength

Two thirds of firms surveyed said they expected to meet their regulatory capital requirement during the pandemic, while one third said there was still too much uncertainty or did not provide any information.

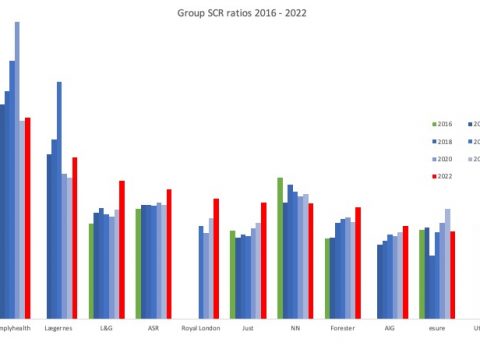

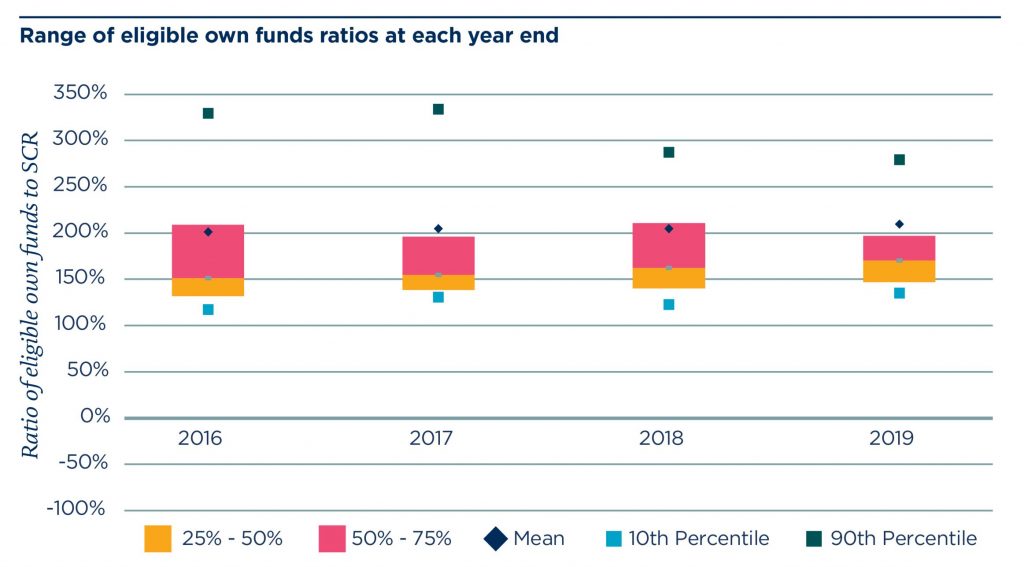

The average (mean) SCR ratio for the sample remained stable at 210% and overall capitalisation remains stable (see chart below).

Impact of COVID-19 on insurance underwriting

The survey found that 78% of firms mentioned the impact of COVID-19 on underwriting, but only 37% provided substantial details including commentary and potential impact.

Some firms also included mitigation action that they we planning to take including pricing action and changes to policy coverage for new and renewed contracts.

COVID-19 impact on insurance investment

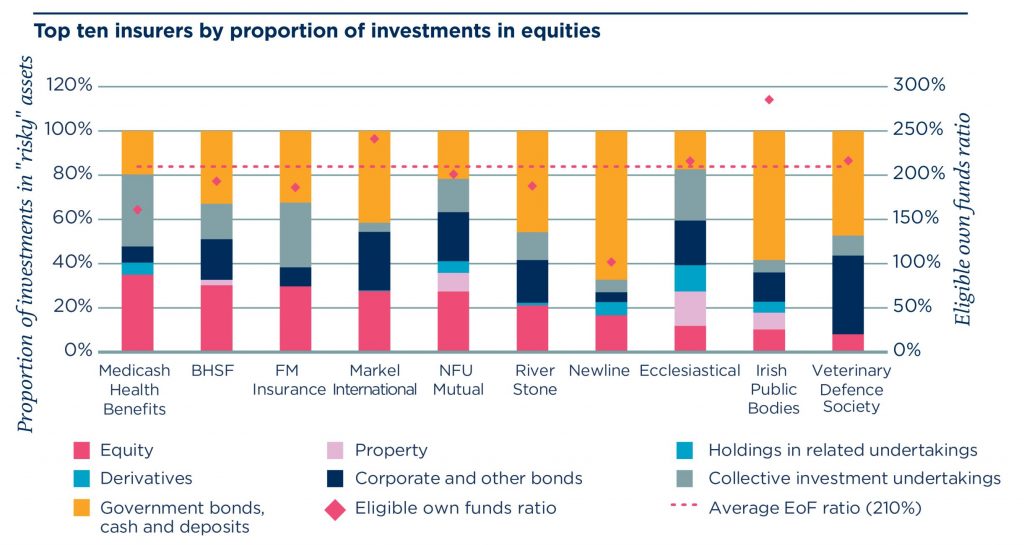

Two thirds of firms surveyed said that COVID-19 had an impact on their investment. Analysis of the 10 insurers with the highest proportion of equities in their portfolio (see chart) showed that all but 3 had an SCR ratio lower than the sample average.

Overall the survey found that the average equity allocation has decreased from 3.7% in 2016 to 2.3% in 2019.

Other impacts of COVID-19 on insurers

The survey also covers other impacts of the pandemic on insurers including operational resilience and policyholder support.

Interestingly the researchers conclude that firms that took advantage of the Solvency II delayed reporting timeline provided more information about the impact of COVID-19 on their business.

The full report can be accessed here: Solvency II: Risk, Resilience and Recovery.

Solvency II Wire Data collects all available public QRT templates for group and solo.

QRT templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.12.01 Life and Health SLT Technical Provisions

S.17.01 Non-life Technical Provisions

S.19.01 Non-life Insurance Claims Information

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern Models

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group