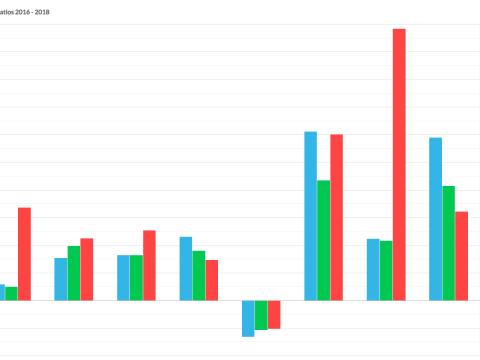

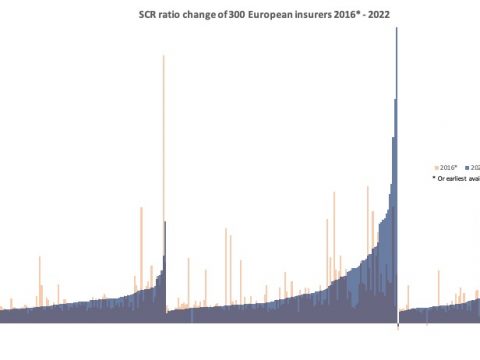

Results from the 2018 Solvency II public disclosures of the top 100 non life insurers in the UK and Ireland show the ongoing strength of this market segment, which reported an average SCR ratio of 206% (up from 199% in 2016).

The findings are part of the third annual survey of Solvency II implementation across the UK and Ireland conducted by consultancy firm Lane Clark & Peacock’s (LCP). The survey, using data from

Solvency II Wire Data, reviews the disclosures of the 100 largest non life insurers in the UK and Ireland.

Despite the overall strength of the sample, the results show that almost a quarter of firms (24) would breach their SCR (Solvency Capital Requirement) following a loss equal to their MCR (Minimum Capital Requirement), up from 18 in 2017 (for detailed analysis see here).

Qualitative analysis of the the SFCRs (Solvency and Financial Condition Reports) revealed a disturbing rise in concerns over Brexit. The proportion of firms highlighting Brexit as a key risk to solvency has nearly doubled from 33% to 64%.

Cat Drummond, Partner in LCP’s General Insurance team, commented: “With nearly two-thirds of firms identifying Brexit as a key risk as the UK confronts the possibility of leaving the European Union with no deal in place, Brexit uncertainty continues to keep insurers awake at night. Almost all firms that highlighted Brexit as a key risk had plans in place (or were formalising such plans) to address the issue.”

Fewer than 15% of firms noted climate change as a key risk to their solvency. Similarly the implementation of IFRS 17 was less prominent compared to cyber risk consideration (43% of the sample).

The researchers found that two-thirds of SFCRs and QRTs were available on firms’ websites on the reporting deadline, echoing findings by Solvency II Wire Data.

Ms Drummond added: “Insurers still have some way to go to ensure that their SFCRs comply with regulatory requirements and are readily available and easy to access. EIOPA’s recent announcement of its intention to discuss with national regulators having public SFCR repositories may assist with this going forwards.”

2nd Solvency II Survey – Survey shows improvement in Solvency II QRT data

Our Solvency II Wire Data database gives you unparalleled access to the Solvency II public disclosures.

Click here to find out more details or request a demo.