Category: SFCR Analysis

Analysis of the Solvency II public disclosures

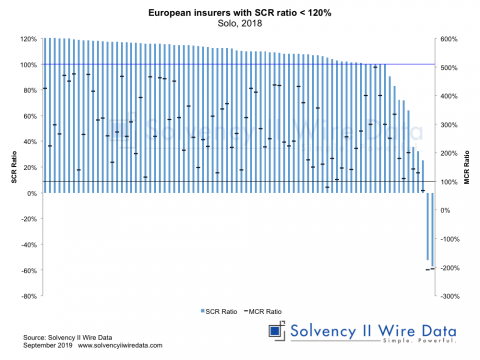

Insight into the lower end of the European insurance market

September 2, 2019

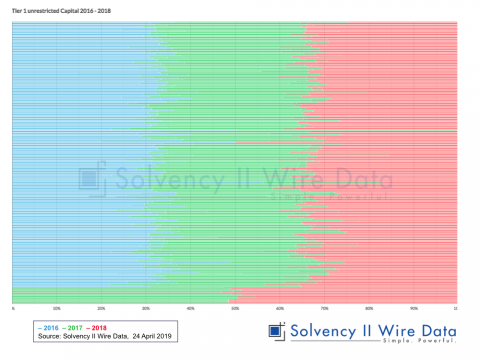

SFCRs 2018 – a market snapshot from early collection

April 24, 2019

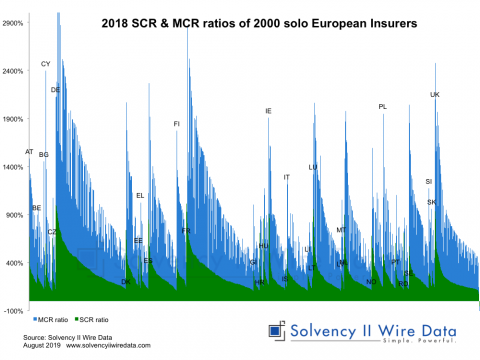

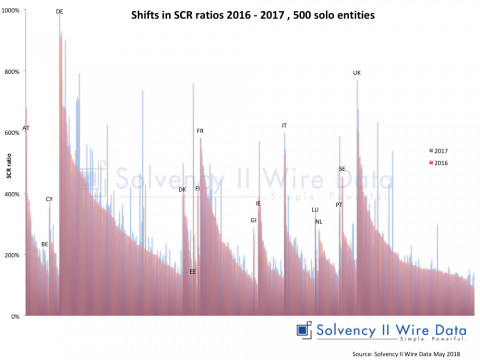

Trends in Solvency II ratio distributions

March 25, 2019

Solvency II News: first 2018 SFCRs

December 14, 2018

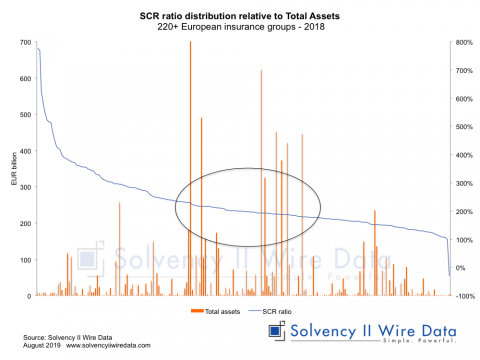

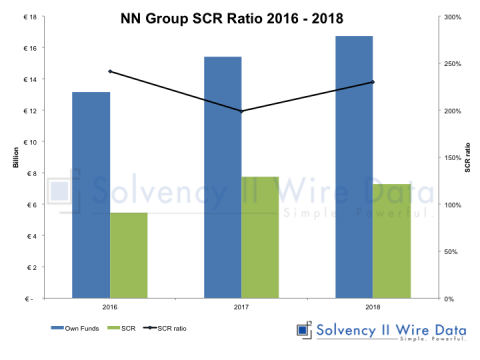

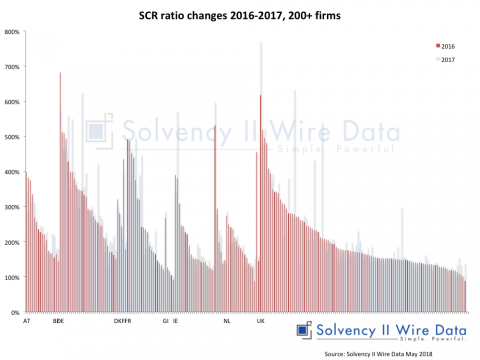

A deep-dive into the Solvency II SCR ratios

December 6, 2018

Putting the Solvency II QRTs to the test

November 16, 2018

A cross-border reinsurance spiral

November 6, 2018

Solvency II and equity price valuation

November 5, 2018

Tracking shifts in counterparty default risk

September 25, 2018

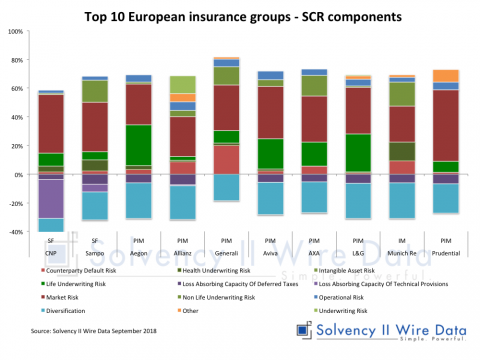

SCR components comparison of European insurance groups

September 11, 2018